Louisiana Tax Declaration 2020

What is the Louisiana Tax Declaration

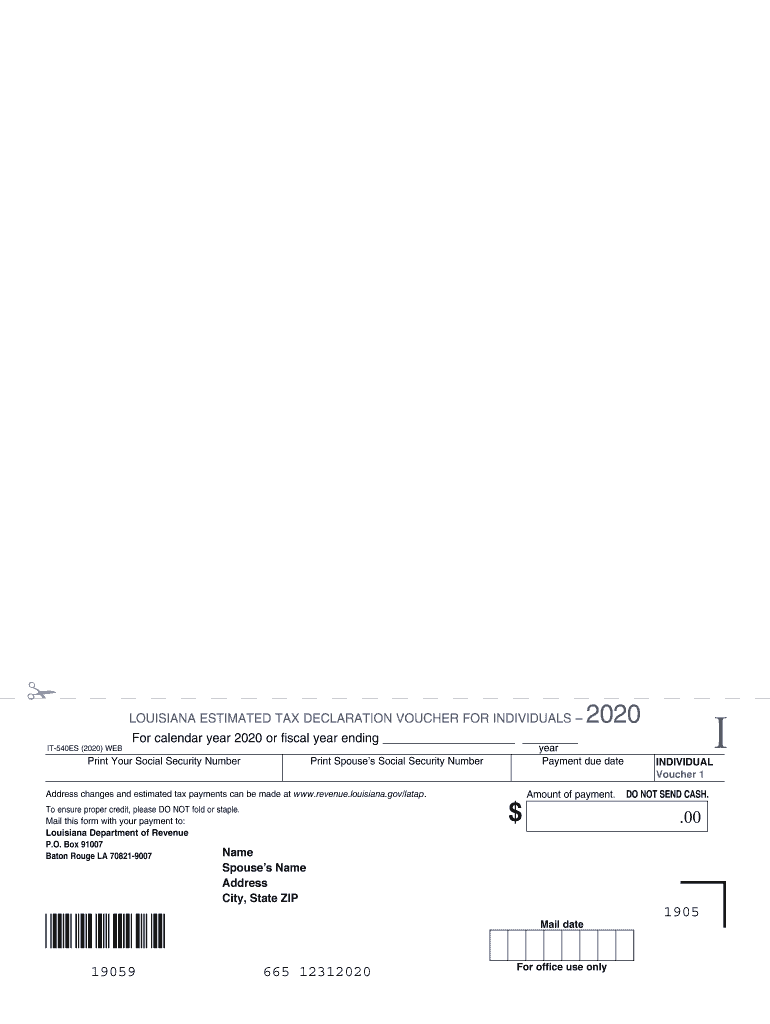

The Louisiana tax declaration is a crucial document used by residents and businesses to report their income and calculate their tax obligations to the state. This form allows taxpayers to declare various types of income, including wages, dividends, and business profits. Understanding the specifics of this declaration is essential for compliance with state tax laws. It serves as a formal statement to the Louisiana Department of Revenue, ensuring that all income is accurately reported and taxed appropriately.

Steps to complete the Louisiana Tax Declaration

Completing the Louisiana tax declaration involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2 forms, 1099s, and any other income statements. Next, follow these steps:

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources.

- Claim any deductions or credits for which you are eligible.

- Calculate your total tax liability based on the reported income and applicable tax rates.

- Review the completed form for accuracy before submission.

Legal use of the Louisiana Tax Declaration

The Louisiana tax declaration is legally binding when completed correctly and submitted to the appropriate tax authorities. It must be signed, either electronically or in print, to validate the information provided. Compliance with state and federal tax laws is essential, as failure to accurately report income can lead to penalties or legal repercussions. Utilizing a reliable digital platform for e-signatures can enhance the legitimacy of the submission.

Filing Deadlines / Important Dates

Awareness of filing deadlines is critical for taxpayers in Louisiana. The Louisiana tax declaration typically must be filed by May fifteenth for individuals and businesses, aligning with the federal tax deadline. However, extensions may be available under certain circumstances. It is advisable to stay informed about any changes to deadlines, as they can vary from year to year.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers in Louisiana have several options for submitting their tax declaration. The form can be submitted online through the Louisiana Department of Revenue’s website, which offers a secure platform for electronic filing. Alternatively, taxpayers can mail their completed forms to the designated tax office or deliver them in person. Each method has its advantages, and choosing the right one depends on individual preferences and circumstances.

Required Documents

To successfully complete the Louisiana tax declaration, several documents are required. These typically include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any additional income sources.

- Documentation for deductions, such as receipts and invoices.

Having these documents organized and accessible will streamline the filing process and help ensure accuracy.

Quick guide on how to complete louisiana tax declaration

Complete Louisiana Tax Declaration effortlessly on any gadget

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Louisiana Tax Declaration on any device with the airSlate SignNow Android or iOS applications and simplify any document-centered process today.

The easiest way to modify and eSign Louisiana Tax Declaration without hassle

- Find Louisiana Tax Declaration and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Modify and eSign Louisiana Tax Declaration and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct louisiana tax declaration

Create this form in 5 minutes!

How to create an eSignature for the louisiana tax declaration

How to make an electronic signature for a PDF in the online mode

How to make an electronic signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The best way to generate an e-signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is a Louisiana tax declaration and why is it important?

A Louisiana tax declaration is a document that provides information about a property’s assessed value for tax purposes. It's important because it helps determine your property tax liability, ensuring you're paying the correct amount based on current assessments.

-

How can airSlate SignNow help with the Louisiana tax declaration process?

airSlate SignNow streamlines the Louisiana tax declaration process by allowing users to eSign and send documents securely and efficiently. This reduces paperwork and simplifies the submission process, ensuring that your declarations are handled swiftly.

-

What are the pricing options for using airSlate SignNow for Louisiana tax declarations?

airSlate SignNow offers various pricing plans tailored to meet the needs of different users, including options for individuals and businesses. Depending on your needs, you can choose a plan that provides the right level of features and integrations to manage your Louisiana tax declaration efficiently.

-

Can I integrate airSlate SignNow with other software for Louisiana tax declarations?

Yes, airSlate SignNow offers integration options with popular accounting and tax software, allowing for seamless transfer of information related to your Louisiana tax declaration. This integration ensures that your documents and data stay synchronized across platforms.

-

What features does airSlate SignNow provide to assist with Louisiana tax declarations?

airSlate SignNow includes features such as customizable templates, document tracking, and automated reminders, making it easier to manage your Louisiana tax declaration efficiently. These tools help you stay organized and ensure that you meet important deadlines.

-

Is airSlate SignNow secure for handling sensitive Louisiana tax declaration information?

Absolutely! airSlate SignNow prioritizes security through advanced encryption and data protection measures, making it a safe choice for handling sensitive Louisiana tax declaration information. Your documents are secure, ensuring your personal and financial information remains confidential.

-

Can I share my Louisiana tax declaration documents with multiple parties using airSlate SignNow?

Yes, airSlate SignNow allows you to easily share your Louisiana tax declaration documents with multiple parties. You can invite collaborators to eSign or review documents, streamlining communication and ensuring everyone involved is on the same page.

Get more for Louisiana Tax Declaration

- What are your rights in joint tenant propertyus legal form

- Amendment for an effective financing statement wyoming form

- Ucc financing statement addendum form ucc1ad rev

- Wwwiacaorgwp contentuploadsucc11pdf form

- Ucc financing statement amendment addendum form ucc3ad rev

- Legal forms uslf are not a substitute for the advice of an

- Children from a prior marriage form

- In the event that i do not possess or own any property listed above on the date of my form

Find out other Louisiana Tax Declaration

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement