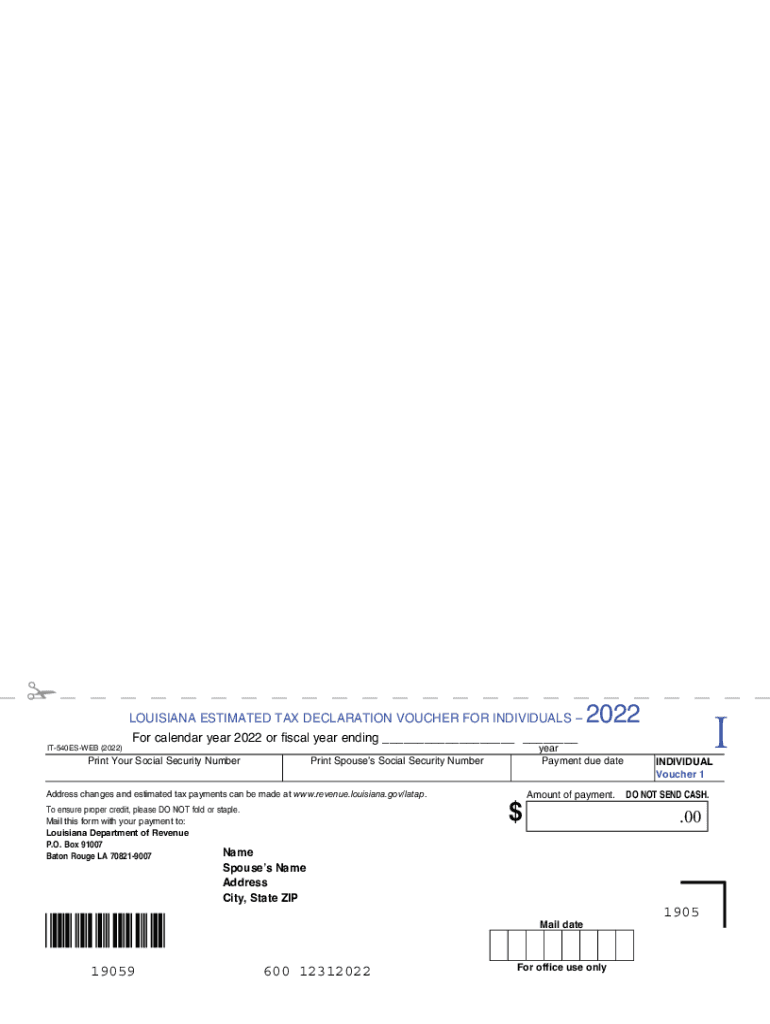

Louisiana Louisiana Estimated Tax Declaration Voucher for 2022

What is the Louisiana estimated tax declaration voucher for?

The Louisiana estimated tax declaration voucher serves as a crucial document for taxpayers who expect to owe a certain amount in state income taxes. This voucher allows individuals and businesses to report their estimated tax payments for the year, ensuring compliance with state tax regulations. By submitting this voucher, taxpayers can avoid underpayment penalties and manage their tax liabilities effectively. It is particularly beneficial for self-employed individuals, freelancers, and those with significant income not subject to withholding.

How to use the Louisiana estimated tax declaration voucher

To utilize the Louisiana estimated tax declaration voucher, taxpayers must first calculate their expected tax liability for the year. This involves estimating income, deductions, and applicable tax rates. Once the estimated amount is determined, the taxpayer fills out the voucher with their personal information, including name, address, and Social Security number. After completing the form, the voucher can be submitted along with the payment to the Louisiana Department of Revenue. This process can be done online, by mail, or in person, depending on the taxpayer's preference.

Steps to complete the Louisiana estimated tax declaration voucher

Completing the Louisiana estimated tax declaration voucher involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Estimate your total income and applicable deductions for the current tax year.

- Calculate your expected tax liability using the current tax rates.

- Fill out the voucher with accurate personal information and the estimated payment amount.

- Review the completed voucher for accuracy to avoid any errors.

- Submit the voucher along with your estimated tax payment to the Louisiana Department of Revenue.

Filing deadlines / important dates

Timely submission of the Louisiana estimated tax declaration voucher is essential to avoid penalties. The filing deadlines for estimated tax payments typically align with quarterly due dates. For 2023, the deadlines are as follows:

- First quarter: April 15, 2023

- Second quarter: June 15, 2023

- Third quarter: September 15, 2023

- Fourth quarter: January 15, 2024

Taxpayers should ensure that payments are made by these dates to remain compliant with state tax laws.

Legal use of the Louisiana estimated tax declaration voucher

The Louisiana estimated tax declaration voucher is legally binding when completed and submitted according to state regulations. To ensure its validity, taxpayers must adhere to specific guidelines, such as providing accurate information and submitting the voucher on time. Electronic submissions are recognized under the ESIGN Act, making them legally enforceable. Taxpayers should retain copies of their submitted vouchers and any correspondence with the Louisiana Department of Revenue for their records.

Who issues the form

The Louisiana Department of Revenue is responsible for issuing the estimated tax declaration voucher. This state agency oversees tax collection and compliance, providing taxpayers with the necessary forms and guidance for fulfilling their tax obligations. The Department of Revenue also updates the voucher annually to reflect any changes in tax laws or rates, ensuring that taxpayers have the most current information available.

Quick guide on how to complete louisiana louisiana estimated tax declaration voucher for

Complete Louisiana Louisiana Estimated Tax Declaration Voucher For effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Louisiana Louisiana Estimated Tax Declaration Voucher For on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to adjust and eSign Louisiana Louisiana Estimated Tax Declaration Voucher For with ease

- Find Louisiana Louisiana Estimated Tax Declaration Voucher For and click Get Form to begin.

- Use the tools we provide to complete your document.

- Select relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Louisiana Louisiana Estimated Tax Declaration Voucher For and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct louisiana louisiana estimated tax declaration voucher for

Create this form in 5 minutes!

How to create an eSignature for the louisiana louisiana estimated tax declaration voucher for

The best way to create an e-signature for your PDF in the online mode

The best way to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to make an e-signature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

How to make an e-signature for a PDF on Android OS

People also ask

-

What are Louisiana estimated tax vouchers 2023?

Louisiana estimated tax vouchers 2023 are official forms used by taxpayers in Louisiana to pay their estimated income taxes on a quarterly basis. These vouchers help individuals and businesses manage their tax obligations effectively, ensuring they stay compliant with state tax regulations.

-

How can airSlate SignNow assist with Louisiana estimated tax vouchers 2023?

AirSlate SignNow streamlines the process of creating, sending, and eSigning Louisiana estimated tax vouchers 2023. Our platform allows users to complete and sign their tax vouchers electronically, making the submission process faster and more efficient.

-

What are the pricing options for using airSlate SignNow to manage Louisiana estimated tax vouchers 2023?

AirSlate SignNow offers various pricing plans tailored to businesses of all sizes, ensuring affordable access to features needed for managing Louisiana estimated tax vouchers 2023. Pricing plans include options for individual users, small teams, and larger enterprises, making it flexible for any budget.

-

What key features make airSlate SignNow ideal for handling Louisiana estimated tax vouchers 2023?

Key features of airSlate SignNow include secure eSigning, document templates, and real-time tracking of document status. These features simplify the process of preparing and submitting Louisiana estimated tax vouchers 2023, allowing users to stay organized and compliant.

-

Can I integrate airSlate SignNow with other software for Louisiana estimated tax vouchers 2023?

Yes, airSlate SignNow offers seamless integrations with popular accounting and financial software, making it easy to manage Louisiana estimated tax vouchers 2023 alongside your other financial tools. This ensures a smooth workflow and enhances overall productivity.

-

What benefits can I expect from using airSlate SignNow for Louisiana estimated tax vouchers 2023?

By using airSlate SignNow for Louisiana estimated tax vouchers 2023, you can expect increased efficiency, reduced paperwork, and enhanced security for your documents. The electronic signing process also eliminates the need for printing and mailing, saving both time and resources.

-

Is airSlate SignNow easy to use for someone new to Louisiana estimated tax vouchers 2023?

Absolutely! AirSlate SignNow is designed with user-friendliness in mind, allowing even those new to Louisiana estimated tax vouchers 2023 to navigate the interface easily. Our step-by-step guides and customer support are also available to help users get started seamlessly.

Get more for Louisiana Louisiana Estimated Tax Declaration Voucher For

- Mississippi 30 form

- Assignment of deed of trust by individual mortgage holder mississippi form

- Mississippi assignment form

- Month to month form

- Ms terminate form

- Mississippi month to month form

- Mississippi 3 day form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property mississippi form

Find out other Louisiana Louisiana Estimated Tax Declaration Voucher For

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement