Ct3 Form Fill and Sign Printable Template OnlineUS 2021

What is the CT3 Form?

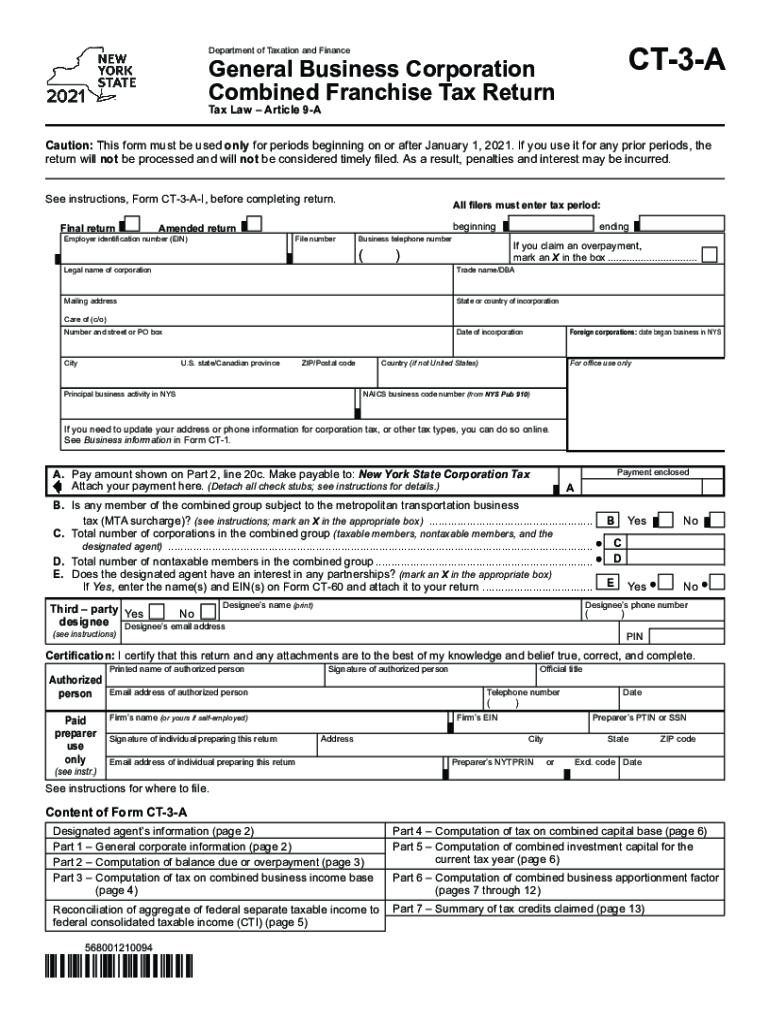

The CT3 form, also known as the New York Corporation Tax Return, is a tax document that corporations in New York State must file annually. This form is essential for reporting income, calculating taxes owed, and ensuring compliance with state tax laws. The CT3 form is specifically designed for various business entities, including corporations, and is used to determine the corporation's tax liability based on its gross income and other financial metrics. Understanding the purpose and requirements of the CT3 form is crucial for businesses to maintain compliance and avoid penalties.

Key Elements of the CT3 Form

The CT3 form consists of several key components that businesses must complete accurately. These include:

- Identification Information: This section requires the corporation's name, address, and identification number.

- Income Reporting: Corporations must report their total income, including gross receipts and other income sources.

- Deductions and Credits: This section allows businesses to claim allowable deductions and tax credits that can reduce their overall tax liability.

- Tax Calculation: The form includes a section for calculating the total tax owed based on the reported income and applicable rates.

Steps to Complete the CT3 Form

Completing the CT3 form involves several steps to ensure accuracy and compliance:

- Gather Financial Records: Collect all necessary financial documents, including income statements and expense records.

- Fill in Identification Information: Enter the corporation's name, address, and identification number at the top of the form.

- Report Income: Accurately report all sources of income in the designated sections of the form.

- Claim Deductions: Identify and enter any applicable deductions and tax credits that the corporation qualifies for.

- Calculate Tax Liability: Use the provided formulas to determine the total tax owed based on the reported income and deductions.

- Review and Sign: Carefully review the completed form for accuracy and ensure it is signed by an authorized representative.

Legal Use of the CT3 Form

The CT3 form serves as a legal document for corporations in New York State, signifying compliance with state tax laws. Filing this form accurately is essential to avoid legal repercussions, including fines and penalties. Corporations must ensure that all information provided is truthful and complete, as any discrepancies may lead to audits or legal challenges. The CT3 form, when filed correctly, protects the corporation's legal standing and supports its operational legitimacy.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the CT3 form to avoid penalties. The due date for filing is typically the 15th day of the third month following the end of the corporation's fiscal year. For corporations operating on a calendar year basis, this means the CT3 form is due by March 15. It is essential for businesses to mark these dates on their calendars and prepare their financial records in advance to ensure timely submission.

Form Submission Methods

The CT3 form can be submitted through various methods to accommodate different preferences. Corporations may choose to file electronically, which is often the most efficient method, allowing for faster processing and confirmation of receipt. Alternatively, businesses can submit the form via mail to the appropriate tax office. In-person submissions are also an option, although they may require scheduling an appointment. Each method has its advantages, and corporations should select the one that best fits their operational needs.

Quick guide on how to complete ct3 form fill and sign printable template onlineus

Effortlessly Complete Ct3 Form Fill And Sign Printable Template OnlineUS on Any Device

The management of online documents has gained traction among both businesses and individuals. It serves as a superb eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly and without issues. Manage Ct3 Form Fill And Sign Printable Template OnlineUS on any platform with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to Edit and Electronically Sign Ct3 Form Fill And Sign Printable Template OnlineUS with Ease

- Find Ct3 Form Fill And Sign Printable Template OnlineUS and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

No more missing or lost files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Ct3 Form Fill And Sign Printable Template OnlineUS to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct3 form fill and sign printable template onlineus

Create this form in 5 minutes!

How to create an eSignature for the ct3 form fill and sign printable template onlineus

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is a CT3 form and why is it essential for businesses?

A CT3 form is a crucial tax document used by corporations to report their income and calculate their taxes. For businesses, understanding and utilizing the CT3 form correctly ensures compliance with tax regulations while maximizing potential deductions. airSlate SignNow offers tools to simplify the eSigning process of these forms, saving time and reducing paperwork.

-

How can airSlate SignNow help with filling out a CT3 form?

airSlate SignNow streamlines the process of completing a CT3 form by allowing users to fill out and sign documents electronically. With its easy-to-use interface and templates, businesses can efficiently prepare their CT3 forms and ensure all necessary fields are completed. This reduces errors and speeds up the submission process.

-

Is airSlate SignNow suitable for filing multiple CT3 forms?

Yes, airSlate SignNow is designed to handle multiple documents efficiently, including CT3 forms. Users can store, manage, and eSign several forms simultaneously, making it ideal for businesses that need to file multiple tax documents. This functionality helps maintain organization and ensures timely submissions.

-

What are the pricing options for using airSlate SignNow for CT3 forms?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of different sizes. The plans include features for eSigning CT3 forms at an affordable rate, ensuring that clients can choose a package that best fits their budget while still benefiting from a robust document management solution.

-

Does airSlate SignNow integrate with accounting software for CT3 form preparation?

Yes, airSlate SignNow seamlessly integrates with various accounting and financial software, enhancing the efficiency of preparing CT3 forms. These integrations allow users to pull necessary data directly into the CT3 form, reducing manual entry and minimizing the chance for errors. This streamlines both the preparation and eSigning process.

-

What security measures does airSlate SignNow have for CT3 forms?

airSlate SignNow prioritizes the security of sensitive documents, including CT3 forms, with strong encryption and compliance with industry security standards. This ensures that all eSigned documents are safely stored and transmitted, protecting your business’s confidential information. Trust in airSlate SignNow to safeguard your important tax documents.

-

Can I use airSlate SignNow on mobile devices for signing CT3 forms?

Yes, airSlate SignNow is compatible with mobile devices, allowing users to eSign CT3 forms on the go. The mobile app offers the same user-friendly features as the desktop version, ensuring that you can access and manage your documents anytime, anywhere. This flexibility supports busy professionals needing to complete forms quickly.

Get more for Ct3 Form Fill And Sign Printable Template OnlineUS

Find out other Ct3 Form Fill And Sign Printable Template OnlineUS

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer