Ct3 a 2018

What is the CT-3A?

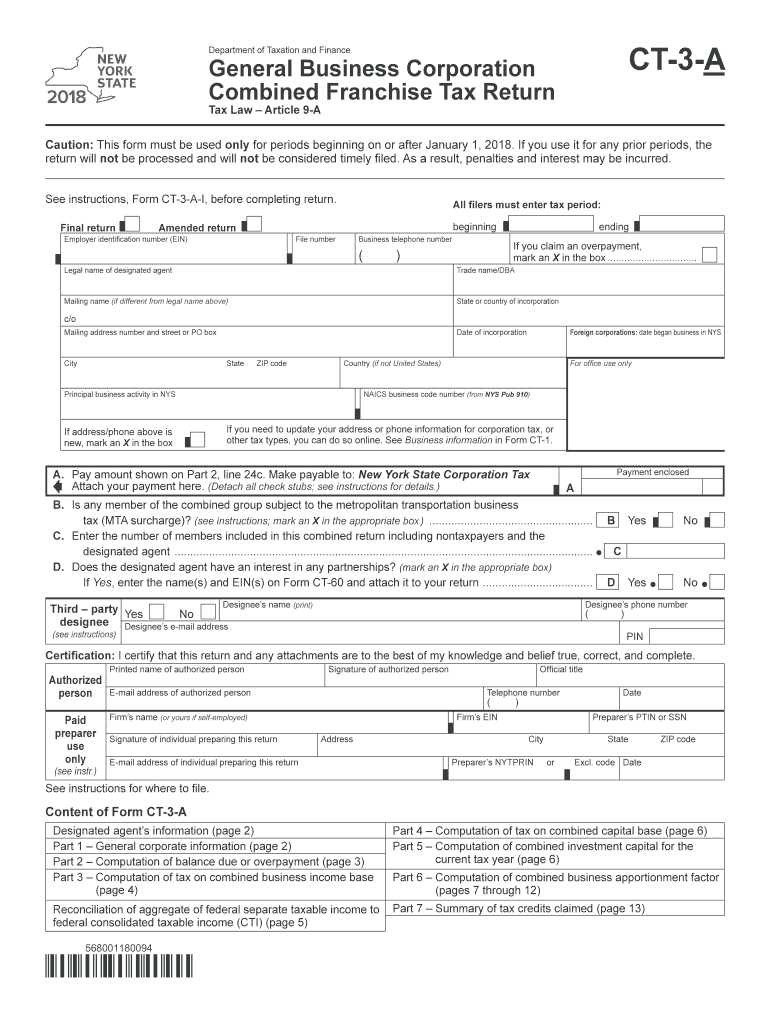

The CT-3A form, also known as the New York Combined Corporation Franchise Tax Return, is a tax document used by corporations operating in New York. This form is essential for corporations that are subject to the franchise tax, allowing them to report their income, deductions, and credits. The CT-3A is specifically designed for corporations that are not classified as S corporations, providing a comprehensive overview of the corporation's financial activities within the tax year.

How to use the CT-3A

Using the CT-3A involves several steps to ensure accurate reporting of your corporation's financial information. First, gather all necessary financial records, including income statements and balance sheets. Next, complete the form by filling in the required sections, such as income, deductions, and credits. It is important to follow the specific instructions provided with the form to avoid errors. Once completed, the CT-3A can be submitted electronically or via mail, depending on your preference and the requirements set by the New York State Department of Taxation and Finance.

Steps to complete the CT-3A

Completing the CT-3A involves a systematic approach to ensure all information is accurately reported. Follow these steps:

- Gather financial documents, including profit and loss statements and previous tax returns.

- Fill in the corporation's identifying information at the top of the form.

- Report total income earned during the tax year in the appropriate section.

- List allowable deductions and credits that apply to your corporation.

- Calculate the total tax liability based on the information provided.

- Review the form for accuracy and completeness before submission.

Legal use of the CT-3A

The CT-3A is legally binding when completed accurately and submitted in accordance with New York State tax laws. It is essential for corporations to comply with all regulations to avoid penalties. The information reported on the CT-3A must be truthful and reflect the corporation's financial status. Any discrepancies or fraudulent information can lead to legal repercussions, including fines or audits by the New York State Department of Taxation and Finance.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines when filing the CT-3A to avoid late fees or penalties. The standard due date for filing is typically the 15th day of the third month following the end of the corporation’s fiscal year. For corporations operating on a calendar year, this means the form is due by March 15. It is advisable to check for any updates or changes to these deadlines each tax year to ensure compliance.

Required Documents

To complete the CT-3A, several documents are necessary to provide accurate financial information. These include:

- Income statements detailing revenue and expenses.

- Balance sheets showing assets, liabilities, and equity.

- Records of any deductions and credits claimed.

- Previous tax returns for reference and consistency.

Quick guide on how to complete fillable online form ct 3 a2018general business corporation

Complete Ct3 A effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage Ct3 A on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and electronically sign Ct3 A with ease

- Obtain Ct3 A and click Get Form to initiate the process.

- Make use of the tools we offer to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Ct3 A and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online form ct 3 a2018general business corporation

Create this form in 5 minutes!

How to create an eSignature for the fillable online form ct 3 a2018general business corporation

How to generate an electronic signature for your Fillable Online Form Ct 3 A2018general Business Corporation in the online mode

How to create an eSignature for your Fillable Online Form Ct 3 A2018general Business Corporation in Chrome

How to create an electronic signature for putting it on the Fillable Online Form Ct 3 A2018general Business Corporation in Gmail

How to make an eSignature for the Fillable Online Form Ct 3 A2018general Business Corporation straight from your smart phone

How to make an electronic signature for the Fillable Online Form Ct 3 A2018general Business Corporation on iOS devices

How to create an eSignature for the Fillable Online Form Ct 3 A2018general Business Corporation on Android

People also ask

-

What is ct 3a in the context of airSlate SignNow?

The term 'ct 3a' refers to a compliance standard that airSlate SignNow adheres to for ensuring secure electronic signatures. Understanding ct 3a is vital for businesses that require legally binding eSignatures for their documents, providing confidence in the security and validity of their operations.

-

How does airSlate SignNow support ct 3a compliance?

airSlate SignNow employs various security measures and best practices to support ct 3a compliance. This includes data encryption, user authentication, and audit trails, which help ensure that all signed documents meet industry regulations and standards.

-

What features of airSlate SignNow help facilitate ct 3a compliance?

Key features of airSlate SignNow that facilitate ct 3a compliance include robust identity verification options, customizable signing processes, and automatic document archiving. These features enhance the security and integrity of the signing process, making it easier for businesses to comply with ct 3a requirements.

-

Is there a pricing plan that accommodates businesses focused on ct 3a compliance?

Yes, airSlate SignNow offers flexible pricing plans to cater to businesses with specific needs, including those prioritizing ct 3a compliance. The cost-effective plans provide access to essential features like secure eSigning and document management, ensuring your budget aligns with compliance requirements.

-

Can airSlate SignNow integrate with other tools to enhance ct 3a operations?

Absolutely, airSlate SignNow offers seamless integrations with various tools and platforms, which can enhance your ct 3a operations. Whether you need CRM integration or workflow automation, these integrations help streamline your document workflows while maintaining compliance.

-

What benefits does airSlate SignNow provide for businesses needing ct 3a compliance?

By using airSlate SignNow, businesses can benefit from enhanced security, increased efficiency, and improved document management—all critical for ct 3a compliance. The user-friendly interface and automation features save time and reduce errors in the signing process, making it easier to manage compliance.

-

How user-friendly is airSlate SignNow for achieving ct 3a compliance?

User-friendliness is a hallmark of airSlate SignNow, making it easy for businesses to achieve ct 3a compliance. The intuitive platform allows users to create, send, and sign documents effortlessly, ensuring that compliance tasks do not hinder productivity or overwhelm teams.

Get more for Ct3 A

Find out other Ct3 A

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter