Form CT 3 General Business Corporation Franchise Tax 2022

What is the Form CT 3 General Business Corporation Franchise Tax

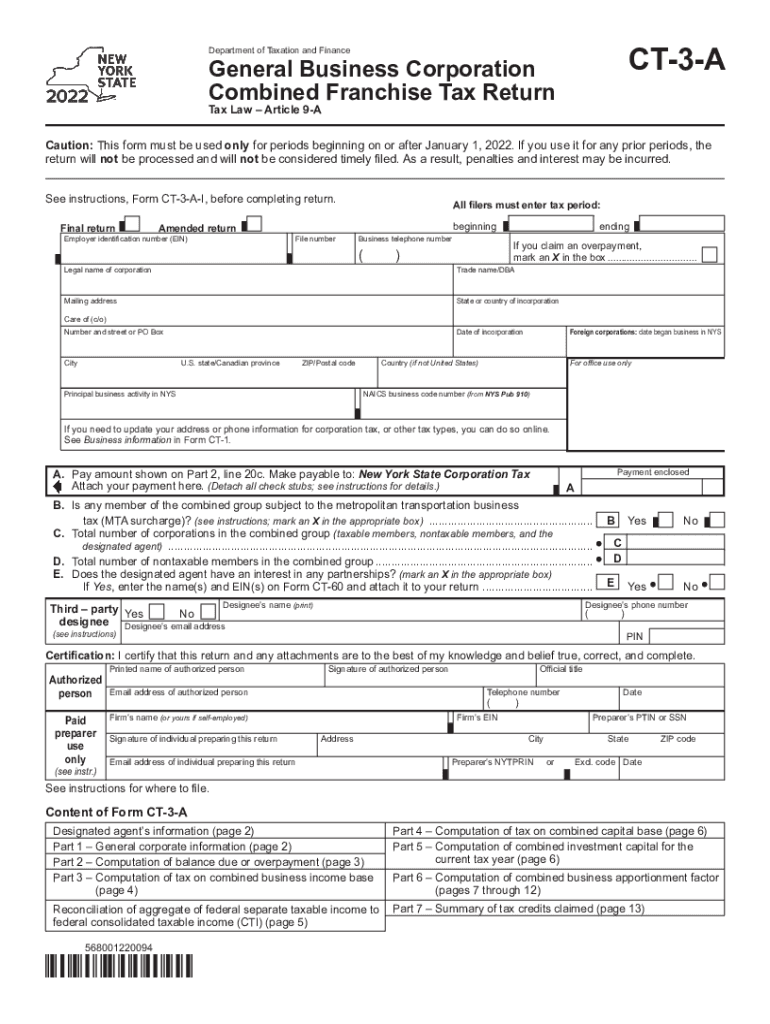

The Form CT 3 is a crucial document for businesses operating in New York, specifically designed for general business corporations. This form is used to report franchise taxes owed by corporations that conduct business within the state. The franchise tax is based on a corporation's income, capital, or a fixed dollar minimum, ensuring that businesses contribute fairly to the state's revenue. Understanding this form is essential for compliance with New York tax laws and for maintaining good standing with the state.

Steps to complete the Form CT 3 General Business Corporation Franchise Tax

Completing the Form CT 3 involves several key steps to ensure accuracy and compliance. Here’s a brief overview:

- Gather financial records: Collect all relevant financial documents, including income statements and balance sheets, to accurately report your corporation's financial status.

- Determine the tax base: Identify whether your tax is based on income, capital, or the minimum tax, as this will dictate how you fill out the form.

- Complete the form: Fill in the required information, ensuring all figures are accurate and supported by your financial records.

- Review for accuracy: Double-check all entries to avoid errors that could result in penalties or additional taxes.

- Submit the form: File the completed form by the designated deadline, either electronically or via mail.

Legal use of the Form CT 3 General Business Corporation Franchise Tax

The legal use of the Form CT 3 is governed by New York State tax regulations. This form must be filed annually by corporations to report their franchise tax obligations. Failure to file or inaccuracies in the form can lead to penalties, interest on unpaid taxes, and potential legal repercussions. It is essential for corporations to understand the legal implications of this form and to ensure compliance with all filing requirements to avoid any legal issues.

Filing Deadlines / Important Dates

Timely filing of the Form CT 3 is critical to avoid penalties. The deadline for submitting the form typically aligns with the corporation's fiscal year end. Corporations must file their CT 3 form by the 15th day of the fourth month following the end of their fiscal year. For those on a calendar year, this means the form is due by April 15. It is advisable to mark these dates on your calendar and prepare the necessary documentation well in advance to ensure compliance.

Who Issues the Form

The Form CT 3 is issued by the New York State Department of Taxation and Finance. This agency is responsible for administering state tax laws and ensuring that corporations comply with their tax obligations. The form can be obtained directly from the Department of Taxation and Finance's official website or through authorized tax professionals. Understanding where to obtain the form is essential for ensuring that you have the most current version and instructions for filing.

Required Documents

To complete the Form CT 3 accurately, corporations need to gather specific documents. These include:

- Financial statements: Income statements, balance sheets, and cash flow statements provide the necessary financial data.

- Prior year tax returns: Previous filings can offer insights and benchmarks for the current year's reporting.

- Supporting documentation: Any additional records that substantiate claims made on the form, such as receipts or invoices related to business expenses.

Having these documents ready will streamline the completion process and help ensure compliance with state regulations.

Quick guide on how to complete form ct 3 general business corporation franchise tax

Complete Form CT 3 General Business Corporation Franchise Tax effortlessly on any device

Managing documents online has gained popularity among companies and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed papers, allowing you to obtain the right template and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and electronically sign your documents quickly and without delays. Manage Form CT 3 General Business Corporation Franchise Tax on any device through airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The optimal method to edit and electronically sign Form CT 3 General Business Corporation Franchise Tax with ease

- Find Form CT 3 General Business Corporation Franchise Tax and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal standing as a traditional handwritten signature.

- Review all details and then click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the frustration of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form CT 3 General Business Corporation Franchise Tax and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 3 general business corporation franchise tax

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 general business corporation franchise tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct3 a and how does it benefit my business?

ct3 a is a powerful feature of airSlate SignNow that simplifies document management. By utilizing ct3 a, businesses can streamline their eSigning processes, improving workflow efficiency. This leads to faster transactions and enhanced productivity for your organization.

-

How much does it cost to use ct3 a with airSlate SignNow?

The pricing for airSlate SignNow, which includes features like ct3 a, is competitive and designed to fit varying budgets. You can choose from different subscription plans to find the one that best meets your needs. Sign up today to explore cost-effective options for incorporating ct3 a into your document workflows.

-

What features does ct3 a include?

ct3 a offers a range of features, including customizable templates, automated workflows, and advanced security options. This ensures that your documents are not only easy to manage but also secure and compliant with industry standards. Leveraging ct3 a can signNowly enhance your document handling capabilities.

-

Can ct3 a integrate with other tools we currently use?

Yes, ct3 a seamlessly integrates with various applications, including CRM and project management tools. This allows businesses to connect their existing software with airSlate SignNow to optimize workflow processes. Enjoy the flexibility of having a streamlined document management solution with ct3 a.

-

Is ct3 a suitable for small businesses?

Absolutely! ct3 a is designed to meet the needs of businesses of all sizes, including small companies. Its easy-to-use interface and cost-effective pricing make it an ideal choice for small businesses looking to enhance their document management without breaking the bank.

-

How secure is the data when using ct3 a?

Data security is a top priority for airSlate SignNow and its ct3 a feature. All documents are secured with encryption and comply with industry regulations to ensure your sensitive information is protected. You can confidently use ct3 a knowing that your data integrity is maintained.

-

What benefits can I expect from using ct3 a?

Using ct3 a brings numerous benefits, including increased efficiency, reduced turnaround times for documents, and enhanced collaboration among team members. The streamlined processes allow you to focus more on core business activities while ct3 a handles the document signing seamlessly. Experience a signNow lift in productivity with ct3 a.

Get more for Form CT 3 General Business Corporation Franchise Tax

- Security contract for contractor south carolina form

- Insulation contract for contractor south carolina form

- Paving contract for contractor south carolina form

- Site work contract for contractor south carolina form

- Siding contract for contractor south carolina form

- Refrigeration contract for contractor south carolina form

- Drainage contract for contractor south carolina form

- Foundation contract for contractor south carolina form

Find out other Form CT 3 General Business Corporation Franchise Tax

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation