Form CT 3 a General Business Corporation Combined Franchise Tax Return Tax Year 2020

What is the Form CT 3 A General Business Corporation Combined Franchise Tax Return?

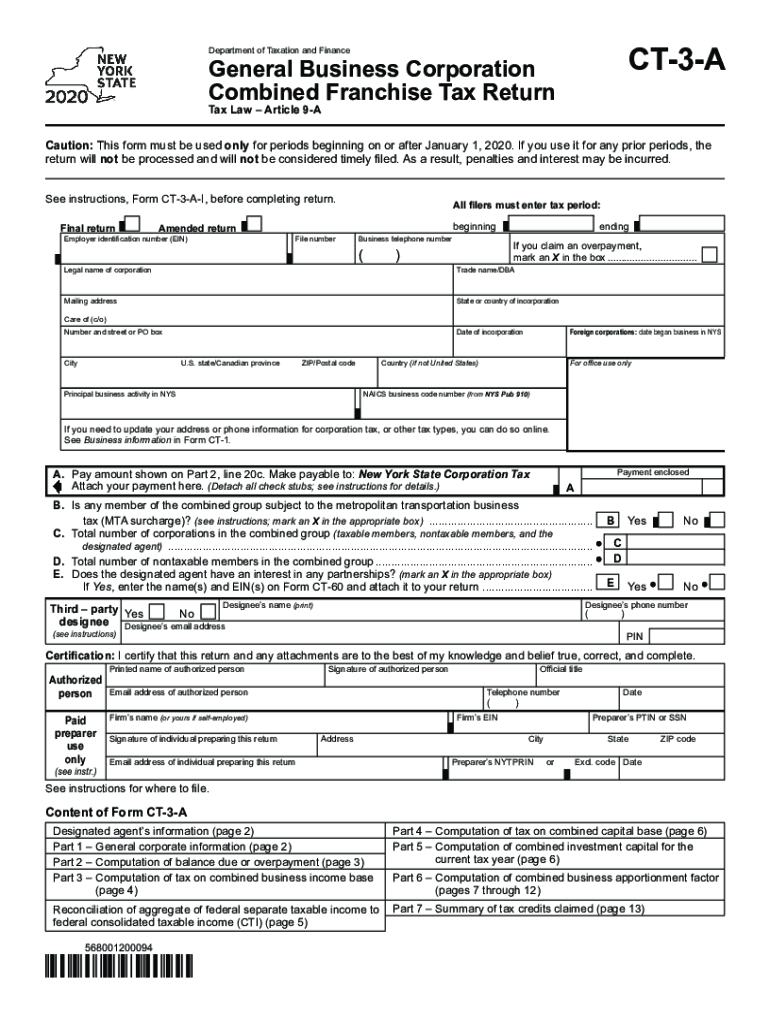

The Form CT 3 A serves as the General Business Corporation Combined Franchise Tax Return for entities operating in New York. This form is specifically designed for corporations that are part of a combined group, allowing them to report their franchise tax obligations collectively. It is crucial for ensuring that all members of the combined group are compliant with state tax regulations. The tax year for which the form is filed typically aligns with the corporation's fiscal year, ensuring accurate reporting of income and tax liabilities.

Steps to Complete the Form CT 3 A General Business Corporation Combined Franchise Tax Return

Completing the Form CT 3 A involves several key steps to ensure accuracy and compliance:

- Gather necessary financial documents, including income statements and balance sheets for each corporation in the combined group.

- Calculate the total income and tax liability for the combined group, ensuring that all inter-company transactions are properly accounted for.

- Fill out the form, providing detailed information for each member of the combined group, including their share of income and tax obligations.

- Review the completed form for accuracy, ensuring that all calculations are correct and that all required signatures are included.

- Submit the form by the designated filing deadline, either electronically or via mail, depending on the submission method chosen.

Legal Use of the Form CT 3 A General Business Corporation Combined Franchise Tax Return

The legal use of the Form CT 3 A is essential for compliance with New York State tax laws. This form must be filed by corporations that are part of a combined group to report their collective franchise tax obligations. Failure to file the form accurately and on time can result in penalties, interest on unpaid taxes, and potential legal complications. It is important for corporations to understand their obligations under the law and ensure that they are using the correct form for their tax filings.

Filing Deadlines / Important Dates for the Form CT 3 A

Corporations must adhere to specific filing deadlines when submitting the Form CT 3 A. Typically, the form is due on the fifteenth day of the third month following the close of the tax year. For example, if a corporation's tax year ends on December 31, the form would be due by March 15 of the following year. It is essential for corporations to keep track of these deadlines to avoid late fees and penalties.

Required Documents for the Form CT 3 A General Business Corporation Combined Franchise Tax Return

To complete the Form CT 3 A, corporations must gather several key documents:

- Financial statements for each corporation in the combined group.

- Records of any inter-company transactions that may affect income reporting.

- Prior year tax returns for all members of the combined group, if applicable.

- Any supporting documentation that substantiates income and deductions claimed on the form.

Form Submission Methods for the CT 3 A

The Form CT 3 A can be submitted through various methods, providing flexibility for corporations. Options include:

- Electronic filing via approved software, which is often the preferred method for its efficiency and speed.

- Mailing a paper copy of the completed form to the appropriate New York State tax office.

- In-person submission at designated tax offices, though this method may require an appointment.

Quick guide on how to complete form ct 3 a general business corporation combined franchise tax return tax year 2020

Effortlessly Prepare Form CT 3 A General Business Corporation Combined Franchise Tax Return Tax Year on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, alter, and electronically sign your documents promptly without any delays. Handle Form CT 3 A General Business Corporation Combined Franchise Tax Return Tax Year on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Way to Alter and eSign Form CT 3 A General Business Corporation Combined Franchise Tax Return Tax Year with Ease

- Locate Form CT 3 A General Business Corporation Combined Franchise Tax Return Tax Year and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important parts of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that function.

- Create your signature with the Sign feature, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Edit and eSign Form CT 3 A General Business Corporation Combined Franchise Tax Return Tax Year and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 3 a general business corporation combined franchise tax return tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 a general business corporation combined franchise tax return tax year 2020

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the form ct 3a and its purpose?

The form ct 3a is a tax form used by businesses in Connecticut to report the income, deductions, and credits specific to their operations. It is essential for ensuring compliance with state tax laws and enables businesses to accurately calculate their tax liabilities.

-

How can airSlate SignNow help with completing the form ct 3a?

airSlate SignNow streamlines the process of filling out the form ct 3a by providing a customizable template that can be easily populated. With its user-friendly interface, you can quickly gather the necessary information, ensuring accuracy and efficiency in completion.

-

Is there a cost associated with using airSlate SignNow for form ct 3a?

airSlate SignNow offers various subscription plans that cater to different business needs. The pricing is affordable and aligns with the features provided, ensuring that you get a cost-effective solution for managing documents like the form ct 3a efficiently.

-

Can I integrate airSlate SignNow with accounting software for filing form ct 3a?

Yes, airSlate SignNow seamlessly integrates with numerous accounting and bookkeeping software applications. This integration simplifies the transfer of data and documents, making it easier to file form ct 3a without manual entry errors.

-

What are the key benefits of using airSlate SignNow for form ct 3a management?

Using airSlate SignNow for form ct 3a management offers several benefits, including enhanced document security, easy collaboration among team members, and quick eSignatures. This saves time and reduces the risk of delays in filing important tax documents.

-

Is airSlate SignNow suitable for small businesses handling form ct 3a?

Absolutely! airSlate SignNow is designed to be user-friendly and affordable, making it an ideal solution for small businesses needing to manage form ct 3a. Its features accommodate businesses of all sizes, streamlining document workflows effectively.

-

How secure is my data when using airSlate SignNow for form ct 3a?

airSlate SignNow prioritizes data security, employing industry-standard encryption and strict access controls. This ensures that your sensitive information related to form ct 3a remains protected throughout the signing and filing process.

Get more for Form CT 3 A General Business Corporation Combined Franchise Tax Return Tax Year

Find out other Form CT 3 A General Business Corporation Combined Franchise Tax Return Tax Year

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template