Form CT 3 a General Business Corporation Combined Franchise Tax Return Tax Year 2023

Understanding the Form CT 3A General Business Corporation Combined Franchise Tax Return

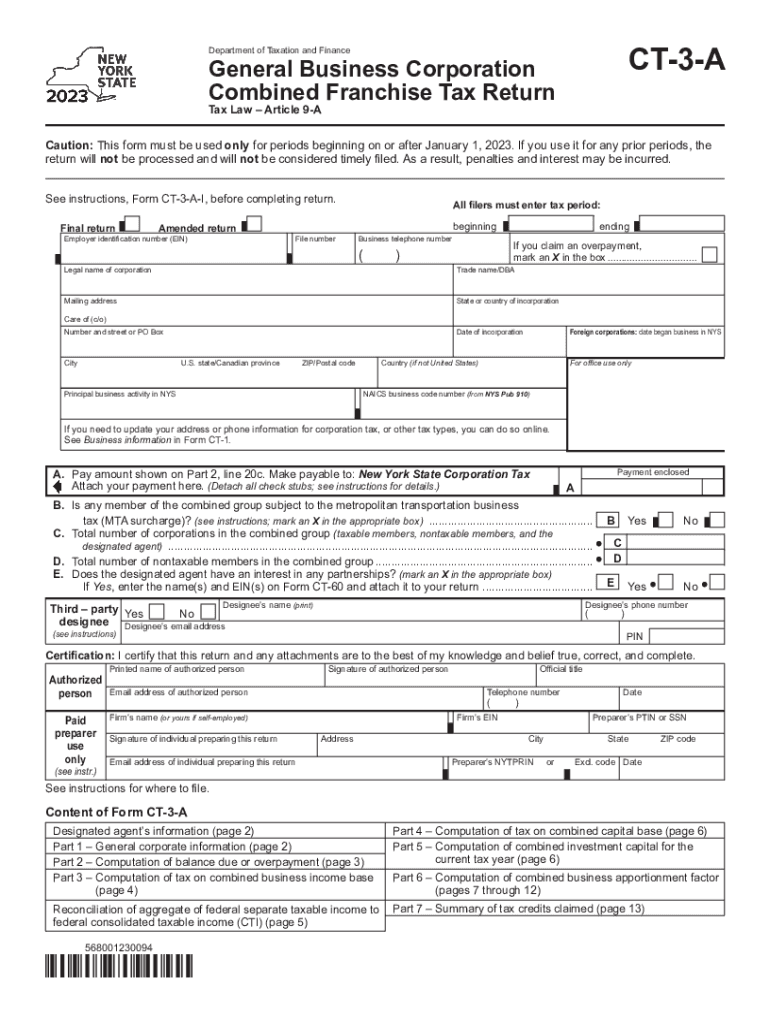

The Form CT 3A is a crucial document for corporations operating in New York, specifically designed for reporting combined franchise tax liabilities. This form is utilized by general business corporations that are part of a combined group, allowing them to report their income and tax obligations collectively. The CT 3A is essential for ensuring compliance with New York State tax regulations and is applicable for the tax year specified on the form.

Steps to Complete the Form CT 3A

Completing the Form CT 3A involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and balance sheets for each corporation in the combined group. Next, fill out the identification section, providing details such as the name, address, and federal employer identification number (EIN) of each corporation. After that, calculate the combined income and tax liabilities, ensuring to follow the specific instructions outlined for each section of the form. Finally, review the completed form for accuracy before submission.

Filing Deadlines and Important Dates for Form CT 3A

Timely filing of the Form CT 3A is essential to avoid penalties. The due date for submitting the form typically aligns with the corporation's fiscal year-end. Corporations must file the CT 3A by the fifteenth day of the third month following the end of the tax year. It is important to stay informed about any changes in deadlines, as extensions may be available under certain circumstances, but they must be formally requested.

Legal Use of the Form CT 3A

The Form CT 3A serves a legal purpose in the context of New York State tax law. It is required for corporations that meet specific criteria, including those that are part of a combined group. Filing this form accurately is not only a matter of compliance but also a legal obligation that helps avoid potential audits and penalties from the New York State Department of Taxation and Finance.

Key Elements of the Form CT 3A

Several key elements must be included when completing the Form CT 3A. These include the identification of all corporations within the combined group, the calculation of combined income, and the allocation of tax liabilities among the group members. Additionally, the form requires detailed information on any credits or deductions applicable to the group, as well as a declaration of the total amount due.

Obtaining the Form CT 3A

The Form CT 3A can be obtained through the New York State Department of Taxation and Finance website. It is available in a downloadable format, allowing businesses to print and complete the form at their convenience. Additionally, businesses may consult with tax professionals to ensure they are using the most current version of the form and to receive guidance on the filing process.

Quick guide on how to complete form ct 3 a general business corporation combined franchise tax return tax year

Effortlessly complete Form CT 3 A General Business Corporation Combined Franchise Tax Return Tax Year on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any holdups. Handle Form CT 3 A General Business Corporation Combined Franchise Tax Return Tax Year on any device using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to modify and electronically sign Form CT 3 A General Business Corporation Combined Franchise Tax Return Tax Year with ease

- Find Form CT 3 A General Business Corporation Combined Franchise Tax Return Tax Year and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with the features that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to confirm your changes.

- Select your preferred method to submit your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form CT 3 A General Business Corporation Combined Franchise Tax Return Tax Year and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 3 a general business corporation combined franchise tax return tax year

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 a general business corporation combined franchise tax return tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 3a in relation to airSlate SignNow?

ct 3a refers to a specific document integration feature that enhances how users manage and send documents through airSlate SignNow. With ct 3a, businesses can streamline their workflow by ensuring that essential documents are easily accessible and manageable within the platform.

-

How does airSlate SignNow's ct 3a feature benefit my business?

The ct 3a feature in airSlate SignNow offers signNow benefits by simplifying the document signing process, reducing errors, and increasing overall efficiency. Businesses using ct 3a can quickly get documents signed, saving time and improving productivity.

-

What pricing plans are available for airSlate SignNow and the ct 3a feature?

AirSlate SignNow offers various pricing tiers that include access to the ct 3a feature, making it affordable for businesses of all sizes. Each plan provides different levels of features, ensuring that you can choose one that meets your needs and budget.

-

Can I integrate ct 3a with other tools I currently use?

Yes, airSlate SignNow's ct 3a feature is designed to seamlessly integrate with numerous popular applications and tools. This integration capability ensures that you can enhance your existing workflows without disruption, making it easier to manage your document processes.

-

What types of documents can I send using the ct 3a feature?

With the ct 3a feature of airSlate SignNow, you can send a wide variety of documents, including contracts, agreements, and forms. This versatility ensures that you can handle different document types with ease and maintain a professional workflow.

-

Is airSlate SignNow secure for sending documents via ct 3a?

Absolutely! AirSlate SignNow prioritizes security, and the ct 3a feature adheres to stringent security protocols. Your document information is protected with encryption and compliant with industry standards, giving you peace of mind while sending important documents.

-

How user-friendly is the ct 3a feature for my team?

The ct 3a feature in airSlate SignNow is designed with a user-friendly interface, making it easy for team members to adopt. Even those who are not tech-savvy can navigate the platform effortlessly, ensuring that everyone can participate in the document signing process.

Get more for Form CT 3 A General Business Corporation Combined Franchise Tax Return Tax Year

Find out other Form CT 3 A General Business Corporation Combined Franchise Tax Return Tax Year

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile