Fillable Online Form it 203 ATTOther Tax Credits and 2021

What is the fillable online form IT 203 ATT?

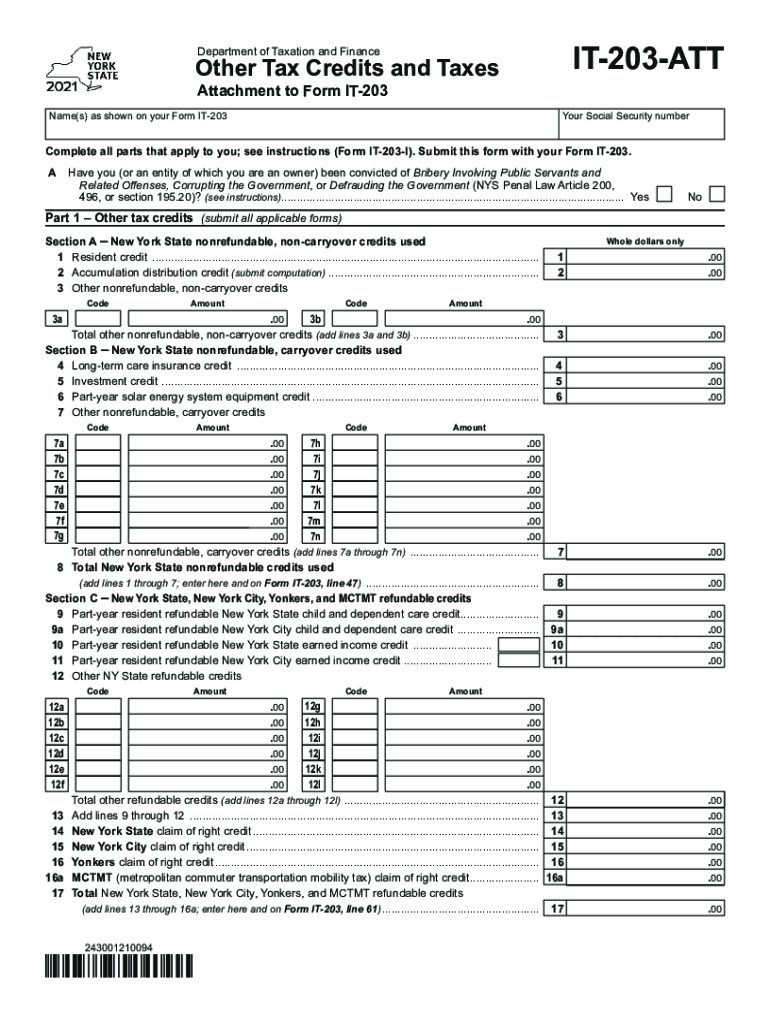

The IT 203 ATT is a tax form used by individuals in New York to claim various tax credits. This form is designed for non-residents who earn income in New York State and need to report their earnings and claim applicable credits. The fillable online version streamlines the process, allowing users to complete the form digitally, which enhances accuracy and efficiency. Utilizing this form can help ensure that taxpayers receive the credits they are entitled to, such as the New York State Earned Income Credit and other relevant credits.

Steps to complete the fillable online form IT 203 ATT

Completing the IT 203 ATT online involves several key steps:

- Access the fillable form through a reliable online platform.

- Enter personal information, including your name, address, and Social Security number.

- Report your income earned in New York State, ensuring all figures are accurate.

- Identify and claim any applicable tax credits by following the form's instructions.

- Review the completed form for errors or omissions before submission.

- Submit the form electronically or print it for mailing, depending on your preference.

Eligibility criteria for the fillable online form IT 203 ATT

To use the IT 203 ATT, taxpayers must meet specific eligibility criteria. Generally, you must be a non-resident of New York who has earned income from New York sources. Additionally, you should be eligible for the credits you are claiming, which may include the New York State Earned Income Credit or other specific credits related to your income level and filing status. It is essential to review the eligibility requirements carefully to ensure compliance and maximize your potential tax benefits.

Required documents for the fillable online form IT 203 ATT

When completing the IT 203 ATT, certain documents are necessary to support your claims. These may include:

- W-2 forms from employers showing income earned in New York.

- 1099 forms for any additional income sources.

- Documentation for any tax credits you are claiming, such as proof of eligibility for the New York State Earned Income Credit.

- Identification documents, like a driver's license or Social Security card, to verify your identity.

Form submission methods for the IT 203 ATT

The IT 203 ATT can be submitted through various methods to accommodate different preferences. Options include:

- Online submission through an authorized tax preparation platform, which allows for immediate processing.

- Mailing a printed version of the completed form to the appropriate New York State tax office.

- In-person submission at designated tax offices, if preferred.

IRS guidelines related to the fillable online form IT 203 ATT

While the IT 203 ATT is specific to New York State, it is essential to be aware of IRS guidelines that may impact your filing. The IRS provides general rules for tax reporting and credits that can affect state filings. Ensure that all income reported on the IT 203 ATT aligns with your federal tax return. Additionally, understanding how state credits interact with federal tax obligations can help in accurately completing the form and avoiding potential issues with compliance.

Quick guide on how to complete fillable online form it 203 att2019other tax credits and

Effortlessly Prepare Fillable Online Form IT 203 ATTOther Tax Credits And on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Fillable Online Form IT 203 ATTOther Tax Credits And on any device with the airSlate SignNow Android or iOS applications and enhance any document-related processes today.

The Simplest Way to Modify and Electronically Sign Fillable Online Form IT 203 ATTOther Tax Credits And with Ease

- Find Fillable Online Form IT 203 ATTOther Tax Credits And and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Fillable Online Form IT 203 ATTOther Tax Credits And to ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online form it 203 att2019other tax credits and

Create this form in 5 minutes!

How to create an eSignature for the fillable online form it 203 att2019other tax credits and

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The best way to generate an e-signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is it 203 att and how does it benefit my business?

It 203 att refers to a comprehensive electronic signature solution that simplifies the signing process. With airSlate SignNow, businesses can send and eSign documents in a secure and efficient manner, enhancing productivity and reducing turnaround times. This can lead to improved customer satisfaction and streamlined operations.

-

How much does it 203 att cost?

The pricing for it 203 att through airSlate SignNow is designed to be cost-effective for businesses of all sizes. Depending on your needs, various subscription plans are available, offering a range of features. You can choose a plan that best fits your budget while ensuring access to essential eSignature functionalities.

-

What features does it 203 att offer?

It 203 att includes features such as customizable templates, real-time tracking, and secure cloud storage for your documents. Additionally, you’ll find features like in-person signing and advanced authentication options, ensuring that your document signing processes are both compliant and efficient. These features work together to provide a seamless signing experience.

-

Can it 203 att integrate with other software?

Yes, it 203 att can seamlessly integrate with various popular software solutions, enhancing your existing workflows. Whether you use CRMs, document management systems, or cloud storage, airSlate SignNow offers integrations that streamline processes. This ensures that your eSignature solution fits well within your current technology ecosystem.

-

Is it 203 att secure for signing sensitive documents?

Absolutely, it 203 att prioritizes security and compliance, making it a reliable choice for signing sensitive documents. airSlate SignNow employs advanced encryption and authentication methods to protect your data. This ensures that all documents signed through the platform are secure and meet regulatory requirements.

-

How does it 203 att improve the document signing workflow?

It 203 att optimizes the document signing workflow by automating several manual steps, allowing for quicker processing times. With features like automated reminders and real-time status updates, users stay informed throughout the signing process. This leads to faster approvals and a more efficient overall workflow.

-

Can I try it 203 att before committing to a subscription?

Yes, airSlate SignNow offers a free trial of it 203 att, allowing you to explore its features and benefits before making a commitment. This trial period gives you the opportunity to experience how it can enhance your document signing processes without any upfront investment. You can see if it aligns with your business needs.

Get more for Fillable Online Form IT 203 ATTOther Tax Credits And

- Ca petition name form

- California change name form

- Ca changing name form

- Not renew lease form

- Ca note template form

- California installments fixed rate promissory note secured by residential real estate california form

- California installments fixed rate promissory note secured by personal property california form

- Ca commercial form

Find out other Fillable Online Form IT 203 ATTOther Tax Credits And

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile