NEW YORK STATE Non Resident Tax Information Forms it 2022

What is the New York State Non-Resident Tax Information Form IT-203?

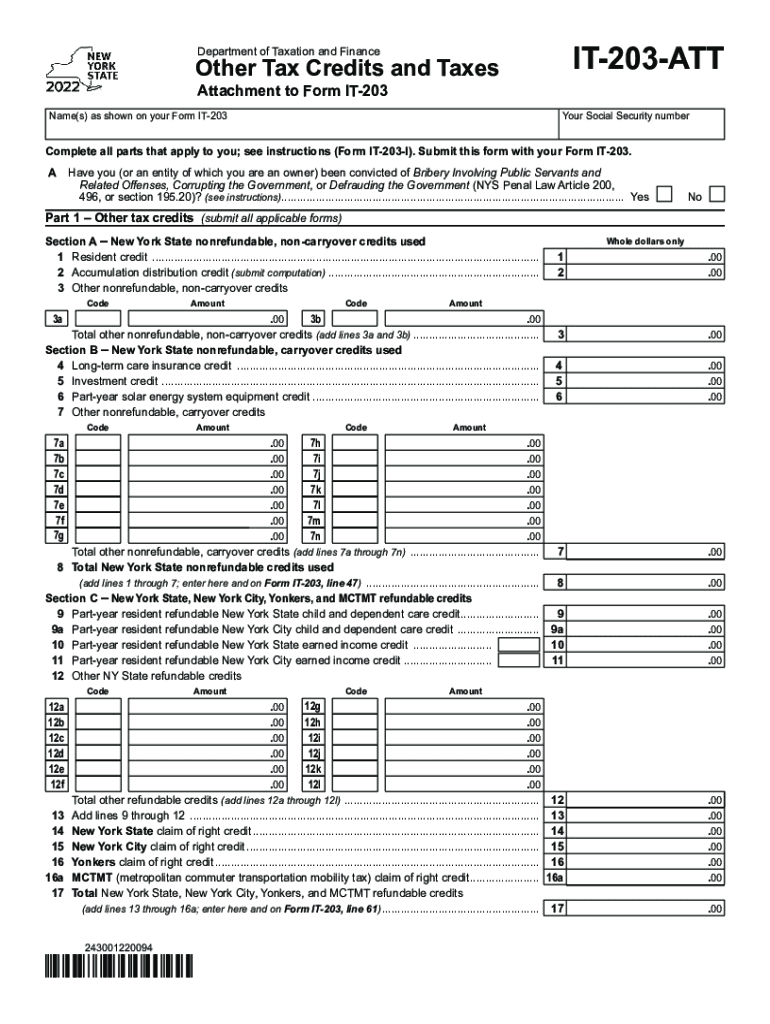

The New York State Non-Resident Tax Information Form IT-203 is designed for individuals who earn income in New York but do not reside in the state. This form allows non-residents to report their New York-source income and calculate the appropriate tax liability. It is essential for ensuring compliance with New York tax laws while providing a clear framework for non-residents to fulfill their tax obligations. The IT-203 form is particularly relevant for individuals who may work in New York temporarily or have other income sources within the state.

Steps to Complete the New York State Non-Resident Tax Information Form IT-203

Completing the IT-203 form involves several key steps to ensure accuracy and compliance:

- Gather necessary documentation, including W-2 forms, 1099s, and any other income statements related to your New York earnings.

- Fill out personal information, including your name, address, and Social Security number, as required on the form.

- Report your New York-source income, detailing the amounts earned from work performed or services rendered in the state.

- Calculate your tax liability based on the provided tax rates for non-residents, ensuring to apply any applicable credits or deductions.

- Review the completed form for accuracy, ensuring all calculations are correct and all required fields are filled out.

- Sign and date the form before submission to validate your filing.

Eligibility Criteria for the New York State Non-Resident Tax Information Form IT-203

To be eligible to file the IT-203 form, individuals must meet specific criteria:

- You must be a non-resident of New York State.

- You must have earned income from New York sources, such as wages, salaries, or business income.

- You should not be a full-time resident of New York State during the tax year in question.

- Individuals who are part-year residents may also need to file this form for the period they were non-residents.

Required Documents for the New York State Non-Resident Tax Information Form IT-203

When preparing to file the IT-203 form, it is crucial to have the following documents ready:

- W-2 forms from employers for income earned in New York.

- 1099 forms for any freelance or contract work completed in the state.

- Records of any other income sources attributable to New York, such as rental income or business earnings.

- Documentation of any deductions or credits you plan to claim, which may include receipts or statements.

Form Submission Methods for the New York State Non-Resident Tax Information Form IT-203

The IT-203 form can be submitted through various methods to accommodate different preferences:

- Online: You can file the IT-203 electronically through the New York State Department of Taxation and Finance website, which offers a user-friendly interface for e-filing.

- Mail: If you prefer to submit a paper form, you can print the completed IT-203 and mail it to the appropriate address provided in the form instructions.

- In-Person: Some individuals may choose to file in person at designated tax offices, although this option may be limited.

Penalties for Non-Compliance with the New York State Non-Resident Tax Information Form IT-203

Failing to file the IT-203 form or underreporting income can lead to significant penalties:

- Late filing penalties may apply if the form is not submitted by the deadline.

- Interest on unpaid taxes can accrue, increasing the total amount owed over time.

- Potential audits or additional scrutiny from tax authorities may occur if discrepancies are found.

Quick guide on how to complete new york state non resident tax information forms it

Complete NEW YORK STATE Non Resident Tax Information Forms IT effortlessly on any device

The management of online documents has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage NEW YORK STATE Non Resident Tax Information Forms IT on any device with the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest way to edit and eSign NEW YORK STATE Non Resident Tax Information Forms IT seamlessly

- Locate NEW YORK STATE Non Resident Tax Information Forms IT and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Select how you wish to send your form—via email, SMS, or invitation link—or download it to your computer.

Eliminate worries about lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign NEW YORK STATE Non Resident Tax Information Forms IT and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york state non resident tax information forms it

Create this form in 5 minutes!

How to create an eSignature for the new york state non resident tax information forms it

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are ny tax credits and how can airSlate SignNow help?

NY tax credits are incentives provided by the state to encourage specific economic activities. By using airSlate SignNow, businesses can streamline document management and stay organized, helping to easily claim these credits through efficient eSigning and document workflows.

-

How does airSlate SignNow simplify the process of applying for ny tax credits?

AirSlate SignNow simplifies the application process for NY tax credits by allowing users to send and sign necessary documents electronically, eliminating the need for printing and scanning. This efficiency not only speeds up the process but also reduces the chances of errors that could delay credit approval.

-

Are there any costs associated with using airSlate SignNow for ny tax credits?

Using airSlate SignNow involves subscription costs, which vary based on the features you need. However, the return on investment can be signNow, as the ease of managing documents for ny tax credits can save businesses both time and money in the long run.

-

What features make airSlate SignNow a good choice for managing ny tax credits?

AirSlate SignNow offers several features ideal for managing ny tax credits, including automated document workflows, reusable templates, and audit trails. These features help ensure that all necessary paperwork is completed accurately and stored securely, facilitating the tax credit application process.

-

Can I integrate airSlate SignNow with other software to handle ny tax credits?

Yes, airSlate SignNow integrates seamlessly with various business applications, allowing for efficient management of documents related to ny tax credits. By connecting with your existing systems, you can streamline your workflow and ensure all your tax-related documents are in one place.

-

Is airSlate SignNow suitable for small businesses looking to take advantage of ny tax credits?

Absolutely! AirSlate SignNow is designed to be cost-effective and user-friendly, making it perfect for small businesses looking to leverage ny tax credits. Its simple interface allows small business owners to focus more on their operations while effectively managing their tax documentation needs.

-

How secure is the documentation process in airSlate SignNow, especially for ny tax credits?

AirSlate SignNow prioritizes security by offering features like advanced encryption and secure storage. This means that all documents related to ny tax credits are handled safely, ensuring sensitive information remains protected during the signing and filing process.

Get more for NEW YORK STATE Non Resident Tax Information Forms IT

- Residential lease renewal agreement south dakota form

- Notice to lessor exercising option to purchase south dakota form

- Assignment of lease and rent from borrower to lender south dakota form

- Assignment of lease from lessor with notice of assignment south dakota form

- Letter from landlord to tenant as notice of abandoned personal property south dakota form

- Guaranty or guarantee of payment of rent south dakota form

- Letter from landlord to tenant as notice of default on commercial lease south dakota form

- Residential or rental lease extension agreement south dakota form

Find out other NEW YORK STATE Non Resident Tax Information Forms IT

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word