What Does the Form 203 F Mean? TurboTax Support Intuit 2023

Understanding the New York State Tax Form IT-203

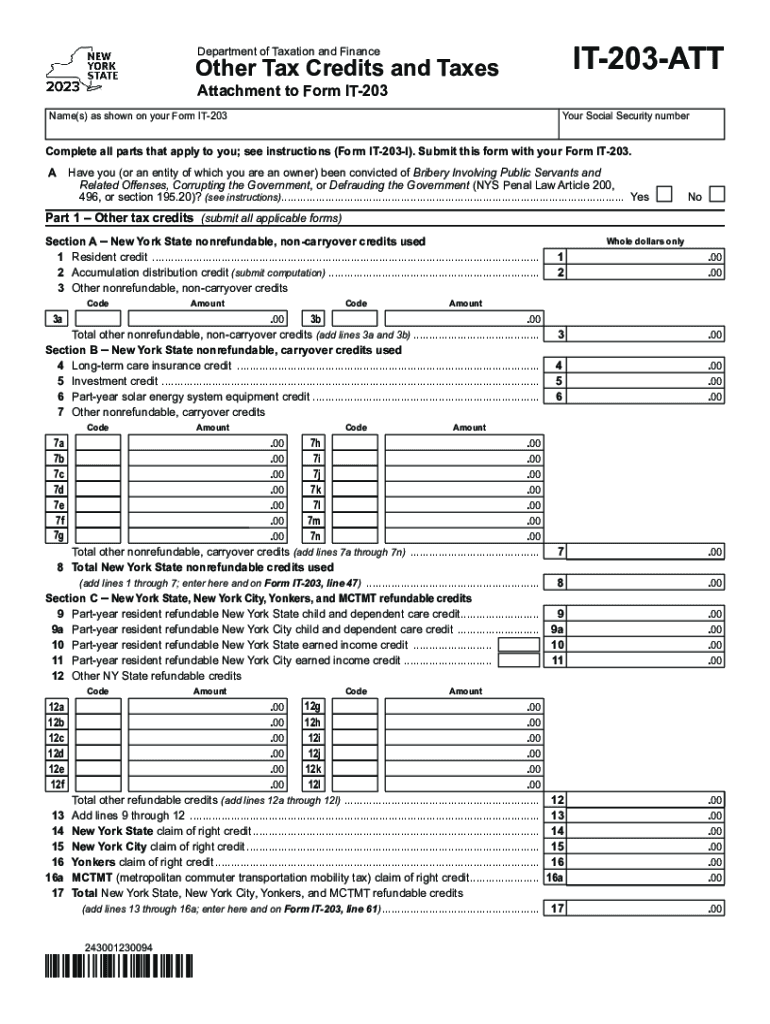

The New York State Tax Form IT-203 is specifically designed for non-residents who earn income from New York sources. This form allows individuals to report their income, calculate their tax liability, and claim any applicable credits. Understanding the purpose of this form is essential for ensuring compliance with state tax laws and accurately reporting income earned in New York.

Steps to Complete the IT-203 Form

Filling out the IT-203 form involves several key steps:

- Gather necessary documents, including W-2s and 1099s that report your New York income.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your New York source income in the appropriate sections of the form.

- Calculate your tax liability using the provided tax tables and instructions.

- Claim any eligible credits to reduce your tax due.

- Review the form for accuracy before submitting.

Required Documents for IT-203

When completing the IT-203 form, it is important to have the following documents ready:

- W-2 forms from employers that report income earned in New York.

- 1099 forms for any freelance or contract work performed in New York.

- Records of any deductions or credits you plan to claim.

- Identification information, such as your Social Security number.

Filing Deadlines for IT-203

Timely filing of the IT-203 form is crucial to avoid penalties. The deadline for submitting this form typically aligns with the federal tax filing deadline, which is usually April 15. However, if you are unable to file by this date, you may request an extension, but it is essential to pay any tax owed to avoid interest and penalties.

Submission Methods for IT-203

The IT-203 form can be submitted in several ways:

- Electronically through tax preparation software that supports New York state forms.

- By mail, sending the completed form to the address specified in the instructions.

- In-person at designated tax offices, if applicable.

Key Elements of the IT-203 Form

Understanding the key elements of the IT-203 form can help ensure accurate completion:

- Personal information section for identification.

- Income reporting sections for various types of income.

- Tax calculation area, including applicable rates and brackets.

- Credits and deductions section to reduce overall tax liability.

Eligibility Criteria for IT-203

To file the IT-203 form, you must meet specific eligibility criteria, including:

- You must be a non-resident of New York State.

- You must have earned income from New York sources during the tax year.

- You must not be a full-year resident of another state, as this may affect your filing status.

Quick guide on how to complete what does the form 203 f mean turbotax support intuit

Complete What Does The Form 203 F Mean? TurboTax Support Intuit easily on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely maintain it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly without interruptions. Handle What Does The Form 203 F Mean? TurboTax Support Intuit on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign What Does The Form 203 F Mean? TurboTax Support Intuit effortlessly

- Locate What Does The Form 203 F Mean? TurboTax Support Intuit and click Get Form to begin.

- Use the tools available to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with specialized tools offered by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign What Does The Form 203 F Mean? TurboTax Support Intuit to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct what does the form 203 f mean turbotax support intuit

Create this form in 5 minutes!

How to create an eSignature for the what does the form 203 f mean turbotax support intuit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ny non resident tax form and who needs to file it?

The ny non resident tax form is designed for individuals who earn income in New York but do not reside there. This form is essential for reporting income sourced from New York State while benefiting from any applicable tax credits. Individuals who work, earn rental income, or have investments in New York need to file this form.

-

How can I easily complete the ny non resident tax form?

To complete the ny non resident tax form effortlessly, you can use airSlate SignNow, which offers intuitive templates and eSignature capabilities. Our platform simplifies the document signing process and ensures you accurately fill out and submit the form without any hassle. Plus, you can review and track the status of your submissions.

-

What features does airSlate SignNow offer for managing the ny non resident tax form?

airSlate SignNow provides a seamless way to manage the ny non resident tax form with our user-friendly interface and robust feature set. Features include customizable templates, cloud storage for easy access, and real-time collaboration, which empower you to complete your tax form efficiently. Our platform also ensures compliance with state regulations.

-

Is airSlate SignNow cost-effective for handling the ny non resident tax form?

Yes, airSlate SignNow is a cost-effective solution for handling the ny non resident tax form without the need for expensive tax software. Our transparent pricing plans cater to various needs and budgets, allowing you to focus on completing your documentation rather than worrying about costs. Sign up for a free trial to explore the benefits.

-

Can I integrate airSlate SignNow with other tax software for filing the ny non resident tax form?

Absolutely! airSlate SignNow integrates seamlessly with various tax software solutions, providing you with a versatile platform to manage your ny non resident tax form efficiently. These integrations streamline workflows, ensuring that your data syncs effortlessly, making the filing process simpler and quicker.

-

What are the benefits of using airSlate SignNow for my ny non resident tax form?

Using airSlate SignNow for your ny non resident tax form offers numerous benefits, including ease of use, efficiency, and enhanced security. Our platform protects your sensitive information while providing features like multi-party signing and real-time notifications. This saves time and ensures you stay on top of important deadlines.

-

How secure is my information when submitting the ny non resident tax form with airSlate SignNow?

Security is a top priority at airSlate SignNow. When submitting your ny non resident tax form, your information is encrypted and stored securely, safeguarding it from unauthorized access. We also comply with industry-standard security measures to ensure that your data remains protected throughout the signing process.

Get more for What Does The Form 203 F Mean? TurboTax Support Intuit

- Patient medical history questionnaire uc davis health form

- To claim a child for federal student financial aid purposes you must be providing more than 50 of the childs financial form

- Psychiatric nurse form

- Paraffin embedded tissue request form unmc

- Title 19 form

- Patient access request for medical records lee health form

- Massage worksheet form

- Download your health history document here to print and fill form

Find out other What Does The Form 203 F Mean? TurboTax Support Intuit

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now