Form it 203 ATT Other Tax Credits and Taxes Tax Year 2024-2026

Understanding the IT-203 ATT Form for Other Tax Credits

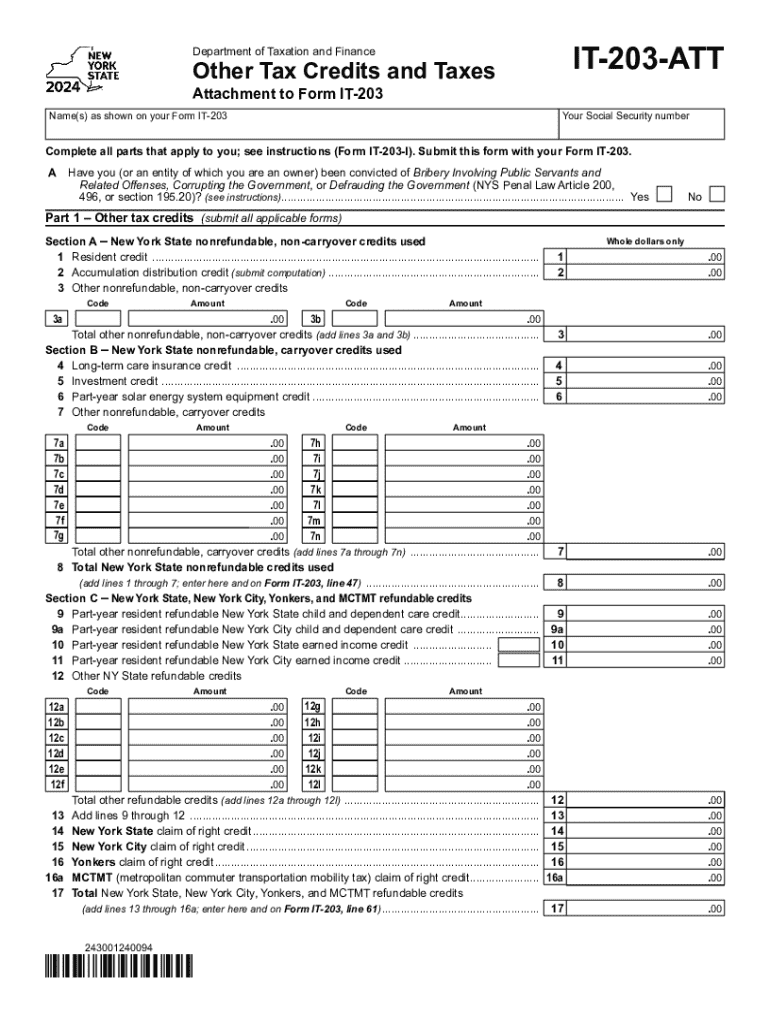

The IT-203 ATT form is specifically designed for New York taxpayers who are eligible for various tax credits. This form allows individuals to report and claim credits that may reduce their overall tax liability. The tax credits available can vary based on factors such as income level, residency status, and specific circumstances like educational expenses or childcare costs. Understanding the purpose and function of this form is crucial for maximizing potential savings on your state taxes.

Steps to Complete the IT-203 ATT Form

Completing the IT-203 ATT form involves several key steps to ensure accurate reporting and compliance with New York tax regulations. Begin by gathering all necessary documentation, including proof of income, residency, and any relevant expenses that qualify for tax credits. Next, carefully fill out the form, providing detailed information about your income and the specific credits you are claiming. It is important to double-check all entries for accuracy before submission to avoid delays or penalties.

Eligibility Criteria for Tax Credits on the IT-203 ATT Form

Eligibility for tax credits reported on the IT-203 ATT form can depend on various factors, including your filing status, income level, and specific life circumstances. For instance, credits may be available for taxpayers with dependents, those who are self-employed, or individuals who have incurred specific expenses such as tuition or childcare. Reviewing the eligibility criteria outlined by the New York State Department of Taxation and Finance is essential to determine which credits you can claim.

Required Documents for Filing the IT-203 ATT Form

When preparing to file the IT-203 ATT form, certain documents are required to substantiate your claims. These may include W-2 forms, 1099 forms, receipts for qualifying expenses, and any other documentation that supports your eligibility for the credits. Having these documents organized and readily available will facilitate a smoother filing process and help ensure that you accurately report your financial information.

Filing Deadlines for the IT-203 ATT Form

Filing deadlines for the IT-203 ATT form align with the general tax filing deadlines set by the state of New York. Typically, taxpayers must submit their forms by April fifteenth of the following tax year. However, if you require an extension, it is important to file the appropriate extension request to avoid penalties. Staying informed about these deadlines will help you maintain compliance and avoid unnecessary complications with your tax filings.

Form Submission Methods for the IT-203 ATT Form

The IT-203 ATT form can be submitted through various methods, including online filing, mail, or in-person submission at designated tax offices. Online filing is often the most efficient method, allowing for quicker processing times. If you choose to mail your form, ensure it is sent to the correct address as specified by the New York State Department of Taxation and Finance to avoid delays. Familiarizing yourself with these submission methods will help streamline your filing experience.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 att other tax credits and taxes tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 203 att other tax credits and taxes tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are NY tax credits and how can they benefit my business?

NY tax credits are incentives provided by the state of New York to encourage business growth and investment. By utilizing these credits, businesses can reduce their tax liabilities, which can signNowly improve cash flow. Understanding how to apply for and maximize these credits can lead to substantial savings.

-

How can airSlate SignNow help me manage my NY tax credits documentation?

airSlate SignNow offers an easy-to-use platform for sending and eSigning documents related to NY tax credits. With our solution, you can streamline the documentation process, ensuring that all necessary forms are completed and submitted on time. This efficiency can help you focus more on maximizing your tax benefits.

-

Are there any costs associated with using airSlate SignNow for NY tax credits?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solution ensures that you can manage your NY tax credits documentation without breaking the bank. We provide a range of features that justify the investment, making it a valuable tool for your business.

-

What features does airSlate SignNow offer for handling NY tax credits?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing NY tax credits. These tools help ensure that your documents are accurate and compliant with state regulations. Additionally, our platform allows for easy collaboration among team members.

-

Can I integrate airSlate SignNow with other software to manage NY tax credits?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage NY tax credits. Whether you use accounting software or project management tools, our integrations ensure that your workflow remains efficient and organized. This connectivity can help streamline your tax credit processes.

-

How does airSlate SignNow ensure the security of my NY tax credits documents?

Security is a top priority at airSlate SignNow. We employ advanced encryption and secure cloud storage to protect your NY tax credits documents from unauthorized access. Our compliance with industry standards ensures that your sensitive information remains safe throughout the eSigning process.

-

What are the benefits of using airSlate SignNow for NY tax credits?

Using airSlate SignNow for NY tax credits offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. Our platform simplifies the eSigning process, allowing you to focus on maximizing your tax credits rather than getting bogged down in administrative tasks. This can lead to faster approvals and better financial outcomes.

Get more for Form IT 203 ATT Other Tax Credits And Taxes Tax Year

Find out other Form IT 203 ATT Other Tax Credits And Taxes Tax Year

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online