Form it 203 B Nonresident and Part Year Resident Income 2020

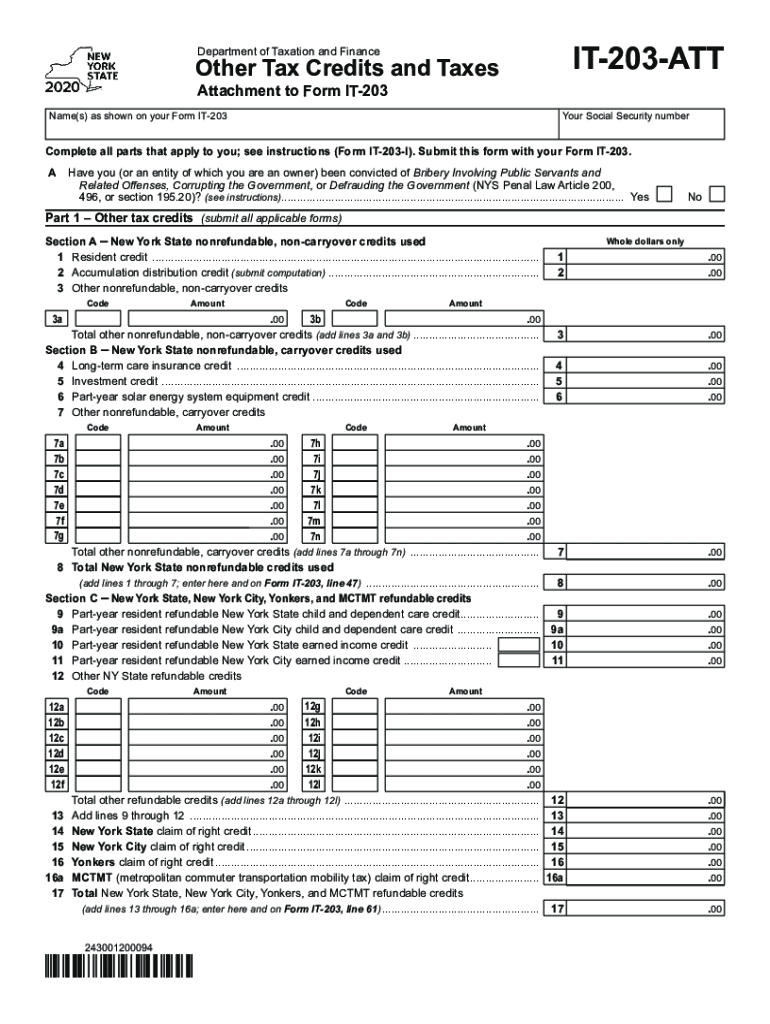

What is the Form IT 203 ATT?

The Form IT 203 ATT is a critical document for individuals who need to report their income as nonresidents or part-year residents of New York State. This form allows taxpayers to accurately calculate their tax obligations based on the income earned within the state during the period of residency. It is essential for ensuring compliance with New York tax laws, particularly for those who may have income sourced from both in-state and out-of-state activities.

How to Use the Form IT 203 ATT

Using the Form IT 203 ATT involves several steps to ensure accurate completion. First, gather all necessary documentation, including W-2 forms, 1099s, and any other income statements. Next, determine your residency status and the specific income earned during your time in New York. Complete the form by entering your personal information, income details, and any applicable deductions or credits. Finally, review the form for accuracy before submitting it to the New York State Department of Taxation and Finance.

Steps to Complete the Form IT 203 ATT

Completing the Form IT 203 ATT requires careful attention to detail. Follow these steps:

- Gather your income statements and any relevant tax documents.

- Identify the period you were a resident of New York and the income earned during that time.

- Fill out your personal information at the top of the form.

- Report your total income, including wages, interest, and dividends.

- Apply any deductions or credits you may qualify for.

- Calculate your total tax liability based on the instructions provided.

- Sign and date the form before submission.

Legal Use of the Form IT 203 ATT

The Form IT 203 ATT is legally binding when completed accurately and submitted on time. It must comply with all relevant New York State tax laws and regulations. Failure to file this form correctly can lead to penalties or audits by the state tax authorities. It is crucial to ensure that all information is truthful and that the form is submitted within the designated filing deadlines to avoid complications.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 203 ATT are critical for compliance. Typically, the form must be submitted by the due date for your New York State tax return, which is usually April fifteenth for most taxpayers. If you are unable to file by this date, you may request an extension, but it is essential to pay any taxes owed by the original deadline to avoid interest and penalties.

Required Documents

To complete the Form IT 203 ATT, you will need several documents:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income, such as rental or investment income.

- Documentation for any deductions or credits you plan to claim.

Form Submission Methods

The Form IT 203 ATT can be submitted in various ways. Taxpayers have the option to file online through the New York State Department of Taxation and Finance website, which offers a streamlined process. Alternatively, you can mail a paper copy of the form to the appropriate address listed in the instructions. In-person submissions may also be available at designated tax offices, though this option may vary based on current regulations and office hours.

Quick guide on how to complete form it 203 b nonresident and part year resident income

Complete Form IT 203 B Nonresident And Part Year Resident Income seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Handle Form IT 203 B Nonresident And Part Year Resident Income on any platform with airSlate SignNow's Android or iOS apps and enhance any document-centric task today.

The easiest way to modify and eSign Form IT 203 B Nonresident And Part Year Resident Income effortlessly

- Locate Form IT 203 B Nonresident And Part Year Resident Income and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device of your choice. Modify and eSign Form IT 203 B Nonresident And Part Year Resident Income and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 b nonresident and part year resident income

Create this form in 5 minutes!

How to create an eSignature for the form it 203 b nonresident and part year resident income

The way to generate an electronic signature for a PDF in the online mode

The way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

How to create an eSignature for a PDF document on Android OS

People also ask

-

What is the main benefit of using airSlate SignNow for 203 att?

The primary benefit of using airSlate SignNow for 203 att is its user-friendly interface that simplifies the process of sending and eSigning documents. Businesses can enhance their workflow efficiency while ensuring compliance and security, making it a valuable tool for document management.

-

How does airSlate SignNow pricing work for 203 att users?

airSlate SignNow offers flexible pricing plans for 203 att users, accommodating businesses of all sizes. Each plan includes features that suit different needs, ensuring cost-effectiveness without compromising on essential functionalities.

-

What features does airSlate SignNow offer for 203 att?

airSlate SignNow provides a range of features specifically designed for 203 att, including customizable templates, real-time tracking, and secure cloud storage. These features help streamline the signing process while keeping documents safe and accessible.

-

Can I integrate airSlate SignNow with other tools while using 203 att?

Yes, airSlate SignNow offers seamless integrations with popular business tools, allowing 203 att users to enhance their workflows. You can connect with platforms like Google Drive, Salesforce, and more, making document management easier than ever.

-

Is airSlate SignNow secure for handling 203 att documents?

Absolutely, airSlate SignNow is committed to security, ensuring that all 203 att documents are protected throughout the signing process. The platform complies with industry-standard security protocols, including SSL encryption and data protection regulations.

-

What kind of support can 203 att users expect from airSlate SignNow?

airSlate SignNow provides robust customer support for 203 att users, including live chat, email, and comprehensive resources like FAQs and video tutorials. This ensures that any questions or issues can be promptly addressed, enhancing user experience.

-

How can airSlate SignNow improve my business processes using 203 att?

Using airSlate SignNow with 203 att can signNowly improve your business processes by automating document workflows and reducing turnaround times. This efficiency not only saves time but also allows your team to focus on more strategic tasks.

Get more for Form IT 203 B Nonresident And Part Year Resident Income

- Cc 1 section 3 report georgia department of community affairs dca ga form

- California transfer disclosure statement california civil code1102 et seq form

- Brokerage disclosure to buyer tenant relationship vaned form

- Real estate broker contracts and forms division of real estate

- Dual status disclosure real estate broker and mortgage form

- Brokerage disclosure community first commercial real form

- Colorado net tangible benefit form

- Lead based paint disclosures salespdf google drive form

Find out other Form IT 203 B Nonresident And Part Year Resident Income

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document