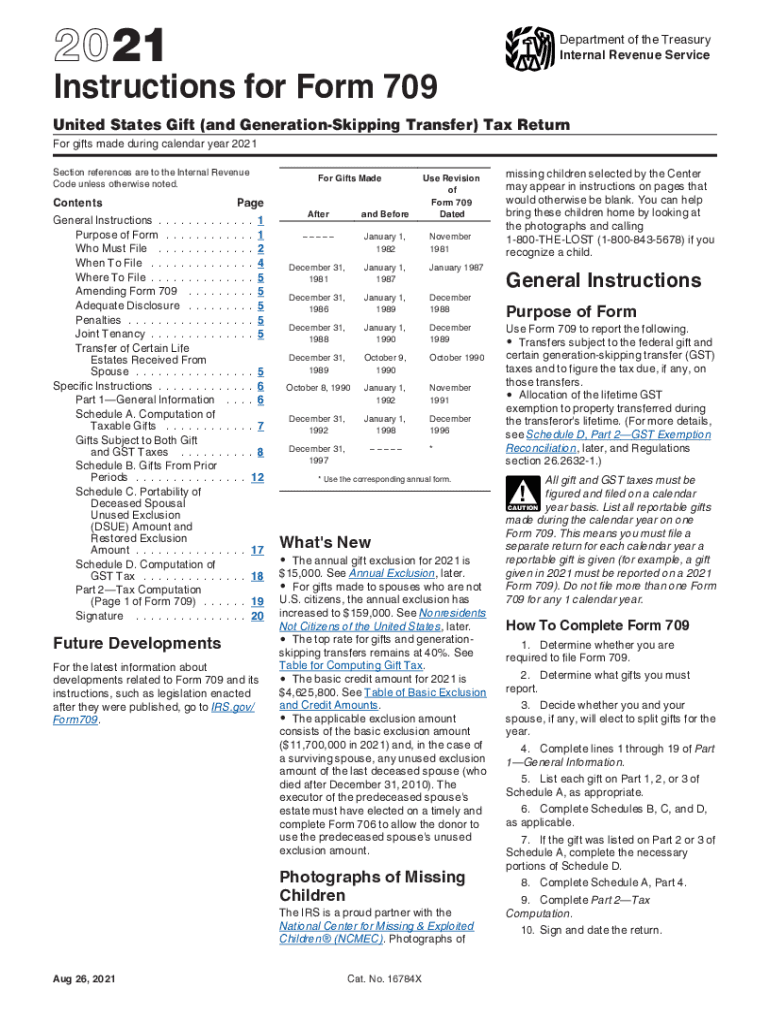

Instructions for Form 709 Instructions for Form 709, United States Gift and Generation Skipping Transfer Tax Return 2021

Understanding Form 709 and Gift Tax Instructions

The Instructions for Form 709, officially titled the United States Gift and Generation-Skipping Transfer Tax Return, are essential for individuals who make gifts that exceed the annual exclusion limit set by the IRS. This form is used to report gifts made during the year and to calculate any gift tax owed. It is important to understand that not all gifts are taxable, but those that exceed the specified limits must be reported. The IRS provides detailed guidelines on how to fill out this form, ensuring compliance with federal tax laws.

Steps to Complete Form 709

Completing Form 709 requires careful attention to detail. Here are the key steps to follow:

- Gather necessary information, including details about the gifts made, the recipients, and any applicable exclusions.

- Fill out the identification information, including your name, Social Security number, and address.

- Report each gift on the form, providing the fair market value at the time of the gift.

- Calculate any applicable deductions, such as the annual exclusion amount.

- Determine the total taxable gifts and calculate the gift tax owed, if any.

- Sign and date the form before submission.

IRS Guidelines for Filing Form 709

The IRS has established specific guidelines for filing Form 709. These guidelines include:

- Filing the form by April fifteenth of the year following the year in which the gifts were made.

- Providing accurate and complete information to avoid penalties.

- Using the correct version of the form for the tax year in question.

Adhering to these guidelines will ensure that your filing is accepted without issues.

Required Documents for Form 709

When preparing to file Form 709, certain documents are necessary to support your claims. These may include:

- Records of all gifts made during the tax year, including appraisals for high-value items.

- Documentation of any prior gift tax returns filed, if applicable.

- Proof of the fair market value of the gifts at the time they were given.

Having these documents ready will facilitate the completion of the form and help ensure accuracy.

Filing Methods for Form 709

Form 709 can be submitted in several ways, including:

- Electronically through IRS-approved e-filing software.

- By mail, sending the completed form to the appropriate IRS address based on your location.

- In-person at designated IRS offices, if necessary.

Choosing the right method for your situation can streamline the filing process and ensure timely submission.

Penalties for Non-Compliance with Gift Tax Regulations

Failing to file Form 709 or inaccuracies in reporting can lead to penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on any unpaid taxes due.

- Potential audits by the IRS, leading to further scrutiny of your financial records.

Understanding these penalties emphasizes the importance of accurate and timely filing.

Quick guide on how to complete 2021 instructions for form 709 instructions for form 709 united states gift and generation skipping transfer tax return

Complete Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents promptly without hindrance. Manage Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to modify and electronically sign Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return with ease

- Obtain Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you want to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunts, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from a device of your choice. Modify and electronically sign Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return and ensure exceptional communication at any point of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 instructions for form 709 instructions for form 709 united states gift and generation skipping transfer tax return

Create this form in 5 minutes!

How to create an eSignature for the 2021 instructions for form 709 instructions for form 709 united states gift and generation skipping transfer tax return

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What are the basic instructions for filing gift tax?

Instructions for gift tax include understanding when to file, which gifts are taxable, and how to calculate the gift's value. Generally, gifts over the annual exclusion limit require filing, and it's essential to document the gift details accurately. Following the instructions gift tax ensures compliance with IRS regulations.

-

How does airSlate SignNow assist with gift tax documentation?

airSlate SignNow simplifies the process of creating and managing the necessary documents for gift tax filing. Our eSigning solution allows users to sign and send gift tax forms securely and efficiently. This feature helps ensure that you have all the required instructions gift tax laid out correctly.

-

Are there any fees associated with using airSlate SignNow for gift tax documentation?

Yes, airSlate SignNow offers competitive pricing plans based on the features you need. While creating and managing gift tax documentation, the cost remains low, making it a cost-effective solution for all your instruction gift tax needs. Visit our pricing page for more detailed information.

-

What integrations does airSlate SignNow offer for managing gift tax forms?

airSlate SignNow integrates seamlessly with popular business tools like Google Drive, Dropbox, and Microsoft Office. These integrations help streamline the process of updating and accessing your gift tax documentation. Leveraging these integrations empowers users to manage their instructions gift tax more efficiently.

-

Can I customize templates for gift tax documents using airSlate SignNow?

Absolutely! With airSlate SignNow, users can create and customize their own templates for gift tax documents. This feature allows for personalized instructions gift tax tailored to individual needs, simplifying the eSignature process.

-

What are the benefits of using airSlate SignNow for gift tax filings?

The benefits of using airSlate SignNow include time savings, enhanced security, and the ease of electronic document management. Our platform streamlines the filing process while ensuring that you comply with all instructions gift tax. This efficiency can help prevent mistakes and delays.

-

Is it easy to track the status of gift tax documents in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all your gift tax documents. You can easily monitor when a document is sent, viewed, and signed, ensuring transparency throughout the signing process. This feature enhances your ability to follow the instructions gift tax without complications.

Get more for Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return

- Colorado income tax form

- Instructions filing court form

- Notice of appeal and designation of record criminal colorado form

- Motion to determine factual innocence colorado form

- Order regarding factual innocence colorado form

- Bond cost colorado form

- Colorado notice intent 497300349 form

- Colorado notice intent 497300350 form

Find out other Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure