Form 709 Instructions Gift Tax 2017

What is the Form 709 Instructions Gift Tax

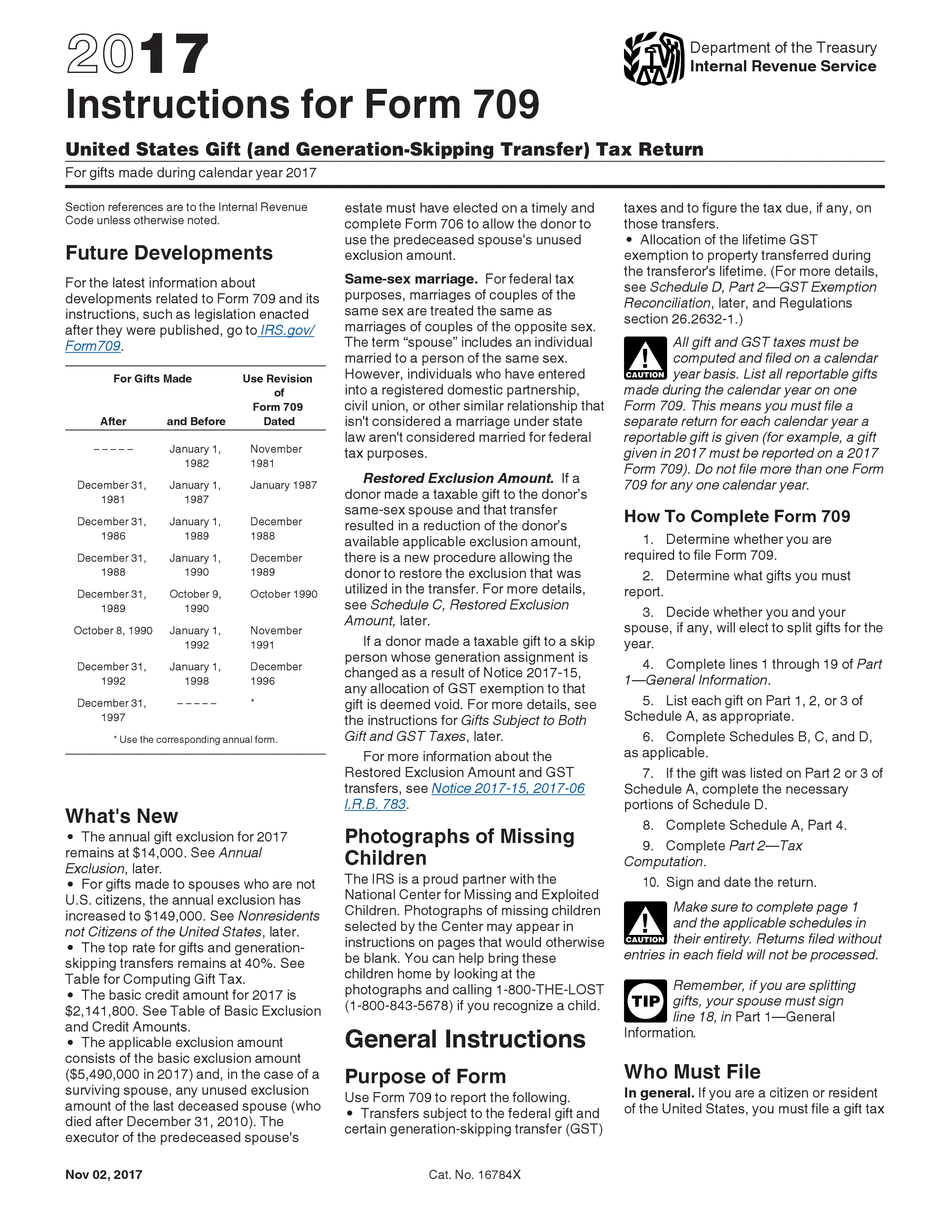

The Form 709, also known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is a crucial document used by individuals to report gifts made during a tax year. This form is essential for those who have given gifts exceeding the annual exclusion limit set by the IRS, which is currently $17,000 per recipient for 2023. The form helps determine the amount of gift tax owed and ensures compliance with federal tax laws. It is important for taxpayers to understand the implications of this form, as it can affect their lifetime gift tax exemption and estate planning strategies.

How to use the Form 709 Instructions Gift Tax

Using the Form 709 involves several key steps to ensure accurate reporting of gifts. First, gather all necessary information about the gifts made, including the recipient's details, the value of each gift, and any applicable exclusions. Next, complete the form by following the detailed instructions provided by the IRS, ensuring that all required fields are filled out correctly. It is advisable to consult a tax professional if there are any uncertainties regarding the form's requirements or calculations. Once completed, the form must be filed with the IRS by the due date, typically on or before April 15 of the year following the gifts.

Steps to complete the Form 709 Instructions Gift Tax

Completing the Form 709 requires careful attention to detail. Here are the steps to follow:

- Review the IRS instructions for the Form 709 to understand the requirements and guidelines.

- Collect documentation for all gifts made during the tax year, including appraisals for non-cash gifts.

- Fill out Part 1 of the form with your personal information, including your name, address, and taxpayer identification number.

- In Part 2, list each gift made, specifying the recipient, the date of the gift, and its value.

- Complete Part 3 to claim any exclusions or deductions applicable to your gifts.

- Review the entire form for accuracy, ensuring all necessary information is included.

- Sign and date the form before submitting it to the IRS.

Filing Deadlines / Important Dates

The Form 709 must be filed by the tax deadline, which is generally April 15 of the year following the year in which the gifts were made. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Additionally, if an extension for filing your income tax return is granted, it does not automatically extend the deadline for Form 709. Taxpayers should be aware of these deadlines to avoid penalties and ensure compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form 709 can be submitted to the IRS in several ways. While electronic filing is not currently available for this form, taxpayers can print the completed form and mail it to the appropriate IRS address based on their location. It is important to use a secure mailing method, such as certified mail, to ensure the form is received by the IRS. In-person submission is not typically available for this form, as it must be filed through the mail.

Key elements of the Form 709 Instructions Gift Tax

Several key elements are essential when completing the Form 709. These include:

- Donor Information: Personal details of the individual making the gifts.

- Recipient Information: Names and addresses of individuals receiving gifts.

- Gift Details: Description and value of each gift, along with the date it was given.

- Exclusions: Any applicable exclusions, such as the annual exclusion limit.

- Signature: The donor must sign and date the form to validate it.

Quick guide on how to complete form 709 instructions gift tax 2017

Uncover the easiest method to complete and endorse your Form 709 Instructions Gift Tax

Are you still spending time creating your official documents on paper instead of doing it digitally? airSlate SignNow offers a superior approach to finalize and authorize your Form 709 Instructions Gift Tax and associated forms for public services. Our intelligent electronic signature solution supplies all you require to handle paperwork rapidly and in compliance with official standards - robust PDF editing, organizing, safeguarding, endorsing, and distributing tools all available within an easy-to-use interface.

Only a few steps are necessary to complete and endorse your Form 709 Instructions Gift Tax:

- Upload the editable template to the editor using the Get Form button.

- Verify what information you need to enter in your Form 709 Instructions Gift Tax.

- Move through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the gaps with your particulars.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is crucial or Obscure sections that are no longer necessary.

- Select Sign to create a legally enforceable electronic signature using whichever method you prefer.

- Add the Date next to your signature and finish your task with the Done button.

Store your completed Form 709 Instructions Gift Tax in the Documents folder within your account, download it, or export it to your preferred cloud storage. Our service also provides versatile file sharing options. There’s no need to print your forms when you need to submit them to the appropriate public office - send them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try now!

Create this form in 5 minutes or less

Find and fill out the correct form 709 instructions gift tax 2017

FAQs

-

Is it more beneficial to file Form 709 Gift Tax than the 1040 (A -X -EZ) for 2019?

Form 709 is for the giver of gifts exceeding $15,000 per person per year (double that for spouses giving jointly, double again if the recipients are married and the gift is to both). Instructions for Form 709 (2018)Form 1040 is for your own income tax - and gifts are not taxable income to the recipient.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

Create this form in 5 minutes!

How to create an eSignature for the form 709 instructions gift tax 2017

How to make an electronic signature for the Form 709 Instructions Gift Tax 2017 online

How to make an electronic signature for the Form 709 Instructions Gift Tax 2017 in Google Chrome

How to generate an eSignature for signing the Form 709 Instructions Gift Tax 2017 in Gmail

How to generate an electronic signature for the Form 709 Instructions Gift Tax 2017 from your smart phone

How to create an electronic signature for the Form 709 Instructions Gift Tax 2017 on iOS devices

How to create an eSignature for the Form 709 Instructions Gift Tax 2017 on Android OS

People also ask

-

What are the Form 709 Instructions Gift Tax?

The Form 709 Instructions Gift Tax provide detailed guidelines on how to complete the IRS Form 709, which is used to report gifts and calculate the gift tax. These instructions help taxpayers understand the requirements for filing, including exemptions and deductions that may apply when reporting gifts.

-

How can airSlate SignNow help with Form 709 Instructions Gift Tax?

airSlate SignNow simplifies the process of managing Form 709 Instructions Gift Tax by allowing users to create, sign, and send documents electronically. Our platform ensures that all necessary information is included, streamlining the filing process and reducing the chances of errors.

-

Is airSlate SignNow cost-effective for managing Form 709 Instructions Gift Tax?

Yes, airSlate SignNow offers a cost-effective solution for managing Form 709 Instructions Gift Tax. With flexible pricing plans, businesses can choose an option that fits their budget while benefiting from our user-friendly features that enhance document management.

-

What features does airSlate SignNow offer for Form 709 Instructions Gift Tax?

airSlate SignNow provides features like customizable templates, secure eSignature options, and automated reminders, all of which are essential when dealing with Form 709 Instructions Gift Tax. These tools make it easy to ensure compliance and keep track of important deadlines.

-

Can I integrate airSlate SignNow with other software for Form 709 Instructions Gift Tax?

Absolutely! airSlate SignNow integrates seamlessly with various software platforms, allowing you to manage Form 709 Instructions Gift Tax alongside your existing tools. This integration enhances workflow efficiency and keeps all your documents organized in one place.

-

What are the benefits of using airSlate SignNow for Form 709 Instructions Gift Tax?

Using airSlate SignNow for Form 709 Instructions Gift Tax offers numerous benefits, including increased accuracy, reduced processing time, and improved security. Our electronic signature solution also ensures that your documents are legally binding and compliant with IRS regulations.

-

How can I get support for Form 709 Instructions Gift Tax on airSlate SignNow?

airSlate SignNow provides comprehensive support for users dealing with Form 709 Instructions Gift Tax. Our customer service team is available via chat, email, and phone to assist you with any questions or concerns about your documents and the signing process.

Get more for Form 709 Instructions Gift Tax

- Fixed price proposal template form

- Familienfragebogen aok form

- Dmv nevada phone number form

- Job fair registration form city of albany georgia albany ga

- Bfank form

- Moslpa form

- Ttb f 5150 22 ttb f 5150 22 application for an industrial alcohol user permit form

- Standard service level agreement template form

Find out other Form 709 Instructions Gift Tax

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer