Form 709 Instructions 2018

What is the Form 709 Instructions

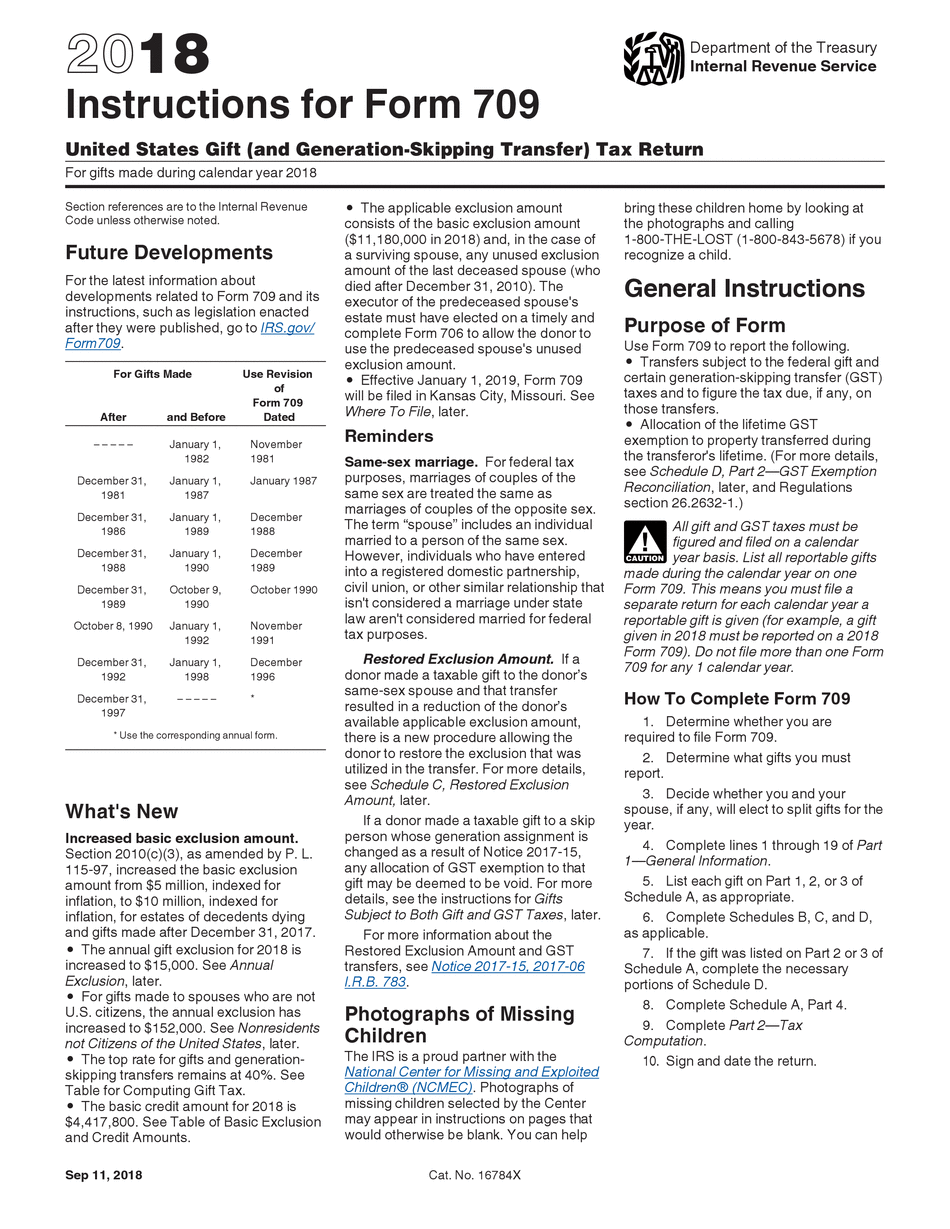

The Form 709 instructions provide detailed guidance on how to complete the IRS Form 709, which is used to report gifts made during the tax year. This form is essential for individuals who have made gifts exceeding the annual exclusion amount. It outlines the necessary information needed to accurately report these gifts to the IRS and ensures compliance with federal tax regulations. Understanding these instructions is crucial for avoiding penalties and ensuring that all required information is submitted correctly.

Steps to complete the Form 709 Instructions

Completing the Form 709 requires careful attention to detail. Here are the key steps involved:

- Gather relevant financial information, including details about the gifts made and their values.

- Review the annual exclusion amount for the relevant tax year to determine which gifts need to be reported.

- Fill out the form accurately, ensuring all required fields are completed.

- Include any necessary attachments, such as appraisals for non-cash gifts.

- Double-check all entries for accuracy before submission.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for Form 709 to avoid penalties. Generally, Form 709 must be filed by April fifteenth of the year following the year in which the gifts were made. If you file for an extension on your income tax return, this extension does not apply to Form 709. Therefore, it is advisable to plan ahead and ensure timely submission.

Required Documents

When preparing to file Form 709, certain documents are essential to support your claims. These may include:

- Documentation of the gifts made, including dates and values.

- Any appraisals for non-cash gifts to establish fair market value.

- Records of previous gift tax returns, if applicable.

Form Submission Methods (Online / Mail / In-Person)

Form 709 can be submitted through various methods. While electronic filing is not available for this form, you can mail your completed Form 709 to the appropriate IRS address based on your state of residence. Ensure that you use secure mailing options to protect sensitive information. In-person submission is generally not available, making it crucial to plan for mailing well in advance of the deadline.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 709. These guidelines include detailed instructions on what constitutes a gift, how to calculate the value of gifts, and the implications of gift splitting between spouses. Adhering to these guidelines is vital for ensuring that your form is accepted and that you remain compliant with tax laws.

Quick guide on how to complete form 709 instructions gift tax 2018 2019

Uncover the easiest method to complete and endorse your Form 709 Instructions

Are you still expending time preparing your official documents on paper instead of doing it digitally? airSlate SignNow offers a superior approach to complete and endorse your Form 709 Instructions and associated forms for public services. Our intelligent eSignature solution equips you with everything necessary to handle paperwork swiftly and in accordance with formal standards - robust PDF editing, managing, safeguarding, signing, and sharing tools all available within a straightforward interface.

Only a few steps are needed to finish filling out and endorsing your Form 709 Instructions:

- Upload the fillable template to the editor by using the Get Form button.

- Review what information you need to supply in your Form 709 Instructions.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the fields with your details.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is truly signNow or Obscure sections that are no longer relevant.

- Press Sign to create a legally binding eSignature using any method you prefer.

- Include the Date alongside your signature and finalize your task with the Done button.

Store your completed Form 709 Instructions in the Documents folder within your profile, download it, or transfer it to your preferred cloud storage. Our solution also provides versatile form sharing options. There’s no need to print your forms when you need to submit them to the relevant public office - send them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it now!

Create this form in 5 minutes or less

Find and fill out the correct form 709 instructions gift tax 2018 2019

FAQs

-

Is it more beneficial to file Form 709 Gift Tax than the 1040 (A -X -EZ) for 2019?

Form 709 is for the giver of gifts exceeding $15,000 per person per year (double that for spouses giving jointly, double again if the recipients are married and the gift is to both). Instructions for Form 709 (2018)Form 1040 is for your own income tax - and gifts are not taxable income to the recipient.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

What if your taxes for 2017 was filed last year 2018 when filling out taxes this year 2019 and you didn't file the 2017 taxes, but waiting to do them with your 2019 taxes?

Looks like you want to wait for next year to file for 2018 & 2019 at the same time. In that case, 2018 will have to be mailed and 2019 only can be electronically filed. If you have refund coming to you on the 2018, no problem, refund check will take around 2 months. If you owe instead, late filing penalties will apply. If you have not yet filed for 2018, you can still file electronically till October 15.

Create this form in 5 minutes!

How to create an eSignature for the form 709 instructions gift tax 2018 2019

How to create an electronic signature for your Form 709 Instructions Gift Tax 2018 2019 in the online mode

How to generate an eSignature for your Form 709 Instructions Gift Tax 2018 2019 in Chrome

How to make an electronic signature for putting it on the Form 709 Instructions Gift Tax 2018 2019 in Gmail

How to make an eSignature for the Form 709 Instructions Gift Tax 2018 2019 from your mobile device

How to make an electronic signature for the Form 709 Instructions Gift Tax 2018 2019 on iOS devices

How to make an electronic signature for the Form 709 Instructions Gift Tax 2018 2019 on Android devices

People also ask

-

What are the key components of the 709 gift tax instructions for 2017?

The 709 gift tax instructions for 2017 detail the process for filing gift tax returns, including reporting requirements, exclusions, and credits. It's essential to understand how to calculate your taxable gifts and the annual exclusion limit to ensure compliance. Familiarizing yourself with these components can help avoid potential penalties.

-

How does airSlate SignNow help with completing the 709 gift tax instructions for 2017?

airSlate SignNow simplifies the process of completing the 709 gift tax instructions for 2017 by providing user-friendly templates for your tax documents. Our platform enables you to easily fill out, sign, and send necessary documents securely. This streamlines your tax filing process while ensuring all required information is accurately captured.

-

Are there any costs associated with using airSlate SignNow for 709 gift tax instructions for 2017?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs, allowing you to choose a package that fits your budget. The cost-effectiveness of our solution means you can easily manage multiple document transactions, including those related to the 709 gift tax instructions for 2017, without breaking the bank.

-

Can I integrate airSlate SignNow with my existing tax software for 709 gift tax instructions for 2017?

Absolutely! airSlate SignNow supports integrations with various tax software, making it easier to incorporate your 709 gift tax instructions for 2017 within your existing workflow. This seamless integration ensures that you can manage your documents effectively without switching between different systems.

-

What are the benefits of using airSlate SignNow for the 709 gift tax instructions for 2017?

Using airSlate SignNow for the 709 gift tax instructions for 2017 provides numerous benefits, including enhanced security, ease of use, and faster processing times. Our electronic signature feature signifies that you will spend less time on paperwork and more time focusing on your financial strategies. Furthermore, our cloud-based platform allows for easy access from anywhere.

-

How secure is airSlate SignNow when handling my 709 gift tax instructions for 2017?

Security is our priority at airSlate SignNow. We use advanced encryption methods to protect your data, ensuring that your sensitive 709 gift tax instructions for 2017 are safe from unauthorized access. Additionally, our platform complies with industry standards to maintain confidentiality during document transactions.

-

Is airSlate SignNow suitable for all types of businesses handling 709 gift tax instructions for 2017?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, making it suitable for anyone needing to handle 709 gift tax instructions for 2017. Whether you're a small business owner or part of a larger corporation, our platform provides the flexibility and features required to manage your documentation effectively.

Get more for Form 709 Instructions

- Mb clubhouse rental form

- Cobb county form ifcb 5

- Vulnerable adult alert submission form division of criminal justice criminaljustice state ny

- Teachers make a difference scholarship application ncesd form

- Print name and signature template form

- Student exploration form

- 00 2409 doc dol form

- Application form for deferral of assessments dkit

Find out other Form 709 Instructions

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement