Form 709 Instructions 2018

What is the Form 709 Instructions

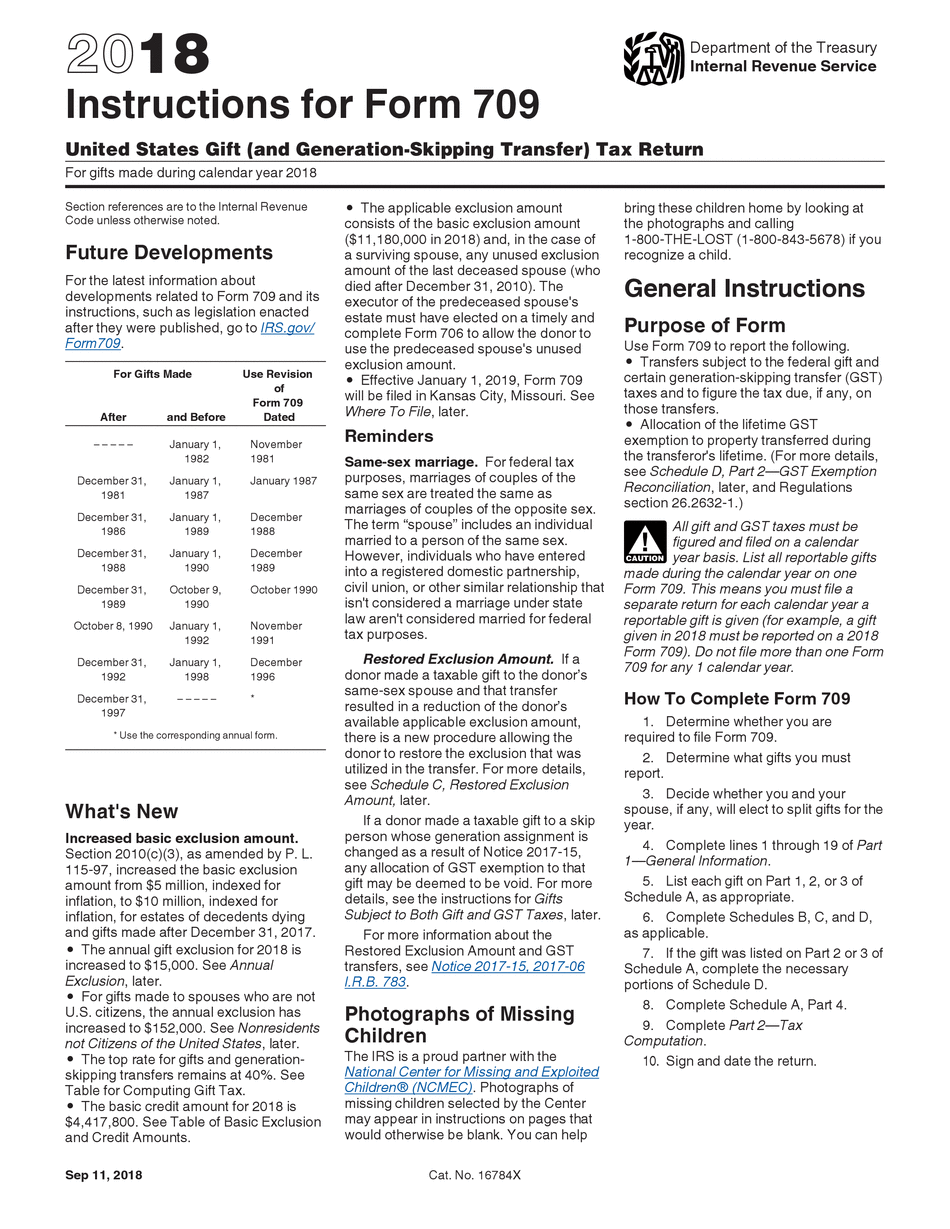

The Form 709 instructions provide detailed guidance on how to complete the IRS Form 709, which is used to report gifts made during the tax year. This form is essential for individuals who have made gifts exceeding the annual exclusion amount. It outlines the necessary information needed to accurately report these gifts to the IRS and ensures compliance with federal tax regulations. Understanding these instructions is crucial for avoiding penalties and ensuring that all required information is submitted correctly.

Steps to complete the Form 709 Instructions

Completing the Form 709 requires careful attention to detail. Here are the key steps involved:

- Gather relevant financial information, including details about the gifts made and their values.

- Review the annual exclusion amount for the relevant tax year to determine which gifts need to be reported.

- Fill out the form accurately, ensuring all required fields are completed.

- Include any necessary attachments, such as appraisals for non-cash gifts.

- Double-check all entries for accuracy before submission.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for Form 709 to avoid penalties. Generally, Form 709 must be filed by April fifteenth of the year following the year in which the gifts were made. If you file for an extension on your income tax return, this extension does not apply to Form 709. Therefore, it is advisable to plan ahead and ensure timely submission.

Required Documents

When preparing to file Form 709, certain documents are essential to support your claims. These may include:

- Documentation of the gifts made, including dates and values.

- Any appraisals for non-cash gifts to establish fair market value.

- Records of previous gift tax returns, if applicable.

Form Submission Methods (Online / Mail / In-Person)

Form 709 can be submitted through various methods. While electronic filing is not available for this form, you can mail your completed Form 709 to the appropriate IRS address based on your state of residence. Ensure that you use secure mailing options to protect sensitive information. In-person submission is generally not available, making it crucial to plan for mailing well in advance of the deadline.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 709. These guidelines include detailed instructions on what constitutes a gift, how to calculate the value of gifts, and the implications of gift splitting between spouses. Adhering to these guidelines is vital for ensuring that your form is accepted and that you remain compliant with tax laws.

Quick guide on how to complete form 709 instructions gift tax 2018 2019

Uncover the easiest method to complete and endorse your Form 709 Instructions

Are you still expending time preparing your official documents on paper instead of doing it digitally? airSlate SignNow offers a superior approach to complete and endorse your Form 709 Instructions and associated forms for public services. Our intelligent eSignature solution equips you with everything necessary to handle paperwork swiftly and in accordance with formal standards - robust PDF editing, managing, safeguarding, signing, and sharing tools all available within a straightforward interface.

Only a few steps are needed to finish filling out and endorsing your Form 709 Instructions:

- Upload the fillable template to the editor by using the Get Form button.

- Review what information you need to supply in your Form 709 Instructions.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the fields with your details.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is truly signNow or Obscure sections that are no longer relevant.

- Press Sign to create a legally binding eSignature using any method you prefer.

- Include the Date alongside your signature and finalize your task with the Done button.

Store your completed Form 709 Instructions in the Documents folder within your profile, download it, or transfer it to your preferred cloud storage. Our solution also provides versatile form sharing options. There’s no need to print your forms when you need to submit them to the relevant public office - send them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it now!

Create this form in 5 minutes or less

Find and fill out the correct form 709 instructions gift tax 2018 2019

FAQs

-

Is it more beneficial to file Form 709 Gift Tax than the 1040 (A -X -EZ) for 2019?

Form 709 is for the giver of gifts exceeding $15,000 per person per year (double that for spouses giving jointly, double again if the recipients are married and the gift is to both). Instructions for Form 709 (2018)Form 1040 is for your own income tax - and gifts are not taxable income to the recipient.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

What if your taxes for 2017 was filed last year 2018 when filling out taxes this year 2019 and you didn't file the 2017 taxes, but waiting to do them with your 2019 taxes?

Looks like you want to wait for next year to file for 2018 & 2019 at the same time. In that case, 2018 will have to be mailed and 2019 only can be electronically filed. If you have refund coming to you on the 2018, no problem, refund check will take around 2 months. If you owe instead, late filing penalties will apply. If you have not yet filed for 2018, you can still file electronically till October 15.

Create this form in 5 minutes!

How to create an eSignature for the form 709 instructions gift tax 2018 2019

How to create an electronic signature for your Form 709 Instructions Gift Tax 2018 2019 in the online mode

How to generate an eSignature for your Form 709 Instructions Gift Tax 2018 2019 in Chrome

How to make an electronic signature for putting it on the Form 709 Instructions Gift Tax 2018 2019 in Gmail

How to make an eSignature for the Form 709 Instructions Gift Tax 2018 2019 from your mobile device

How to make an electronic signature for the Form 709 Instructions Gift Tax 2018 2019 on iOS devices

How to make an electronic signature for the Form 709 Instructions Gift Tax 2018 2019 on Android devices

People also ask

-

What are the Form 709 Instructions for filing gift tax returns?

The Form 709 Instructions detail the process for reporting gifts made during the tax year that exceed the annual exclusion amount. Following the Form 709 Instructions is essential to ensure compliance with IRS regulations and avoid penalties. This form must be filed by April 15 of the year following the tax year in which the gifts were made.

-

How can airSlate SignNow help with completing Form 709?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending your Form 709. Our features streamline the process, ensuring that you can fill out and submit your Form 709 according to the IRS Instructions. With our secure eSignature capabilities, you can be confident your documents are handled safely and efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 709?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs when working with documents like Form 709. Our cost-effective solutions provide essential features for electronic signing and document management, ensuring you get the best value. You can choose a plan that fits your budget while still having access to all necessary functionalities for completing Form 709.

-

Can I integrate airSlate SignNow with other applications for Form 709 processing?

Absolutely! airSlate SignNow offers seamless integrations with various applications, which simplifies the process of managing Form 709. By integrating with tools like Google Drive, Dropbox, or CRM systems, you can easily access and send your Form 709 without disrupting your workflow.

-

What are the benefits of using airSlate SignNow for Form 709?

Using airSlate SignNow for your Form 709 filing offers numerous benefits, including efficiency, security, and accessibility. Our platform allows you to complete, sign, and send your Form 709 from anywhere, streamlining the process signNowly. Plus, our encryption ensures your sensitive information remains protected throughout the signing process.

-

How do I get started with airSlate SignNow for Form 709?

Getting started with airSlate SignNow for your Form 709 is simple! Just sign up for an account on our website, and you can immediately start using our electronic signing features. Our user-friendly interface will guide you through the steps to complete and submit your Form 709 effortlessly.

-

Are there any tutorials available for Form 709 on airSlate SignNow?

Yes, airSlate SignNow provides a range of tutorials and resources specifically focused on Form 709 Instructions. These resources will help you understand how to fill out the form accurately and utilize our platform effectively. You can find video tutorials and written guides on our support page.

Get more for Form 709 Instructions

- Mb clubhouse rental form

- Cobb county form ifcb 5

- Vulnerable adult alert submission form division of criminal justice criminaljustice state ny

- Teachers make a difference scholarship application ncesd form

- Print name and signature template form

- Student exploration form

- Clinical data reporting form lung

- Application form for deferral of assessments dkit

Find out other Form 709 Instructions

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast