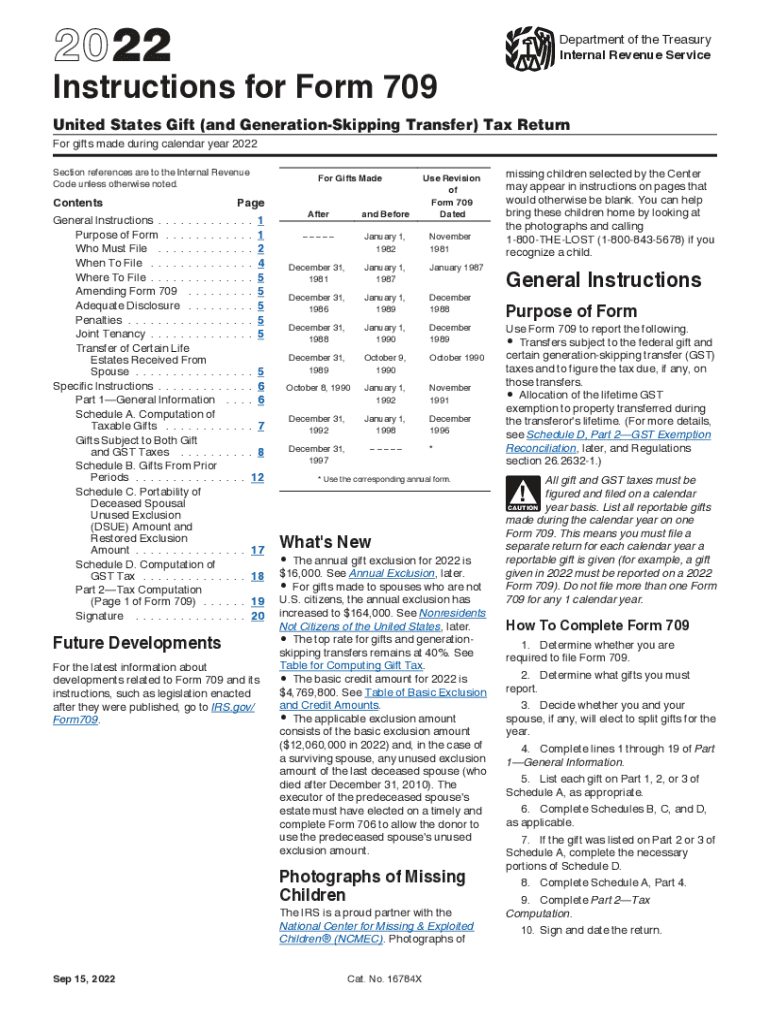

Instructions for Form 709 Instructions for Form 709, United States Gift and Generation Skipping Transfer Tax Return 2022

Understanding the 2018 Form 709 Instructions

The 2018 Form 709 is essential for reporting gifts and generation-skipping transfers to the IRS. This form is used to calculate and report any taxable gifts made during the tax year, as well as to allocate the lifetime generation-skipping transfer tax exemption. Understanding the instructions for this form is crucial for compliance with U.S. tax regulations. The instructions detail how to complete the form accurately, ensuring that all necessary information is provided to avoid potential penalties.

Steps to Complete the 2018 Form 709

Filling out the 2018 Form 709 requires careful attention to detail. Here are the key steps to follow:

- Gather all relevant documentation regarding gifts made during the year, including the value of each gift and the recipient's information.

- Begin by entering your personal information, including your name, address, and taxpayer identification number.

- Complete the sections detailing the gifts made, ensuring that you report any gifts that exceed the annual exclusion amount.

- Calculate the total value of gifts and any applicable deductions, then determine your tax liability.

- Review the form for accuracy before submitting it to the IRS.

Legal Use of the 2018 Form 709

The 2018 Form 709 is legally binding when completed and submitted according to IRS guidelines. To ensure legal compliance, it is important to follow the instructions precisely and provide accurate information. Electronic signatures are accepted, provided that they meet the requirements set forth by the ESIGN Act and UETA. This allows for secure and efficient submission of the form, maintaining its validity in legal contexts.

Filing Deadlines for the 2018 Form 709

Timely filing of the 2018 Form 709 is essential to avoid penalties. The form must be filed by April fifteenth of the year following the gift. If you are unable to meet this deadline, you may request an extension, which typically extends the filing period by six months. However, any taxes owed must still be paid by the original due date to avoid interest and penalties.

Required Documents for Completing the 2018 Form 709

To accurately complete the 2018 Form 709, certain documents are necessary:

- Records of all gifts made during the tax year, including appraisals if applicable.

- Documentation of any prior gift tax returns filed, particularly if you are electing to split gifts with a spouse.

- Proof of payment for any gift taxes owed from previous years.

Examples of Using the 2018 Form 709

Understanding practical applications of the 2018 Form 709 can clarify its importance. For instance, if an individual gifts a property valued at $15,000 to a family member, they must report this on the form, as it exceeds the annual exclusion limit. Another example includes a couple who decides to gift a combined total of $30,000 to their child, which may require them to file jointly to utilize the gift-splitting option. These examples underscore the necessity of accurate reporting for compliance with tax laws.

Quick guide on how to complete 2022 instructions for form 709 instructions for form 709 united states gift and generation skipping transfer tax return

Complete Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return effortlessly on any device

Digital document management has become prevalent among businesses and individuals. It offers a perfect environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return smoothly

- Obtain Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or black out confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal authority as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searches, or errors requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return to ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 instructions for form 709 instructions for form 709 united states gift and generation skipping transfer tax return

Create this form in 5 minutes!

People also ask

-

What is a 2018 form file and why is it important?

A 2018 form file is a document format used for tax and other official submissions. It’s essential for businesses to accurately complete these forms to avoid penalties and ensure compliance with regulatory requirements.

-

How can I upload a 2018 form file to airSlate SignNow?

Uploading a 2018 form file to airSlate SignNow is straightforward. Simply log into your account, select 'Upload Document,' and choose the 2018 form file from your device to start the eSigning process.

-

What features does airSlate SignNow offer for handling a 2018 form file?

airSlate SignNow provides features like eSignature, document templates, and automated workflows that streamline the management of your 2018 form file. These tools help you save time and ensure your documents are signed quickly and securely.

-

What are the pricing plans for using airSlate SignNow with 2018 form files?

airSlate SignNow offers various pricing plans designed to fit different business needs. You can choose a plan that allows you to manage unlimited 2018 form files without any hidden fees, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other applications for my 2018 form file?

Yes, airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and Salesforce. This allows you to manage and eSign your 2018 form file efficiently within your existing workflow.

-

How secure is my 2018 form file when using airSlate SignNow?

Your 2018 form file is protected with industry-standard encryption and security protocols when using airSlate SignNow. We ensure that your documents remain confidential and secure throughout the signing process.

-

Is there a mobile app for signing my 2018 form file?

Yes, airSlate SignNow provides a mobile app that enables you to sign your 2018 form file on the go. The app is user-friendly and ensures that you can manage your documents from anywhere, anytime.

Get more for Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return

- Limited power of attorney where you specify powers with sample powers included nevada form

- Limited power of attorney for stock transactions and corporate powers nevada form

- Nv poa form

- Nevada small business startup package nevada form

- Nevada foreclosure form

- Nevada property 497321000 form

- Nv annual 497321001 form

- Nevada professional corporation form

Find out other Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement