Instructions for Form 709 Instructions for Form 709, United States Gift and Generation Skipping Transfer Tax Return 2024

What is Form 709?

The Form 709, officially known as the United States Gift and Generation-Skipping Transfer Tax Return, is a tax form used to report gifts made during a calendar year that exceed the annual exclusion limit. This form is essential for individuals who have given gifts to others that may be subject to federal gift tax. Understanding the purpose of Form 709 is crucial for compliance with IRS regulations regarding gift taxation.

Steps to Complete Form 709

Filling out Form 709 involves several key steps to ensure accurate reporting of gifts. Begin by gathering necessary information about the gifts made, including the recipient's details and the value of each gift. Next, follow these steps:

- Complete the identification section, providing your name, address, and taxpayer identification number.

- Detail each gift on the appropriate schedules, noting the fair market value and any deductions.

- Calculate the total gifts and apply any exclusions or deductions as applicable.

- Sign and date the form before submission.

It is important to review the form for accuracy before filing to avoid potential penalties.

Filing Deadlines / Important Dates

Form 709 must be filed by April fifteenth of the year following the year in which the gifts were made. If you are unable to meet this deadline, you may request an extension, but it is important to note that any taxes owed must still be paid by the original due date to avoid interest and penalties. Keeping track of these deadlines is essential for compliance.

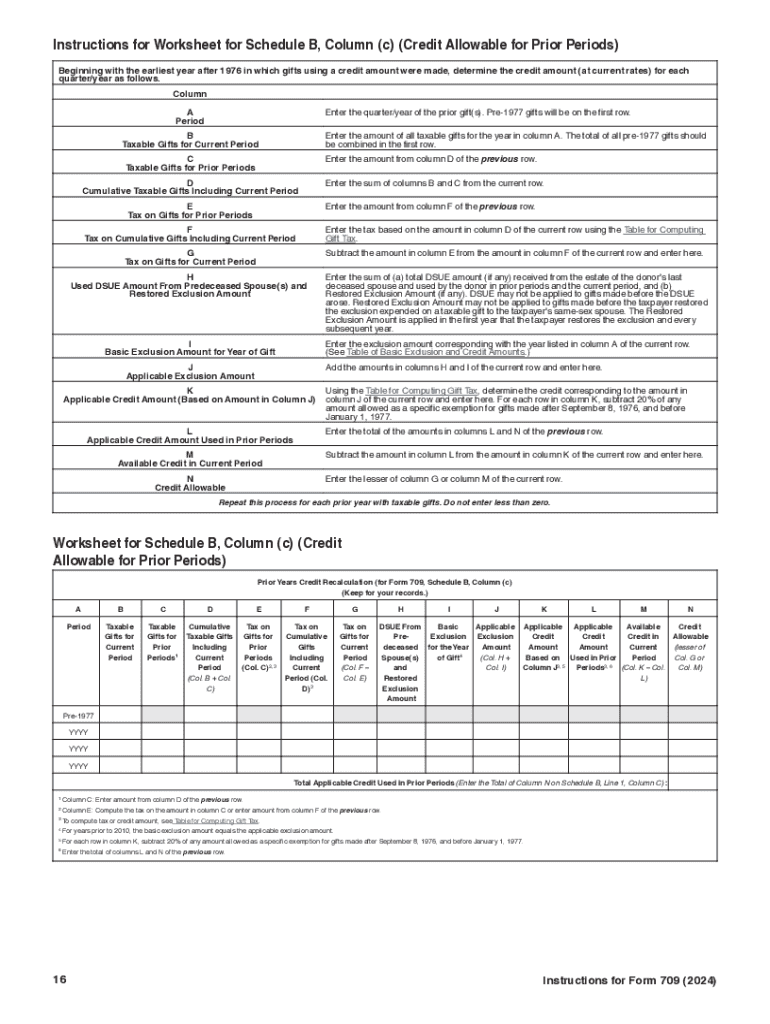

IRS Guidelines for Form 709

The IRS provides specific guidelines for completing and filing Form 709. These guidelines include detailed instructions on what constitutes a gift, how to value gifts, and the various exclusions available. It is advisable to refer to the latest IRS instructions for Form 709 to ensure compliance with current regulations and to understand any changes in tax law that may affect your filing.

Required Documents for Filing Form 709

When preparing to file Form 709, certain documents are required to support your claims. These may include:

- Documentation of the fair market value of the gifts.

- Records of any previous gift tax returns filed.

- Information regarding any applicable exclusions, such as the annual exclusion or marital deduction.

Having these documents organized will facilitate a smoother filing process and help ensure accuracy.

Examples of Using Form 709

Form 709 is commonly used in various scenarios, such as when an individual gifts property, cash, or other assets exceeding the annual exclusion limit. For example, if a parent gifts a child a car valued at twenty-five thousand dollars, the amount exceeding the annual exclusion must be reported on Form 709. Understanding these examples can clarify when and how to use the form appropriately.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 709 instructions for form 709 united states gift and generation skipping transfer tax return 767976026

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 709 instructions for form 709 united states gift and generation skipping transfer tax return 767976026

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the basic instructions for gift tax?

Instructions for gift tax involve understanding the annual exclusion limit and the lifetime gift tax exemption. It's essential to keep detailed records of all gifts made, including their value and recipient. Following these instructions can help ensure compliance with IRS regulations.

-

How does airSlate SignNow assist with gift tax documentation?

airSlate SignNow simplifies the process of preparing and signing gift tax documents. With our platform, you can easily create, send, and eSign necessary forms, ensuring that all instructions for gift tax are followed accurately. This streamlines the documentation process and reduces the risk of errors.

-

Are there any costs associated with using airSlate SignNow for gift tax forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution ensures that you can manage your gift tax documentation without breaking the bank. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for managing gift tax documents?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking. These features help you efficiently manage your gift tax documents while ensuring compliance with all necessary instructions for gift tax. Our platform is designed to enhance your workflow and save time.

-

Can I integrate airSlate SignNow with other software for gift tax management?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage your gift tax documentation alongside your existing tools. This integration ensures that you can follow all instructions for gift tax while maintaining a cohesive workflow across platforms.

-

What are the benefits of using airSlate SignNow for gift tax purposes?

Using airSlate SignNow for gift tax purposes offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that you can easily follow the necessary instructions for gift tax while providing a user-friendly experience. This ultimately leads to a smoother process for both you and your recipients.

-

How can I ensure compliance with gift tax regulations using airSlate SignNow?

To ensure compliance with gift tax regulations, utilize airSlate SignNow's comprehensive templates and eSigning features. By following the provided instructions for gift tax and maintaining accurate records within our platform, you can confidently navigate the complexities of gift tax compliance. Our solution is designed to support your needs every step of the way.

Get more for Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return

Find out other Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement