Tennessee Department of RevenuePDF4PRO 2021

What is the Tennessee Department of Revenue?

The Tennessee Department of Revenue is the state agency responsible for administering tax laws and collecting state taxes in Tennessee. This includes various taxes such as sales tax, income tax, and business taxes. The department ensures compliance with state tax regulations and provides resources for taxpayers to understand their obligations. It plays a crucial role in maintaining the state's revenue system, which supports public services and infrastructure.

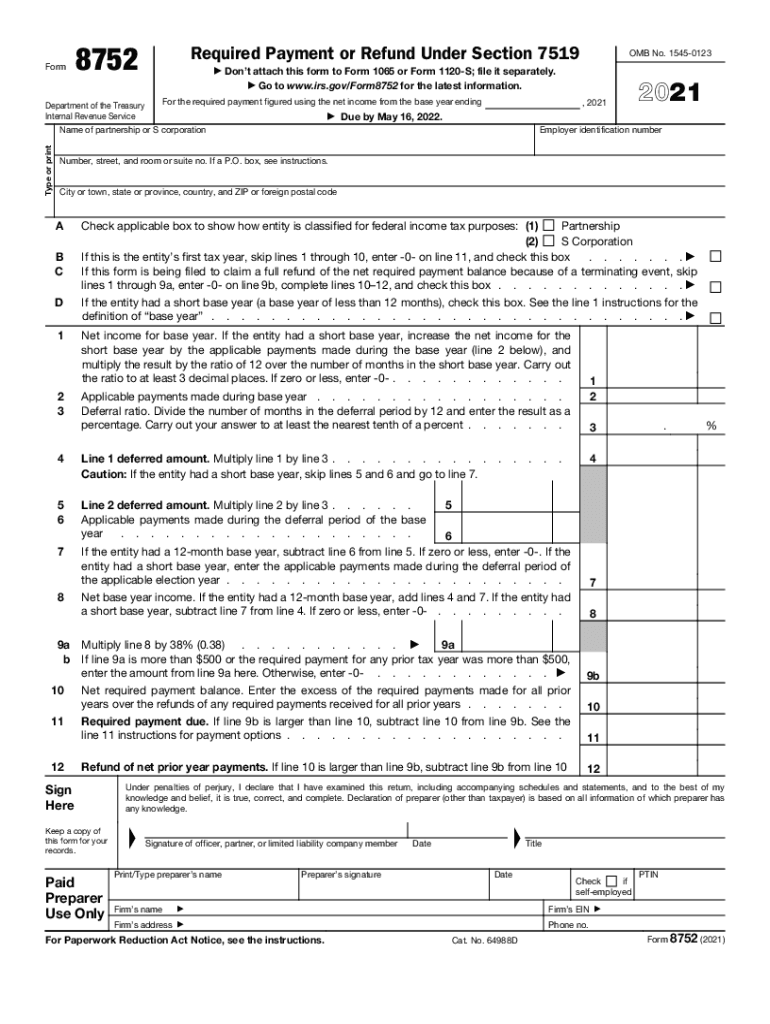

Steps to complete the Tennessee Department of Revenue form

Completing forms from the Tennessee Department of Revenue requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather necessary information, such as your Social Security number, income details, and any relevant financial documents.

- Download the appropriate form from the Tennessee Department of Revenue website or access it through a trusted source.

- Fill out the form accurately, ensuring all required fields are completed. Double-check for any errors or omissions.

- Review the form for compliance with state regulations, ensuring that you have included all necessary attachments.

- Submit the form via the designated method, whether online, by mail, or in person, as specified in the instructions.

Filing Deadlines / Important Dates

Understanding filing deadlines is essential for compliance with Tennessee tax laws. Key dates include:

- April 15: Deadline for individual income tax returns.

- Quarterly deadlines for estimated tax payments, typically on April 15, June 15, September 15, and January 15 of the following year.

- Specific deadlines for business tax filings, which may vary based on the type of business entity.

Penalties for Non-Compliance

Failure to comply with Tennessee tax regulations can result in significant penalties. These may include:

- Late filing penalties, which can accumulate daily until the return is filed.

- Interest on unpaid taxes, which accrues from the due date until payment is made.

- Potential legal action for severe violations, which may involve audits or additional fines.

IRS Guidelines

The Tennessee Department of Revenue operates in conjunction with IRS guidelines to ensure consistency in tax administration. Taxpayers should be aware of:

- IRS regulations that affect state tax filings, including deductions and credits.

- How federal tax changes may impact state tax obligations.

- Resources available through the IRS for understanding tax responsibilities.

Required Documents

When filing with the Tennessee Department of Revenue, certain documents are typically required. These may include:

- Proof of income, such as W-2 forms or 1099 statements.

- Documentation for any deductions or credits claimed.

- Identification documents, including Social Security cards or driver's licenses.

Quick guide on how to complete tennessee department of revenuepdf4pro

Prepare Tennessee Department Of RevenuePDF4PRO seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can access the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Tennessee Department Of RevenuePDF4PRO on any device with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and eSign Tennessee Department Of RevenuePDF4PRO effortlessly

- Find Tennessee Department Of RevenuePDF4PRO and click Get Form to begin.

- Use the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Tennessee Department Of RevenuePDF4PRO to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tennessee department of revenuepdf4pro

Create this form in 5 minutes!

How to create an eSignature for the tennessee department of revenuepdf4pro

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What are airSlate SignNow's payments plans?

airSlate SignNow offers flexible pricing plans for businesses of all sizes, focusing on affordability and value. Customers can choose from monthly or annual subscriptions, which cater to varying needs and budgets. Each plan provides comprehensive features, ensuring smooth management of the company's payments and document signing.

-

How does airSlate SignNow ensure secure handling of payments?

airSlate SignNow prioritizes security by employing industry-standard encryption to protect sensitive payment information. The platform complies with legal regulations, ensuring that all transactions are secure. This commitment to safety allows users to confidently process their payments while maintaining data integrity.

-

Can I integrate airSlate SignNow with my existing payment systems?

Yes, airSlate SignNow supports integrations with various popular payment systems, enhancing your business workflow. This capability enables seamless synchronization between document signing and payments, streamlining the process for both you and your clients. Integration with existing systems simplifies payment tracking and management.

-

What features does airSlate SignNow offer for managing payments?

airSlate SignNow provides features that facilitate efficient management of payments alongside document eSigning. Users can automate payment requests, send invoices, and track payment statuses directly within the platform. This comprehensive suite of tools optimizes your cash flow and eliminates manual errors.

-

How does airSlate SignNow improve the payment experience for my customers?

By leveraging airSlate SignNow's intuitive interface, your customers can quickly sign documents and process payments without hassle. The streamlined workflow minimizes delays, ensuring a smoother experience for clients. This ease of use increases customer satisfaction and encourages timely payments.

-

Is there a trial period for testing airSlate SignNow's payments features?

Absolutely! airSlate SignNow offers a free trial period, allowing potential users to explore all features, including payments, without commitment. This trial provides a hands-on experience of how the platform can integrate into your business operations. Take this opportunity to see how seamless document signing and payments can be.

-

What payment methods are supported by airSlate SignNow?

airSlate SignNow supports a variety of payment methods, including credit cards and eChecks, to accommodate diverse customer preferences. This flexibility allows your clients to choose the most convenient option for them. Supporting multiple payment means enhances transaction efficiency and speeds up payment processing.

Get more for Tennessee Department Of RevenuePDF4PRO

- Colorado child form

- Warranty deed for separate or joint property to joint tenancy colorado form

- Warranty deed to separate property of one spouse to both as joint tenants colorado form

- Warranty deed for fiduciary colorado form

- Colorado deed personal form

- Colorado deed trust form

- Warranty deed from limited partnership or llc is the grantor or grantee colorado form

- Deed correction form

Find out other Tennessee Department Of RevenuePDF4PRO

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement