Www Uslegalforms Comform LibrarytaxIRS 8752 Fill and Sign Printable Template Online 2022

IRS Guidelines for Form 8752

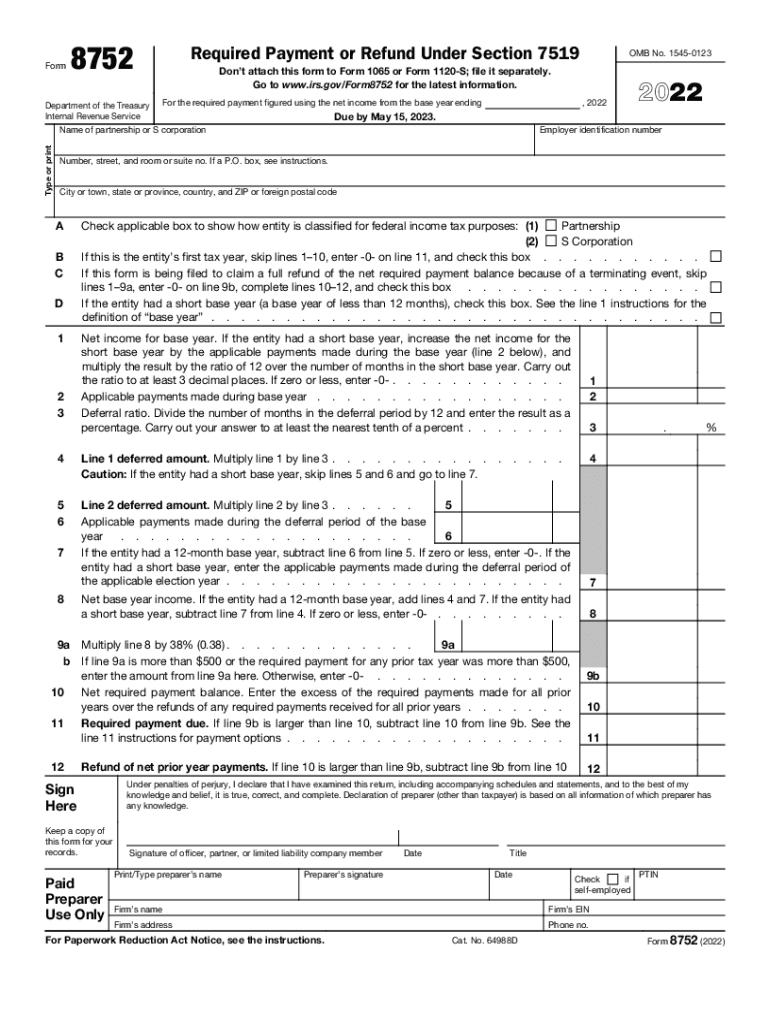

The IRS Form 8752 is essential for businesses that wish to make an election under section 1362 of the Internal Revenue Code. This form is specifically used by corporations to request S corporation status. Understanding the guidelines provided by the IRS is crucial for successful filing. The IRS outlines specific requirements for eligibility, including the type of business entity and the number of shareholders. It's important to ensure that all information is accurate and complete to avoid delays or denials in processing.

Steps to Complete Form 8752

Completing the 8752 form involves several key steps. First, gather all necessary information, including the business's legal name, address, and Employer Identification Number (EIN). Next, indicate the election being made and provide details about the shareholders. Each shareholder must consent to the election, so obtaining their signatures is vital. After filling out the form, review it thoroughly for accuracy before submission. Finally, submit the form to the IRS by the specified deadline to ensure compliance and maintain your S corporation status.

Filing Deadlines for Form 8752

Timely submission of Form 8752 is critical to avoid penalties and ensure the election is effective. Generally, the form must be filed by the 15th day of the third month following the end of the tax year for which the election is sought. For instance, if your tax year ends on December 31, the form is due by March 15 of the following year. If the deadline falls on a weekend or holiday, it is extended to the next business day. Keeping track of these deadlines helps maintain compliance with IRS regulations.

Required Documents for Form 8752

When preparing to file Form 8752, certain documents are necessary to support your application. These include the corporation's articles of incorporation, bylaws, and any prior tax returns. Additionally, you should have documentation that verifies the consent of all shareholders to the S corporation election. Ensuring that all required documents are included can facilitate a smoother filing process and reduce the likelihood of requests for additional information from the IRS.

Penalties for Non-Compliance with Form 8752

Failure to comply with the requirements of Form 8752 can result in significant penalties. If the form is not filed on time, the corporation may lose its S corporation status, leading to taxation at the corporate level. Additionally, the IRS may impose penalties for late filing, which can accumulate over time. Understanding these potential consequences emphasizes the importance of adhering to filing deadlines and ensuring that all information is accurate and complete.

Digital vs. Paper Version of Form 8752

Form 8752 can be completed and submitted in both digital and paper formats. The digital version allows for easier data entry and may streamline the submission process, especially when using e-signature solutions. However, some businesses may prefer the traditional paper method for record-keeping purposes. Regardless of the method chosen, ensuring that the form is filled out correctly and submitted on time is crucial for maintaining compliance with IRS regulations.

Quick guide on how to complete wwwuslegalformscomform librarytaxirs 8752 2021 2022 fill and sign printable template online

Complete Www uslegalforms comform librarytaxIRS 8752 Fill And Sign Printable Template Online effortlessly on any device

Digital document management has become widely adopted by businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Www uslegalforms comform librarytaxIRS 8752 Fill And Sign Printable Template Online on any device using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to edit and eSign Www uslegalforms comform librarytaxIRS 8752 Fill And Sign Printable Template Online with ease

- Locate Www uslegalforms comform librarytaxIRS 8752 Fill And Sign Printable Template Online and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Modify and eSign Www uslegalforms comform librarytaxIRS 8752 Fill And Sign Printable Template Online to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwuslegalformscomform librarytaxirs 8752 2021 2022 fill and sign printable template online

Create this form in 5 minutes!

People also ask

-

What is form 8752 and why is it important?

Form 8752 is an IRS form used to report and pay the required tax for certain organizations. It's important because timely and accurate submission ensures compliance with IRS regulations, helping businesses avoid penalties. Using airSlate SignNow, you can easily eSign and send your form 8752, making the submission process seamless.

-

How can airSlate SignNow help with completing form 8752?

airSlate SignNow streamlines the process of completing form 8752 by providing electronic templates that you can fill out and eSign. The platform also allows you to store and share documents securely, ensuring that your form 8752 is accessible whenever needed. This reduces the hassle of paperwork and increases efficiency.

-

What are the pricing options for using airSlate SignNow for form 8752?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. You can choose a plan that fits your budget, which includes features specifically aimed at simplifying workflows like completing and sending form 8752. Explore our pricing page for detailed options to find the best fit for your organization.

-

Can I integrate airSlate SignNow with other tools when working with form 8752?

Yes, airSlate SignNow can be integrated with many popular applications to enhance your workflow. Whether you use CRM systems, cloud storage, or project management tools, you can connect them with airSlate SignNow to facilitate the handling of form 8752 and other documents seamlessly. This integration ensures that your data flows smoothly across platforms.

-

What features does airSlate SignNow offer for managing form 8752?

airSlate SignNow offers a variety of features that make managing form 8752 simple and efficient. Key features include customizable templates, secure eSigning, and real-time tracking of document status. Additionally, the user-friendly interface allows you to organize and manage your forms with ease.

-

Are there any security measures in place for form 8752 submissions?

Absolutely! airSlate SignNow prioritizes document security, employing advanced encryption and secure storage protocols. When you submit form 8752, you can be confident that your sensitive data is protected from unauthorized access and bsignNowes, providing peace of mind while you handle important business documents.

-

Can I access my previous submissions of form 8752 with airSlate SignNow?

Yes, airSlate SignNow allows you to easily access all your previous submissions of form 8752. You can review, download, or resend these documents whenever needed, making record-keeping straightforward. This archival feature ensures that you always have the information you need at your fingertips.

Get more for Www uslegalforms comform librarytaxIRS 8752 Fill And Sign Printable Template Online

- Concrete mason contractor package new hampshire form

- Demolition contractor package new hampshire form

- Security contractor package new hampshire form

- Insulation contractor package new hampshire form

- Paving contractor package new hampshire form

- Site work contractor package new hampshire form

- Siding contractor package new hampshire form

- Refrigeration contractor package new hampshire form

Find out other Www uslegalforms comform librarytaxIRS 8752 Fill And Sign Printable Template Online

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online