Form 8752 2011

What is the Form 8752

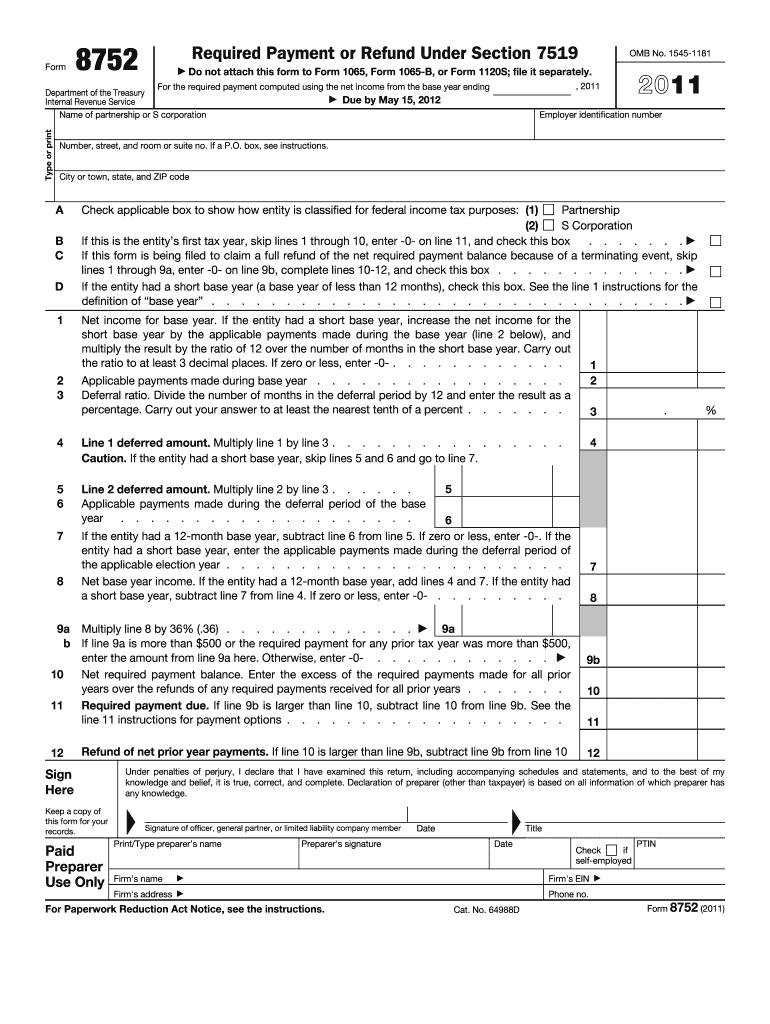

The Form 8752, officially known as the "Required Payment or Refund of Excess Contributions," is a crucial document used by businesses to report excess contributions to their retirement plans. This form is primarily utilized by employers who sponsor retirement plans, ensuring compliance with the Internal Revenue Service (IRS) regulations. It helps organizations rectify any excess contributions made during a tax year, thereby maintaining the tax-qualified status of their retirement plans.

How to use the Form 8752

Using the Form 8752 involves several steps to ensure accurate reporting and compliance. First, employers must gather relevant financial information regarding their retirement contributions. Next, they should complete the form by providing necessary details, including the total contributions made and the excess amounts that need to be reported. Once completed, the form must be submitted to the IRS as part of the employer's tax filing process. It is essential to review the form for accuracy before submission to avoid potential penalties.

Steps to complete the Form 8752

Completing the Form 8752 requires careful attention to detail. Here are the steps involved:

- Gather all relevant financial records related to retirement contributions for the tax year.

- Determine the total contributions made to the retirement plan.

- Identify any excess contributions that exceed the allowable limits set by the IRS.

- Fill out the form, ensuring all required fields are completed accurately.

- Double-check the calculations to confirm the accuracy of the reported excess contributions.

- Submit the completed form to the IRS along with the appropriate tax return.

Legal use of the Form 8752

The legal use of the Form 8752 is essential for maintaining compliance with IRS regulations. When used correctly, the form helps employers rectify any excess contributions, thereby preventing potential penalties or loss of tax-qualified status for their retirement plans. It is important to follow all guidelines set forth by the IRS to ensure the form is legally binding and accepted. Utilizing electronic signature solutions, such as signNow, can enhance the security and legality of submitting the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8752 are crucial for compliance. Employers must submit the form by the due date of their tax return, including any extensions. Typically, this means the form should be filed by April fifteenth of the following year. However, if an extension is filed, the deadline may be extended to October fifteenth. It is important for employers to keep track of these dates to avoid late fees or penalties associated with late submissions.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form 8752 can result in significant penalties. The IRS may impose fines for late filings, inaccuracies, or failure to report excess contributions. These penalties can impact the overall financial health of a business and may lead to additional scrutiny from tax authorities. To mitigate these risks, it is advisable for employers to ensure timely and accurate completion of the form.

Quick guide on how to complete 2011 form 8752

Effortlessly prepare Form 8752 on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed forms, allowing you to find the appropriate template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without any delays. Handle Form 8752 on any device with the airSlate SignNow applications available for Android and iOS, streamlining your document processes today.

The easiest way to modify and electronically sign Form 8752 with ease

- Find Form 8752 and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize essential sections of your documents or obscure sensitive information with specialized tools offered by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Alter and eSign Form 8752 while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 form 8752

Create this form in 5 minutes!

How to create an eSignature for the 2011 form 8752

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is Form 8752 and why is it important?

Form 8752 is a tax form used for the application of extension of time to file a tax return for certain businesses. Understanding this form is crucial for maintaining compliance with IRS regulations and avoiding penalties. Utilizing airSlate SignNow to eSign this form streamlines your submission process, ensuring it is completed accurately and efficiently.

-

How does airSlate SignNow simplify the process of completing Form 8752?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and eSign Form 8752. The digital signature feature accelerates the approval process, making it more convenient than traditional paper methods. Plus, you can track the status of your submission directly from the platform, enhancing your overall experience.

-

Is there a cost associated with filing Form 8752 using airSlate SignNow?

Yes, there is a pricing plan for using airSlate SignNow, but it is cost-effective compared to traditional paper filing methods. The subscription includes features designed to help you efficiently manage forms like Form 8752. You can choose a plan based on your business needs, protecting your finances while ensuring compliance.

-

What are the benefits of using airSlate SignNow for Form 8752?

Using airSlate SignNow for Form 8752 offers numerous benefits, including enhanced security, faster processing times, and easier collaboration with team members. The platform uses advanced encryption to protect sensitive information while providing seamless integrations with other software for a comprehensive workflow. This way, your document management remains efficient and secure.

-

Can I integrate airSlate SignNow with my existing software for managing Form 8752?

Absolutely! airSlate SignNow offers robust integration capabilities with various applications, ensuring you can manage Form 8752 alongside your other business tools. This allows for a streamlined workflow as you can easily export and import data between systems, making it more efficient to handle your tax forms.

-

What features of airSlate SignNow make it suitable for handling Form 8752?

airSlate SignNow includes features such as templates, eSigning, and document tracking that are particularly useful for handling Form 8752 efficiently. Templates save you time by providing pre-filled forms that you can quickly modify. Moreover, document tracking ensures you remain updated on all signatures and approvals needed.

-

How secure is my information when submitting Form 8752 through airSlate SignNow?

Your information is extremely secure when submitting Form 8752 through airSlate SignNow. The platform uses industry-standard encryption protocols to protect your data and ensure confidentiality. Additionally, airSlate SignNow complies with privacy regulations, giving you peace of mind when handling sensitive tax forms.

Get more for Form 8752

- Brick mason contractor package iowa form

- Roofing contractor package iowa form

- Electrical contractor package iowa form

- Sheetrock drywall contractor package iowa form

- Flooring contractor package iowa form

- Trim carpentry contractor package iowa form

- Fencing contractor package iowa form

- Hvac contractor package iowa form

Find out other Form 8752

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy