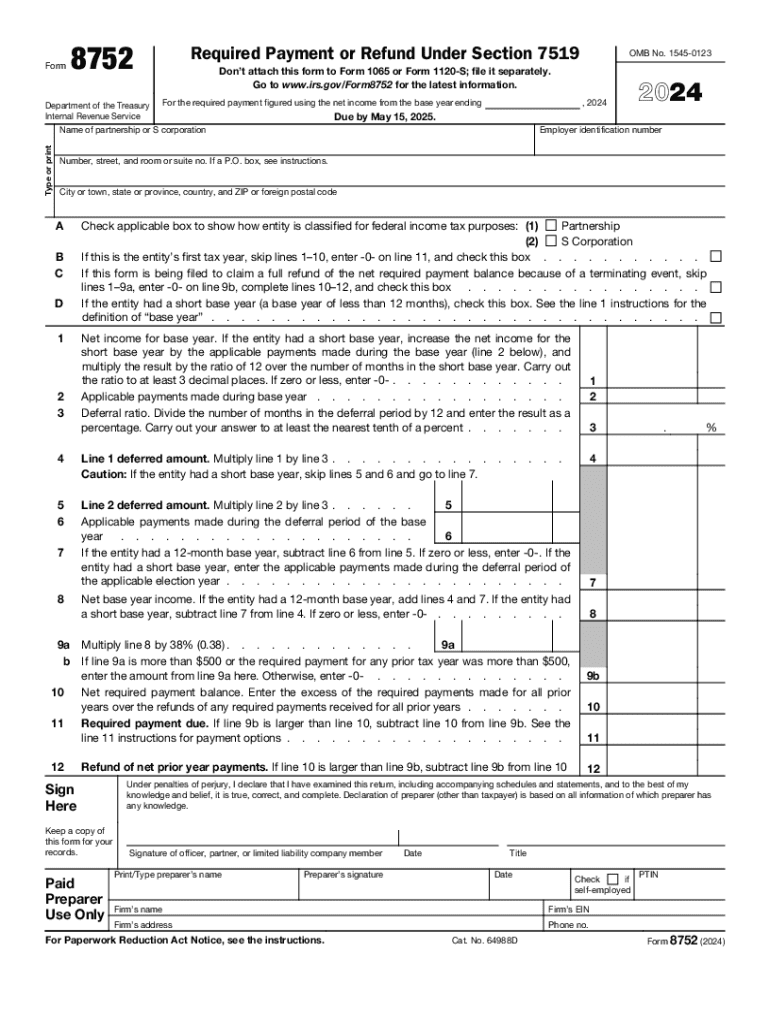

Form 8752 Required Payment or Refund under Section 7519 2024-2026

What is Form 8752 Required Payment Or Refund Under Section 7519

Form 8752 is a tax document used by partnerships to report required payments or refunds under Section 7519 of the Internal Revenue Code. This form is essential for partnerships that have made distributions to partners, which may affect the tax liabilities of the partnership and its partners. The form helps ensure compliance with IRS regulations regarding the allocation of tax benefits and liabilities among partners, particularly in situations involving the transfer of partnership interests.

How to use Form 8752 Required Payment Or Refund Under Section 7519

Using Form 8752 involves several key steps. First, determine if your partnership is required to file this form based on distributions made during the tax year. Next, gather all necessary financial information, including the amount of distributions and the partners involved. Complete the form by accurately reporting the required payment or refund amounts. After completing the form, it should be submitted to the IRS as part of your partnership's tax filings.

Steps to complete Form 8752 Required Payment Or Refund Under Section 7519

To complete Form 8752, follow these steps:

- Gather financial records related to partnership distributions.

- Identify the partners who received distributions and the corresponding amounts.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form to the IRS by the appropriate deadline.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for Form 8752. Typically, the form must be submitted alongside your partnership's tax return. For most partnerships, this means filing by the fifteenth day of the third month after the end of the tax year. For partnerships operating on a calendar year, this deadline falls on March 15. Be mindful of any extensions that may apply, as these can affect your submission timeline.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 8752. These guidelines detail the information required, including how to calculate the required payment or refund. It is important to refer to the IRS instructions for Form 8752 to ensure compliance with current tax laws and regulations. Following these guidelines can help prevent errors that may lead to penalties or delays in processing.

Eligibility Criteria

Eligibility to file Form 8752 is primarily determined by the structure of the partnership and the nature of the distributions made. Partnerships that have made distributions to partners during the tax year may be required to file this form. Additionally, partnerships must ensure they meet any specific IRS criteria related to the type of distributions and the tax implications for each partner involved.

Create this form in 5 minutes or less

Find and fill out the correct form 8752 required payment or refund under section 7519

Create this form in 5 minutes!

How to create an eSignature for the form 8752 required payment or refund under section 7519

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8752 for 2024?

Form 8752 for 2024 is a tax form used by certain partnerships to report their tax obligations. It is essential for ensuring compliance with IRS regulations and helps businesses manage their tax responsibilities effectively.

-

How can airSlate SignNow help with form 8752 for 2024?

airSlate SignNow provides a seamless platform for businesses to prepare, send, and eSign form 8752 for 2024. Our user-friendly interface simplifies the document management process, ensuring that your forms are completed accurately and efficiently.

-

What are the pricing options for using airSlate SignNow for form 8752 for 2024?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you are a small business or a large enterprise, you can find a plan that allows you to manage form 8752 for 2024 without breaking the bank.

-

Are there any features specifically designed for form 8752 for 2024?

Yes, airSlate SignNow includes features that streamline the process of completing form 8752 for 2024. These features include customizable templates, automated reminders, and secure eSigning capabilities, ensuring that your documents are handled efficiently.

-

What benefits does airSlate SignNow offer for managing form 8752 for 2024?

Using airSlate SignNow for form 8752 for 2024 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to track document status in real-time, ensuring that you never miss a deadline.

-

Can I integrate airSlate SignNow with other software for form 8752 for 2024?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to manage form 8752 for 2024 alongside your existing tools. This integration helps streamline your workflow and enhances productivity.

-

Is airSlate SignNow secure for handling form 8752 for 2024?

Yes, airSlate SignNow prioritizes security and compliance when handling form 8752 for 2024. Our platform employs advanced encryption and security protocols to protect your sensitive information throughout the signing process.

Get more for Form 8752 Required Payment Or Refund Under Section 7519

- Think like da vinci book pdf in hindi form

- Udyog aadhar download pdf 452394666 form

- Financial statement farmers and ranchers form

- Cwf1 form pdf

- Cg 10 application form 6070254

- Supervision notes template form

- 30 day notice of moving out form

- Sa103f self employment full if youre self employed have more complex tax affairs and your annual business turnover was 73000 or form

Find out other Form 8752 Required Payment Or Refund Under Section 7519

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed