Form 8752 Required Payment or Refund under Section 7519 2020

What is the Form 8752 Required Payment Or Refund Under Section 7519

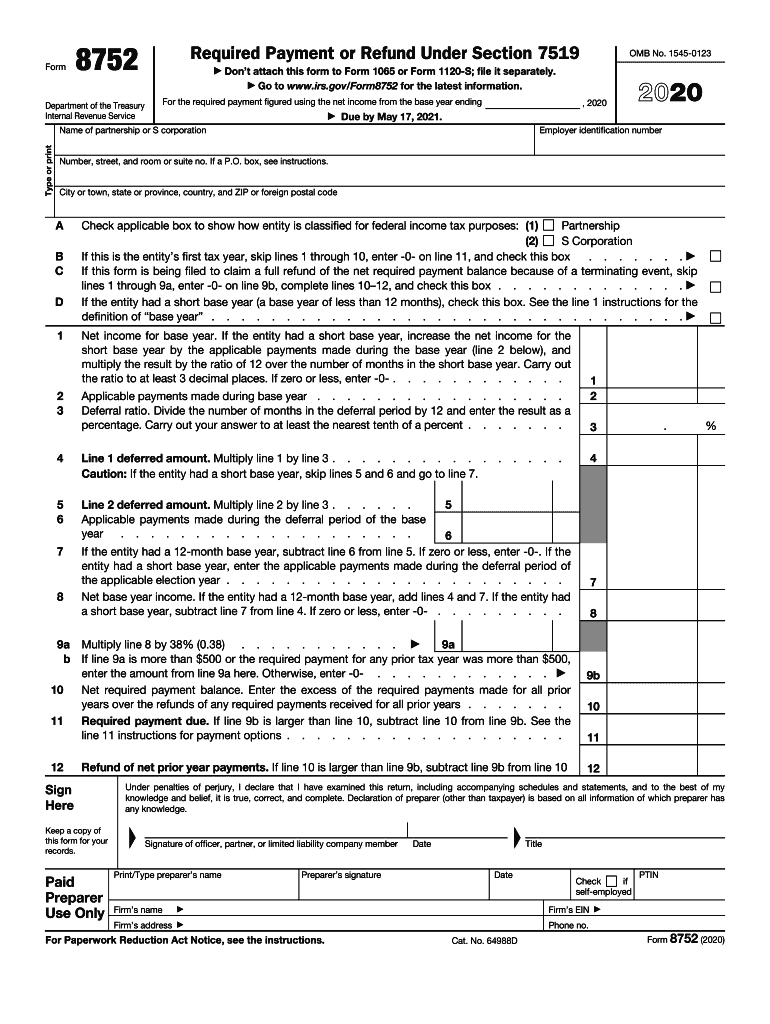

The Form 8752 is utilized to report required payments or refunds under Section 7519 of the Internal Revenue Code. This form is particularly relevant for partnerships and certain corporations that must make payments to the IRS for tax liabilities. Understanding the purpose of Form 8752 is essential for ensuring compliance with tax obligations and avoiding potential penalties. The form helps determine whether a business entity is required to make a payment or if it is eligible for a refund based on its tax situation.

How to use the Form 8752 Required Payment Or Refund Under Section 7519

Using Form 8752 involves several steps to ensure accurate reporting. First, gather all necessary financial information related to the partnership or corporation. This includes income, deductions, and any previous payments made. Next, fill out the form by following the provided instructions carefully. It is crucial to double-check all entries for accuracy, as errors can lead to complications with the IRS. Once completed, the form can be submitted electronically or via mail, depending on the preferences of the entity filing.

Steps to complete the Form 8752 Required Payment Or Refund Under Section 7519

Completing Form 8752 requires a systematic approach:

- Gather all relevant financial documents, including income statements and tax returns.

- Access the Form 8752, which can typically be downloaded from the IRS website.

- Fill in the required fields, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before finalizing it.

- Submit the form according to the specified guidelines, either electronically or by mail.

Legal use of the Form 8752 Required Payment Or Refund Under Section 7519

Form 8752 is legally binding when completed and submitted in compliance with IRS regulations. The form must be filled out accurately to reflect the entity's financial status and tax obligations. Failure to adhere to the legal requirements can result in penalties or denial of refunds. It is important for businesses to understand the legal implications of submitting this form, as it serves as a record of their compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for Form 8752 are critical to maintaining compliance with tax regulations. Typically, the form must be submitted by the due date of the partnership or corporation's tax return. It is advisable to check the IRS website for any updates or changes to the deadlines as they can vary year to year. Missing the deadline can lead to penalties or interest on unpaid amounts, making timely submission essential.

Required Documents

To complete Form 8752, certain documents are necessary. These include:

- Previous tax returns and financial statements of the entity.

- Records of any payments made towards tax liabilities.

- Documentation supporting any claims for refunds or adjustments.

Having these documents readily available will streamline the completion process and help ensure accuracy.

Quick guide on how to complete 2020 form 8752 required payment or refund under section 7519

Complete Form 8752 Required Payment Or Refund Under Section 7519 effortlessly on any device

Virtual document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can discover the correct form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Handle Form 8752 Required Payment Or Refund Under Section 7519 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to alter and electronically sign Form 8752 Required Payment Or Refund Under Section 7519 effortlessly

- Find Form 8752 Required Payment Or Refund Under Section 7519 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to preserve your modifications.

- Choose how you would like to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Alter and electronically sign Form 8752 Required Payment Or Refund Under Section 7519 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 8752 required payment or refund under section 7519

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 8752 required payment or refund under section 7519

The best way to create an electronic signature for your PDF in the online mode

The best way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What is IRS 8752 and how does airSlate SignNow help?

IRS 8752 is an important form used for electing tax benefits for certain entities. airSlate SignNow simplifies the process of completing and submitting IRS 8752 by providing an easy-to-use platform that allows for efficient document signing and tracking, ensuring compliance and timely submissions.

-

How does airSlate SignNow ensure the security of documents related to IRS 8752?

airSlate SignNow prioritizes the security of your documents, especially for sensitive forms like IRS 8752. We utilize advanced encryption technologies and comply with industry standards to protect your data, ensuring that only authorized users have access to your documents.

-

Is airSlate SignNow cost-effective for filing IRS 8752?

Yes, airSlate SignNow offers competitive pricing plans tailored to meet various business needs, making it cost-effective for managing IRS 8752. With our platform, you can reduce paperwork and save time, which in turn lowers your overall operational costs.

-

What features does airSlate SignNow provide for electronic signing of IRS 8752?

airSlate SignNow includes features such as customizable templates, in-person signing, and automated workflows that enhance the electronic signing process for IRS 8752. These features streamline your document management, ensuring that all parties can access and sign the form quickly and efficiently.

-

Can I integrate airSlate SignNow with my existing systems for IRS 8752 processing?

Absolutely! airSlate SignNow supports a wide range of integrations with popular business applications, allowing for seamless processing of IRS 8752 within your existing systems. This integration capability ensures that you can manage your documents without disrupting your workflows.

-

What are the benefits of using airSlate SignNow for IRS 8752 document management?

Using airSlate SignNow for IRS 8752 document management offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced collaboration among your team. Our solution helps you stay organized and ensures that important deadlines are met.

-

How does airSlate SignNow handle multiple signers for IRS 8752?

airSlate SignNow simplifies handling multiple signers for IRS 8752 by allowing you to set signing orders and notifications. This feature ensures that each participant knows their responsibilities, which streamlines the overall process and minimizes delays.

Get more for Form 8752 Required Payment Or Refund Under Section 7519

- Vermont emancipation form

- Month to month lease 497428838 form

- 14 day notice to pay rent or lease terminates for residential property vermont form

- Terminate material form

- 7 day notice to terminate week to week lease including shared space in landlords personal residence residential vermont form

- Vermont month to month form

- Vt tenant form

- 30 day notice to terminate written month to month lease where tenant has resided in premises two years or less residential form

Find out other Form 8752 Required Payment Or Refund Under Section 7519

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document