Form W 8 BEN Rev October Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting Indiv 2021-2026

Understanding the Form W-8 BEN

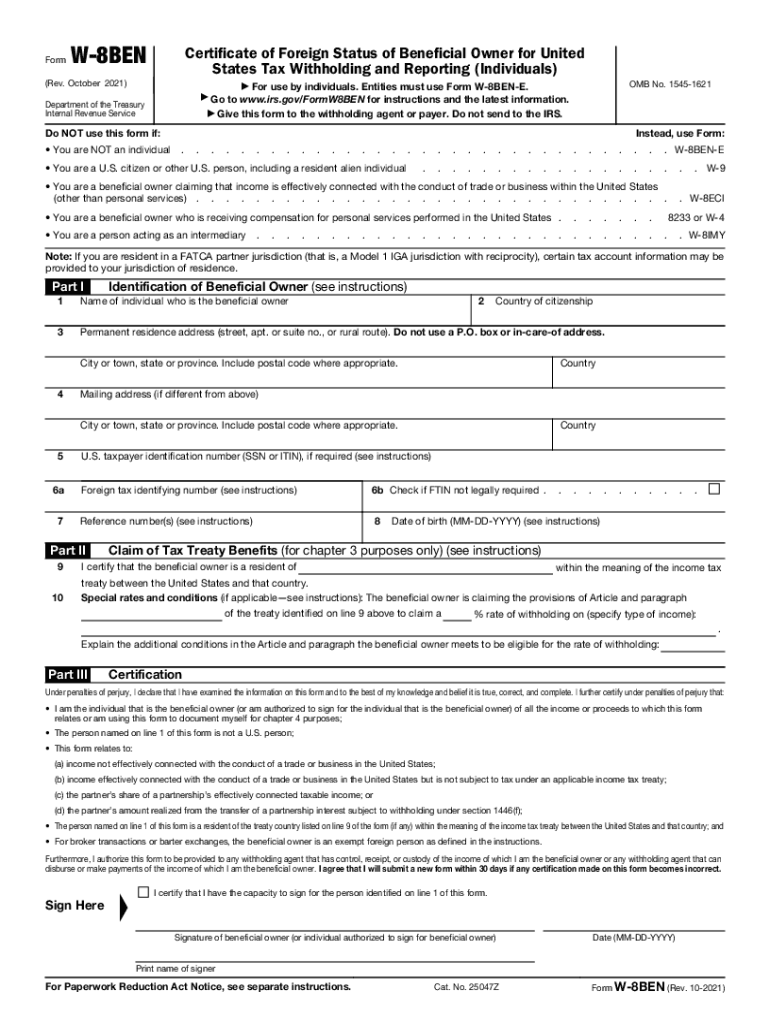

The Form W-8 BEN is a crucial document for foreign individuals and entities who wish to certify their foreign status for U.S. tax purposes. This form is officially titled the Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals). It is primarily used to claim a reduced rate of withholding tax on certain types of income received from U.S. sources, such as dividends and interest. By submitting this form, beneficial owners can ensure that they are not subject to unnecessary taxation on income that is eligible for exemption or reduction under U.S. tax treaties.

Steps to Complete the Form W-8 BEN

Completing the Form W-8 BEN involves several key steps to ensure accuracy and compliance. The form requires the following information:

- Identification of the individual: Provide your name, country of citizenship, and address.

- Claim of tax treaty benefits: Indicate if you are claiming benefits under a tax treaty between your country and the U.S.

- Signature: Sign and date the form to certify that the information provided is accurate.

It is important to ensure that all information is complete and correct to avoid delays in processing or issues with withholding tax rates.

Legal Use of the Form W-8 BEN

The Form W-8 BEN serves a legal purpose by establishing the foreign status of the beneficial owner. This is essential for compliance with U.S. tax laws, as it helps to determine the correct withholding tax rate applicable to income received from U.S. sources. The form must be submitted to the withholding agent or financial institution responsible for the payment, not to the IRS directly. Proper use of this form can help prevent over-withholding and ensure that individuals receive the correct tax treatment under applicable treaties.

IRS Guidelines for the Form W-8 BEN

The IRS provides specific guidelines regarding the completion and submission of the Form W-8 BEN. It is essential to follow these guidelines to ensure compliance and avoid penalties. The IRS requires that the form be updated every three years or whenever there is a change in circumstances that affects the information provided. Additionally, the IRS may request documentation to support the claims made on the form, especially if the income is subject to withholding tax.

Filing Deadlines for the Form W-8 BEN

There are no specific filing deadlines for submitting the Form W-8 BEN, as it is not filed directly with the IRS. However, it should be submitted to the withholding agent or financial institution before the payment is made to ensure that the correct withholding tax rate is applied. It is advisable to submit the form as early as possible to avoid any delays in processing payments.

Eligibility Criteria for Using the Form W-8 BEN

To be eligible to use the Form W-8 BEN, the individual must be a foreign person who is not a U.S. citizen or resident alien. This includes individuals who receive income from U.S. sources, such as royalties, dividends, or interest. It is important to ensure that the individual meets the criteria for foreign status and can provide the necessary documentation to support their claims on the form.

Quick guide on how to complete form w 8 ben rev october 2021 certificate of foreign status of beneficial owner for united states tax withholding and reporting

Effortlessly Prepare Form W 8 BEN Rev October Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding And Reporting Indiv on Any Device

The management of documents online has gained signNow traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents quickly without hassles. Manage Form W 8 BEN Rev October Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding And Reporting Indiv on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to Edit and Electronically Sign Form W 8 BEN Rev October Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding And Reporting Indiv with Ease

- Obtain Form W 8 BEN Rev October Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding And Reporting Indiv and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and press the Done button to store your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from your preferred device. Edit and electronically sign Form W 8 BEN Rev October Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding And Reporting Indiv and ensure smooth communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 8 ben rev october 2021 certificate of foreign status of beneficial owner for united states tax withholding and reporting

Create this form in 5 minutes!

How to create an eSignature for the form w 8 ben rev october 2021 certificate of foreign status of beneficial owner for united states tax withholding and reporting

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

How to make an e-signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how can it benefit my business?

airSlate SignNow is a powerful eSigning solution that allows businesses to send and manage documents effortlessly. By choosing airSlate SignNow, you can streamline your document workflows, reduce turnaround times, and ultimately save costs. The key benefit is that it provides an easy-to-use platform that integrates seamlessly with your existing tools, making it a smart choice for companies looking to enhance their efficiency.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features including customizable templates, real-time tracking, and automated reminders. These functionalities allow businesses to manage their documents more efficiently and ensure that all signatures are collected in a timely manner. Moreover, the platform's user-friendly interface means that anyone can easily navigate and utilize the features without extensive training.

-

How does airSlate SignNow's pricing structure work?

The pricing for airSlate SignNow is designed to be cost-effective and flexible, catering to businesses of all sizes. Typically, there are tiered subscription plans that vary based on feature access and the number of users. This allows companies to choose a plan that best fits their needs and budget, ensuring that investing in an efficient eSigning solution like airSlate SignNow remains affordable.

-

Can airSlate SignNow integrate with other software and applications?

Yes, airSlate SignNow seamlessly integrates with a wide array of applications, including CRM systems, cloud storage services, and productivity tools. Popular integrations include Google Drive, Salesforce, and Microsoft Office. This compatibility allows businesses to enhance their existing workflows while leveraging the powerful signing capabilities of airSlate SignNow.

-

Is airSlate SignNow secure for sensitive documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance with industry standards. This ensures that all sensitive information remains protected during transmission and storage. By using airSlate SignNow, businesses can confidently manage their documents, knowing that the platform takes document security seriously.

-

How can I ensure that my team adopts airSlate SignNow effectively?

To ensure effective adoption, consider providing your team with training resources that airSlate SignNow offers, such as tutorials and customer support. Additionally, involve your team in the decision-making process so they feel more invested in using the new tool. The intuitive design of airSlate SignNow also facilitates a smoother transition, as users can quickly familiarize themselves with its functionalities.

-

What support options are available for airSlate SignNow users?

airSlate SignNow provides several support options to assist users, including a dedicated customer service team, online documentation, and live chat features. This ensures that users can get quick help for any issues they encounter while using the platform. Moreover, the extensive FAQs and tutorials available on the signNow website can also aid users in maximizing their use of airSlate SignNow.

Get more for Form W 8 BEN Rev October Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding And Reporting Indiv

- Sheetrock drywall contract for contractor connecticut form

- Flooring contract for contractor connecticut form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract connecticut form

- Notice of intent to enforce forfeiture provisions of contact for deed connecticut form

- Final notice of forfeiture and request to vacate property under contract for deed connecticut form

- Buyers request for accounting from seller under contract for deed connecticut form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed connecticut form

- General notice of default for contract for deed connecticut form

Find out other Form W 8 BEN Rev October Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding And Reporting Indiv

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors