Ct 222 New York Form 2012

What is the Ct 222 New York Form

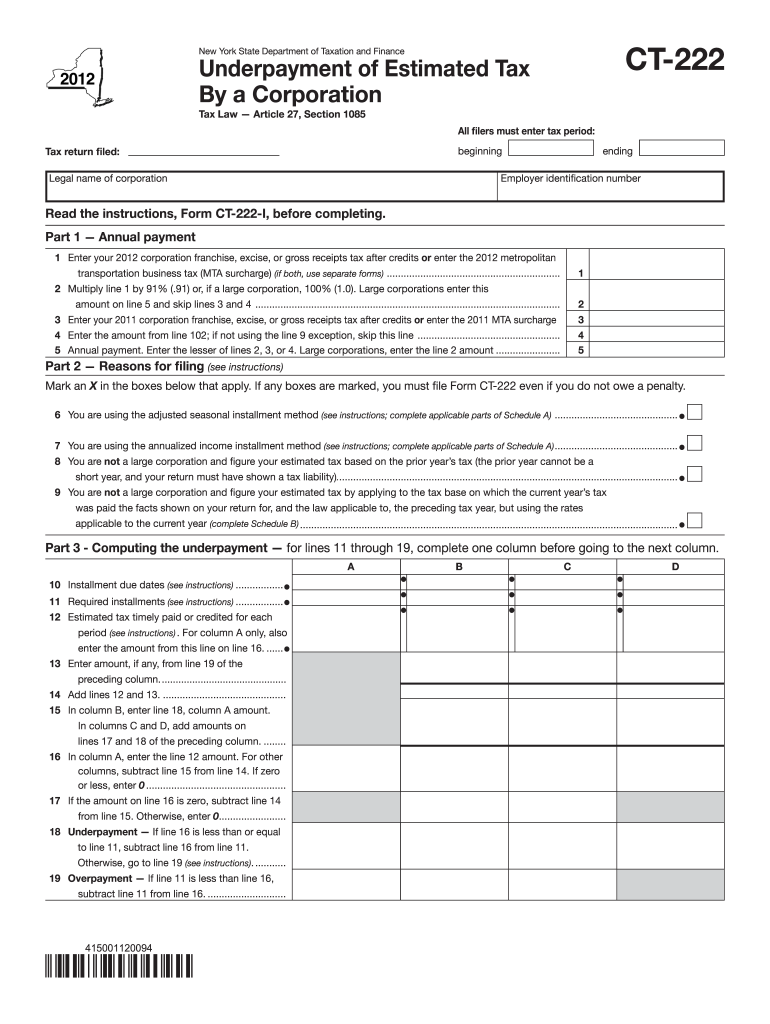

The Ct 222 New York Form is a tax form used by businesses and individuals in New York for reporting specific financial information. This form is essential for ensuring compliance with state tax regulations and allows taxpayers to accurately report their income and deductions. Understanding the purpose and requirements of this form is crucial for effective tax management.

How to use the Ct 222 New York Form

To use the Ct 222 New York Form, start by obtaining the latest version from the official state resources. Fill out the form by entering the required information in the designated fields. Ensure that all data is accurate and complete to avoid delays in processing. Once filled, review the form for any errors before submitting it according to the specified guidelines.

Steps to complete the Ct 222 New York Form

Completing the Ct 222 New York Form involves several steps:

- Download the form from a reliable source.

- Fill in your personal and financial details as required.

- Double-check all entries for accuracy.

- Sign the form electronically or by hand, depending on your submission method.

- Submit the form via the appropriate channel, whether online, by mail, or in person.

Legal use of the Ct 222 New York Form

The legal use of the Ct 222 New York Form is governed by state tax laws. It is important to ensure that the form is completed in accordance with these laws to maintain compliance. Using this form correctly helps avoid potential penalties and ensures that taxpayers fulfill their obligations to the state.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 222 New York Form vary depending on the type of taxpayer and the specific tax year. Generally, it is advisable to file the form by the due date to avoid late fees and penalties. Keeping track of important dates related to tax filings can help ensure timely submissions and compliance with state regulations.

Form Submission Methods (Online / Mail / In-Person)

The Ct 222 New York Form can be submitted through various methods, including online submission, mailing a hard copy, or delivering it in person to the appropriate tax office. Each method may have specific instructions and requirements, so it is essential to choose the one that best fits your needs and ensures compliance with submission guidelines.

Quick guide on how to complete ct 222 new york 2012 form

Your assistance manual on how to prepare your Ct 222 New York Form

If you’re contemplating how to finalize and submit your Ct 222 New York Form, here are some brief guidelines on how to simplify tax processing.

To get underway, you simply need to register your airSlate SignNow account to transform how you handle documentation online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, create, and finalize your tax documents effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and electronic signatures, allowing you to adjust responses as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and seamless sharing.

Follow the steps outlined below to complete your Ct 222 New York Form in just a few minutes:

- Establish your account and start working on PDFs within minutes.

- Access our catalog to obtain any IRS tax form; browse through different versions and schedules.

- Click Get form to launch your Ct 222 New York Form in our editor.

- Populate the required fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to insert your legally-effective eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to digitally file your taxes with airSlate SignNow. Please be aware that filing on paper can increase return errors and delay refunds. Certainly, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ct 222 new york 2012 form

FAQs

-

I am applying for a job as Interaction Designer in New York, the company has an online form to fill out and they ask about my current salary, I am freelancing.. What should I fill in?

As Sarah said, leave it blank or, if it's a free-form text field, put in "Freelancer".If you put in $50k and they were thinking of paying $75k, you just lost $25k/year. If you put in $75k, but their budget only allows $50k, you may have lost the job on that alone.If you don't put in anything, leave it to the interview, and tell thm that you're a freelancer and adjust your fee according to the difficulty of the job, so there's no set income. If they ask for how much you made last year, explain that that would include periods between jobs, where you made zero, so it's not a fair number.In any financial negotiation, an old saying will always hold true - he who comes up with a number first, loses. Jobs, buying houses - they're both the same. Asking "How much?" is the better side to be on. then if they say they were thinking of $50k-$75k, you can tell them that it's just a little less than you were charging, but the job looks to be VERY interesting, the company seems to be a good one to work for and you're sure that when they see what you're capable of, they'll adjust your increases. (IOW, "I'll take the $75k, but I expect to be making about $90k in a year.")They know how to play the game - show them that you do too.

-

How do I fill out the New Zealand visa form?

Hi,Towards the front of your Immigration Form there is a check list. This check list explains the documents you will need to include with your form (i.e. passport documents, proof of funds, medical information etc). With any visa application it’s important to ensure that you attach all the required information or your application may be returned to you.The forms themselves will guide you through the process, but you must ensure you have the correct form for the visa you want to apply for. Given that some visa applications can carry hefty fees it may also be wise to check with an Immigration Adviser or Lawyer as to whether you qualify for that particular visa.The form itself will explain which parts you need to fill out and which parts you don’t. If you don’t understand the form you may wish to get a friend or a family member to explain it to you. There is a part at the back of the form for them to complete saying that they have assisted you in the completion of it.If all else fails you may need to seek advice from a Immigration Adviser or Lawyer. However, I always suggest calling around so you can ensure you get the best deal.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

Which forms do I need to fill in order to file New York state taxes?

You must determine your New York State residency status. You need to answer these questions:Did you live in an on-campus apartment or an apartment or house off-campus in New York State in 2012?Did you maintain, or rent, the on-campus apartment or off-campus residence for at least 11 months in 2012?Were you physically present in New York State for at least 183 days in 2012?If the answers to all three questions are "Yes", and you were not a full-time undergraduate student (which as an F-1 OPT I assume you were not), you are a New York State resident for tax purposes. Otherwise you are a nonresident.You file Form IT-201, http://www.tax.ny.gov/pdf/curren..., if you are a resident of New York State, Form IT-203, http://www.tax.ny.gov/pdf/curren..., if you are not.

-

How long does it take to get from New York City, NY to Greenwich, CT?

Metro North is the best bet heading into the city. Takes around 42 mins.Greenwich has 4 train stations;Old Greenwich StationRiverside StationCos Cob StationCentral Greenwich StationThe residents of the west side of town consider Portchester, NY Station to be the unofficial 5th.Here’s a quick map…

-

What are some must sees or dos when in New York City to fill out a two day itinerary?

Get yourself Metrocards. They work in the Subways and on the buses. Each ride is about $2.75. However, you can transfer from bus to subway, bus to bus, Subway to Subway, or Subway to bus for free.When I take people around for two days, I typically start with the Statue of Liberty. First boat goes out at 8:30 a m. Do not talk to sidewalk ticket agents. At best, they will sell you the $19 ticket for $25, with a commission. At worst, thousands last year paid for boat trips that did not go to the Statue of Liberty, after being told by street ticket agents that it would.From the statue, it's a short walk to either the financial district or World Trade Center Memorial. (We don't call it Ground Zero anymore.)After that, I walk over the Brooklyn Bridge to Brooklyn Heights, with its beautiful 150-year-old houses, including those that housed Arthur Miller, Norman Mailer, Truman Capote and WH Auden. Stop at the Brooklyn Heights Promenade with a 15 km or 10 Mile view of the city and the harbor.This takes us to lunch the first day.Contact me if you want to learn the rest of this two-day itinerary. I'm always looking for another day of work!

-

Do non profit corporations in New York have to file a form each year after filing the ct-247 the first year?

The non-profit does not have to file CT-247 each year; it only needs to refile if its Federal exemption is revoked, and later restored. However, a non-profit with unrelated business income from New York state activities will have to file Form CT-13 for any year in which the corporation had such income.There is also a separate form (ST-119.2) to file for an exemption from state and local sales taxes.

Create this form in 5 minutes!

How to create an eSignature for the ct 222 new york 2012 form

How to generate an eSignature for your Ct 222 New York 2012 Form online

How to make an eSignature for your Ct 222 New York 2012 Form in Google Chrome

How to create an electronic signature for putting it on the Ct 222 New York 2012 Form in Gmail

How to generate an eSignature for the Ct 222 New York 2012 Form from your mobile device

How to create an eSignature for the Ct 222 New York 2012 Form on iOS

How to create an eSignature for the Ct 222 New York 2012 Form on Android OS

People also ask

-

What is the Ct 222 New York Form used for?

The Ct 222 New York Form is primarily used for reporting specific tax information to state authorities. Businesses often utilize this form to ensure compliance with New York tax regulations. Using airSlate SignNow simplifies the process by allowing you to fill and send this form electronically, enhancing efficiency.

-

How does airSlate SignNow help with completing the Ct 222 New York Form?

airSlate SignNow provides an easy-to-use platform for filling out the Ct 222 New York Form. With its user-friendly interface, you can complete and eSign the form quickly. This not only saves time but also ensures that your submissions are accurate and compliant with state requirements.

-

Is there a cost associated with using airSlate SignNow for the Ct 222 New York Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that fits your budget and requirements, ensuring access to all features required for managing the Ct 222 New York Form efficiently. Affordable pricing makes it a cost-effective solution for businesses of all sizes.

-

Are there any specific features for handling the Ct 222 New York Form in airSlate SignNow?

airSlate SignNow offers features like customizable templates, document tracking, and secure cloud storage specifically for managing the Ct 222 New York Form. These features enhance your efficiency and provide a streamlined workflow for document handling and eSignature processes. This ensures your submissions remain organized and easily accessible.

-

Can airSlate SignNow integrate with other software for the Ct 222 New York Form?

Yes, airSlate SignNow integrates seamlessly with various applications such as CRM systems and cloud storage solutions. This means you can easily import and use data while managing the Ct 222 New York Form. These integrations help streamline your workflow and improve productivity across various platforms.

-

What benefits does airSlate SignNow provide for eSigning the Ct 222 New York Form?

Using airSlate SignNow for eSigning the Ct 222 New York Form offers signNow benefits like enhanced security and quick turnaround times. Electronic signatures are legally binding and help in expediting the signing process. Additionally, the platform ensures that your documents are securely stored and easily retrievable.

-

Is airSlate SignNow user-friendly for first-time users of the Ct 222 New York Form?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it ideal for first-time users handling the Ct 222 New York Form. With comprehensive tutorials and a straightforward interface, users can easily navigate through the application for an efficient experience, regardless of their technical background.

Get more for Ct 222 New York Form

Find out other Ct 222 New York Form

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement