Www Irs Govforms Pubsabout Form 4684About Form 4684, Casualties and TheftsInternal Revenue Service 2021

Understanding Form 4684: Casualties and Thefts

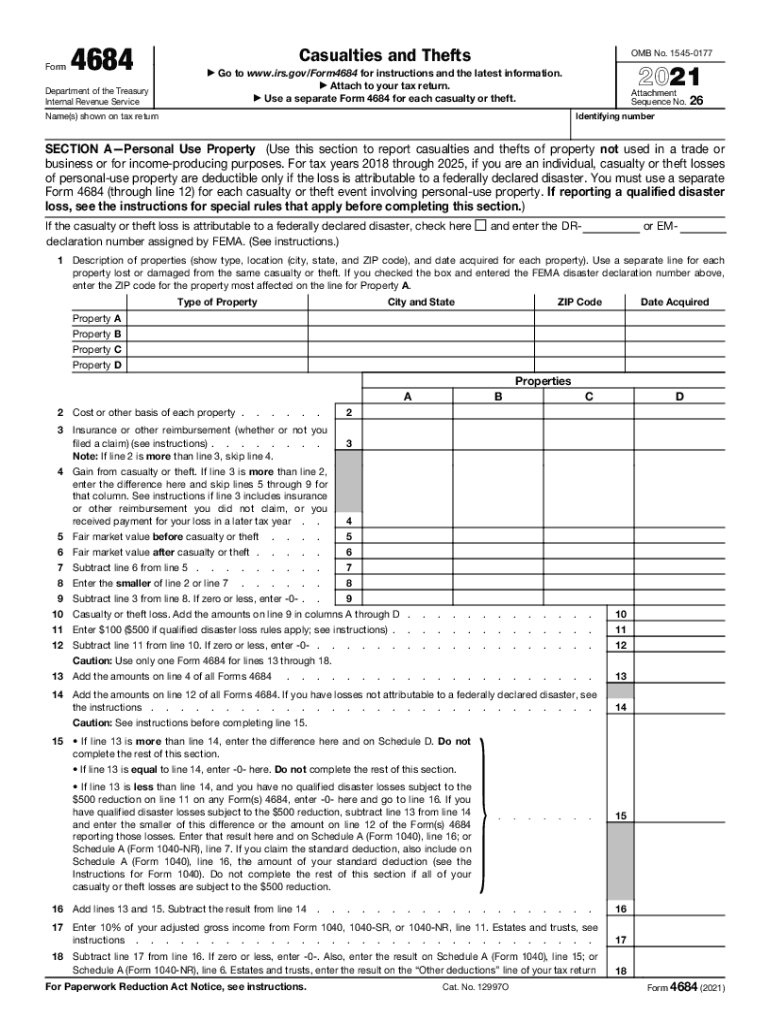

Form 4684, officially titled "Casualties and Thefts," is utilized by taxpayers to report losses due to casualties or thefts. This form is essential for individuals and businesses seeking to claim deductions for property losses on their federal tax returns. The Internal Revenue Service (IRS) provides guidelines on how to accurately complete this form to ensure compliance with tax laws. It is important to understand the specific circumstances under which this form should be filed, including the nature of the loss and the documentation required.

Steps to Complete Form 4684

Completing Form 4684 involves several key steps to ensure accurate reporting of casualty and theft losses. Begin by gathering all necessary documentation, including evidence of the loss, such as photographs, police reports, and repair estimates. Next, fill out the form by providing details about the property, the type of loss, and the amount of the loss. It is crucial to follow the IRS instructions closely to avoid errors that could delay processing or lead to audits. After completing the form, review it for accuracy before submitting it with your tax return.

Legal Use of Form 4684

Form 4684 must be used in accordance with IRS regulations to ensure that claims for deductions are valid. The form is legally binding when completed correctly and submitted on time. Taxpayers should be aware of the requirements for substantiating losses, including the need for detailed records and documentation. Failure to comply with these legal standards may result in penalties or disallowance of the claimed deductions. Understanding the legal implications of using Form 4684 is essential for taxpayers seeking to protect their interests.

Examples of Using Form 4684

There are various scenarios in which Form 4684 may be applicable. For instance, a homeowner who experiences damage from a natural disaster, such as a flood or fire, can use this form to report the loss. Similarly, individuals who have had personal property stolen, such as a vehicle or valuable items, can also claim deductions using Form 4684. Each example illustrates the importance of accurately documenting the loss and understanding the specific IRS guidelines related to casualty and theft deductions.

Filing Deadlines for Form 4684

Timely filing of Form 4684 is critical to ensure that taxpayers can claim their deductions for casualty and theft losses. The form must be submitted along with the federal tax return by the standard filing deadline, typically April 15 of the following tax year. In cases where extensions are filed, taxpayers should be aware of the extended deadlines and ensure that Form 4684 is included in their submissions. Staying informed about these deadlines can help prevent missed opportunities for claiming valid deductions.

Required Documents for Form 4684

To successfully file Form 4684, taxpayers must provide specific documentation that supports their claims of loss. This includes, but is not limited to, evidence of ownership, detailed descriptions of the property, and any relevant police reports or insurance claims. Additionally, taxpayers should keep records of any repairs or replacements made due to the loss. Proper documentation is essential for substantiating claims and ensuring compliance with IRS requirements.

Quick guide on how to complete wwwirsgovforms pubsabout form 4684about form 4684 casualties and theftsinternal revenue service

Accomplish Www irs govforms pubsabout form 4684About Form 4684, Casualties And TheftsInternal Revenue Service effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as a flawless eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your files swiftly without delays. Handle Www irs govforms pubsabout form 4684About Form 4684, Casualties And TheftsInternal Revenue Service on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest method to modify and eSign Www irs govforms pubsabout form 4684About Form 4684, Casualties And TheftsInternal Revenue Service effortlessly

- Locate Www irs govforms pubsabout form 4684About Form 4684, Casualties And TheftsInternal Revenue Service and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Put aside worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks on any device you prefer. Modify and eSign Www irs govforms pubsabout form 4684About Form 4684, Casualties And TheftsInternal Revenue Service and guarantee exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovforms pubsabout form 4684about form 4684 casualties and theftsinternal revenue service

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovforms pubsabout form 4684about form 4684 casualties and theftsinternal revenue service

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an e-signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is form 4684 and how is it used in airSlate SignNow?

Form 4684 is designed for reporting casualties and theft losses for tax purposes. With airSlate SignNow, you can easily fill out and eSign form 4684 digitally, ensuring a secure and efficient filing process that saves time and reduces paperwork.

-

How does airSlate SignNow simplify the process of filling out form 4684?

airSlate SignNow provides an intuitive platform for completing form 4684 online. Users can quickly access templates, fill in necessary information, and eSign the document, making it easier to submit your tax reports accurately and on time.

-

Is there a cost associated with using airSlate SignNow for form 4684?

Yes, airSlate SignNow offers competitive pricing plans to suit various business needs. Subscribing allows users to access unlimited electronic signatures, including for form 4684, along with additional features that enhance document management.

-

What are the key features of airSlate SignNow for managing form 4684?

airSlate SignNow offers features like customizable templates, secure eSigning, and easy document sharing. With these functionalities, completing and submitting form 4684 becomes straightforward and compliant with tax regulations.

-

Can I integrate airSlate SignNow with other tools to manage form 4684?

Yes, airSlate SignNow integrates with various productivity tools and cloud storage solutions. This allows users to streamline their workflow when managing form 4684 alongside other documents and applications.

-

What benefits does airSlate SignNow offer for users of form 4684?

By using airSlate SignNow for form 4684, you gain a secure, efficient, and cost-effective way to manage your tax documentation. The platform signNowly reduces the time needed for paperwork, ensuring your submissions are quick and accurate.

-

Is airSlate SignNow easy to use for completing form 4684?

Absolutely! airSlate SignNow has been designed with user experience in mind, making it simple to navigate and complete form 4684. Even those unfamiliar with digital solutions will find the platform straightforward and helpful.

Get more for Www irs govforms pubsabout form 4684About Form 4684, Casualties And TheftsInternal Revenue Service

- Dc affidavit form 497301506

- Discovery interrogatories from plaintiff to defendant with production requests district of columbia form

- Dc affidavit form 497301508

- 21 309 form

- Transfer under the district of columbia district of columbia form

- Discovery interrogatories from defendant to plaintiff with production requests district of columbia form

- Dc divorce form

- Dc process servers form

Find out other Www irs govforms pubsabout form 4684About Form 4684, Casualties And TheftsInternal Revenue Service

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple