Printable Form 4684 2018

What is the Printable Form 4684

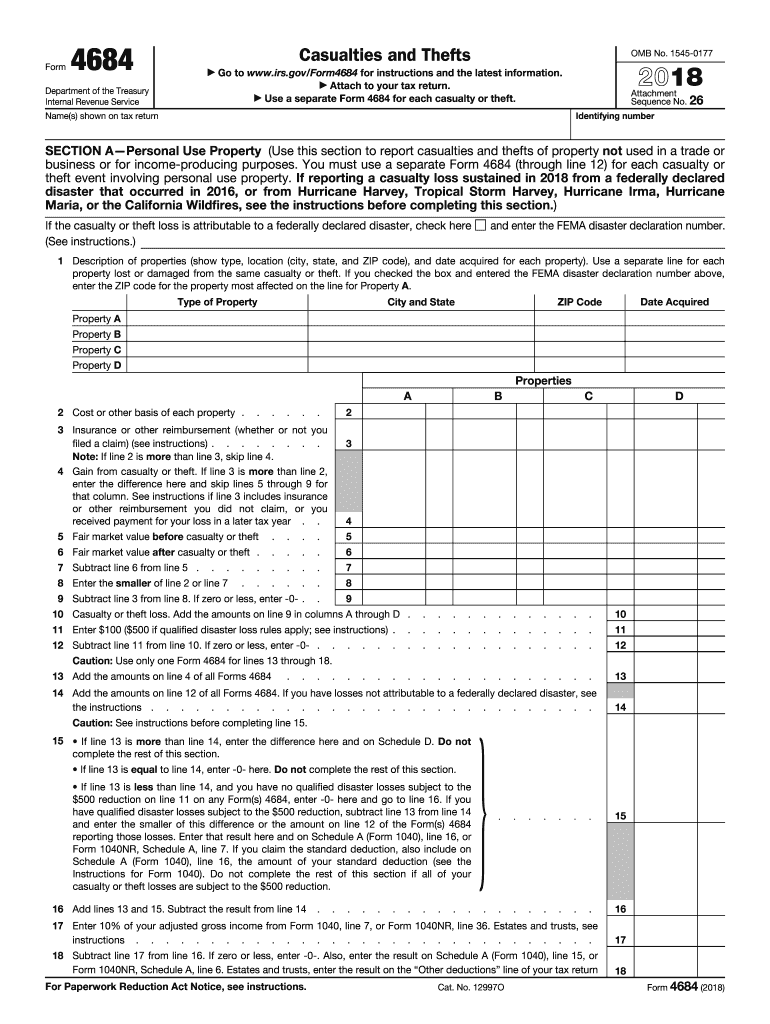

The 2017 Form 4684, officially known as the "Casualties and Thefts" form, is utilized by taxpayers to report losses due to casualties or thefts. This form is essential for individuals who have experienced property loss from events such as natural disasters, accidents, or theft. By completing this form, taxpayers can claim deductions for the losses incurred, which can significantly impact their overall tax liability.

How to Obtain the Printable Form 4684

Taxpayers can easily obtain the 2017 Form 4684 from the Internal Revenue Service (IRS) website. The form is available in a printable format, allowing users to download and print it directly. Additionally, many tax preparation software programs include the form, making it accessible for those who prefer to file electronically. It is important to ensure that the correct version of the form is used to avoid any issues during the filing process.

Steps to Complete the Printable Form 4684

Completing the 2017 Form 4684 involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Identify the type of casualty or theft loss you are reporting, and provide details about the event.

- Calculate the amount of loss by determining the decrease in fair market value of the property.

- Complete the required sections regarding insurance reimbursements and other compensations received.

- Ensure all calculations are accurate and double-check for any missing information before submission.

IRS Guidelines

The IRS provides specific guidelines for completing the 2017 Form 4684. Taxpayers must adhere to these guidelines to ensure compliance and maximize their deductions. Key points include the requirement to document losses with appropriate evidence, such as photographs, receipts, and police reports for thefts. Additionally, it is crucial to understand the limitations on deductions, as certain losses may not be fully deductible based on IRS regulations.

Form Submission Methods

The 2017 Form 4684 can be submitted through various methods, including online filing, mailing, or in-person submission at designated IRS offices. For those filing electronically, using tax preparation software can streamline the process and ensure accuracy. If submitting by mail, it is advisable to send the form via certified mail to confirm receipt by the IRS. Each submission method has its own processing times, so it is essential to consider deadlines when choosing a method.

Eligibility Criteria

To use the 2017 Form 4684, taxpayers must meet specific eligibility criteria. Primarily, the form is intended for individuals who have suffered losses due to casualties or thefts within the tax year. Additionally, taxpayers must provide evidence of the loss and ensure that it meets the IRS's definition of a deductible casualty or theft loss. Understanding these criteria is vital for accurately reporting losses and claiming deductions.

Quick guide on how to complete 2015 4684 2018 2019 form

Uncover the simplest method to complete and endorse your Printable Form 4684

Are you still squandering time preparing your official papers on physical copies instead of doing it digitally? airSlate SignNow provides a superior approach to finish and endorse your Printable Form 4684 and comparable documents for public services. Our intelligent eSignature solution delivers all the tools necessary to work on documents swiftly and in accordance with official standards - comprehensive PDF editing, management, protection, signing, and sharing features available within an intuitive interface.

Only a few actions are required to finalize and endorse your Printable Form 4684:

- Upload the editable template to the editor using the Get Form button.

- Determine what details you need to input in your Printable Form 4684.

- Navigate through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Enhance the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Redact fields that are no longer necessary.

- Click on Sign to create a legally binding eSignature using your preferred method.

- Add the Date next to your signature and finalize your work with the Done button.

Store your completed Printable Form 4684 in the Documents folder within your account, download it, or export it to your choice of cloud storage. Our solution also provides versatile form sharing. There’s no requirement to print your forms when you need to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” dispatch from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct 2015 4684 2018 2019 form

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the 2015 4684 2018 2019 form

How to generate an eSignature for the 2015 4684 2018 2019 Form in the online mode

How to generate an eSignature for the 2015 4684 2018 2019 Form in Chrome

How to create an eSignature for putting it on the 2015 4684 2018 2019 Form in Gmail

How to generate an electronic signature for the 2015 4684 2018 2019 Form right from your mobile device

How to make an eSignature for the 2015 4684 2018 2019 Form on iOS

How to create an eSignature for the 2015 4684 2018 2019 Form on Android

People also ask

-

What is the 2017 form 4684 used for?

The 2017 form 4684 is used to report casualties and theft losses for tax purposes. This form helps taxpayers claim deductions for losses incurred during the tax year, making it essential for accurate tax reporting.

-

How can airSlate SignNow help with the 2017 form 4684?

airSlate SignNow simplifies the process of filling out and eSigning the 2017 form 4684. Our user-friendly platform ensures that you can complete this form efficiently and securely, streamlining your tax filing process.

-

Is there a cost associated with using airSlate SignNow for the 2017 form 4684?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for businesses frequently dealing with tax forms like the 2017 form 4684. We provide affordable solutions that can save you time and resources.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as electronic signatures, document templates, and real-time tracking to enhance your document management. These features are particularly useful when working with forms like the 2017 form 4684, ensuring everything is streamlined.

-

Can I integrate airSlate SignNow with my existing software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various tax software, making it easy to include the 2017 form 4684 in your existing workflow. This allows users to manage their documents more efficiently and maintain consistency across platforms.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like the 2017 form 4684 provides numerous benefits, including enhanced security, speed, and convenience. Our platform ensures that your sensitive information is protected while making it easy to eSign and share documents.

-

Is it easy to track the status of my 2017 form 4684 with airSlate SignNow?

Yes! airSlate SignNow allows you to track the status of your documents, including the 2017 form 4684, in real-time. You will receive notifications when your document is viewed and signed, ensuring you stay updated on its progress.

Get more for Printable Form 4684

- Power of attorney regarding the care of a minor child or form

- Memory jogger list form

- Bp stock transfer form

- El2 florida high school athletic association revised 0310 preparticipation physical evaluation page 1 of 3 this completed form

- Cancellation template wwf australia davids version for pdf v0 3 docx form

- Ecuador visa requirements ampamp application ecuador travel visa form

- Satcomm911 446031959 form

- State of arkansas composite estimated tax declarat form

Find out other Printable Form 4684

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe