Irs Form 4684 2023-2026

What is the IRS Form 4684?

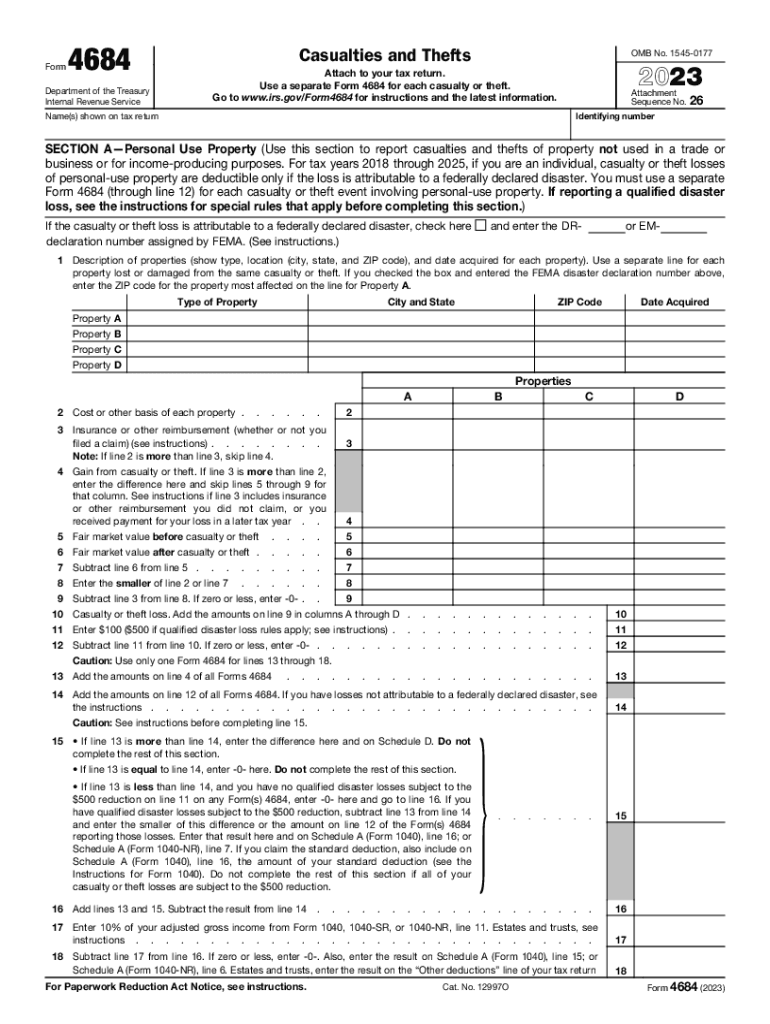

The IRS Form 4684, also known as the 2022 form 4684, is utilized by taxpayers to report casualties and thefts. This form allows individuals to claim deductions for losses incurred due to events such as natural disasters, accidents, or theft. The information provided on this form is essential for calculating the allowable deductions on your federal tax return. Understanding the purpose of this form is crucial for taxpayers who have experienced significant losses and wish to receive tax relief.

How to Obtain the IRS Form 4684

To obtain the IRS Form 4684, you can visit the official IRS website, where you can download the form in PDF format. The 2022 IRS 4684 is also available in print at local IRS offices and some public libraries. Additionally, tax professionals can provide this form as part of their services. It is important to ensure you are using the correct version for the tax year you are filing, as forms may change from year to year.

Steps to Complete the IRS Form 4684

Completing the IRS Form 4684 involves several key steps:

- Begin by gathering all necessary documentation related to your losses, including receipts, insurance claims, and police reports.

- Fill out your personal information at the top of the form, including your name, address, and Social Security number.

- Detail the nature of your loss in the appropriate sections, specifying whether it was due to a casualty or theft.

- Calculate the amount of your loss using the guidelines provided in the form instructions, ensuring you adhere to IRS rules.

- Review your completed form for accuracy and completeness before submission.

Key Elements of the IRS Form 4684

The IRS Form 4684 includes several key elements that taxpayers must understand:

- Type of Loss: Indicate whether the loss was due to a casualty or theft.

- Amount of Loss: Provide detailed calculations of the loss, including fair market value and any insurance reimbursements.

- Location of Loss: Specify where the loss occurred, which may affect eligibility for certain deductions.

- Documentation: Attach any supporting documents that substantiate your claim, such as photographs or estimates.

IRS Guidelines for Form 4684

The IRS provides specific guidelines for completing Form 4684. Taxpayers must ensure their losses are eligible for deduction under current tax laws. The IRS requires detailed documentation to support claims, including proof of ownership and the extent of the loss. Additionally, taxpayers should be aware of any limitations on deductions based on the type of loss and the taxpayer's adjusted gross income. Familiarizing yourself with these guidelines can help ensure a smooth filing process.

Filing Deadlines for the IRS Form 4684

Filing deadlines for the IRS Form 4684 align with the general tax filing deadlines. For most taxpayers, the deadline to file your federal income tax return, including Form 4684, is April 15 of the following year. If you require additional time, you may file for an extension, which typically extends the deadline to October 15. However, any taxes owed must still be paid by the original due date to avoid penalties and interest.

Quick guide on how to complete irs form 4684

Complete Irs Form 4684 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed forms, allowing you to obtain the necessary document and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents promptly without any delays. Manage Irs Form 4684 on any platform with airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to edit and electronically sign Irs Form 4684 effortlessly

- Find Irs Form 4684 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or conceal confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Select how you wish to share your document, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Irs Form 4684 and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 4684

Create this form in 5 minutes!

How to create an eSignature for the irs form 4684

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 form 4684 used for?

The 2022 form 4684 is used for reporting casualty and theft losses to the IRS. This form helps taxpayers calculate their deductible losses, which can reduce tax liabilities. Understanding how to fill it out correctly can maximize your deductions.

-

How can airSlate SignNow assist with the 2022 form 4684?

airSlate SignNow provides an efficient platform for electronically signing and managing the 2022 form 4684. Its user-friendly interface makes it easy to prepare your document and send it for signatures. This eliminates the hassles of paperwork and speeds up the submission process.

-

Is there a cost associated with using airSlate SignNow for the 2022 form 4684?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs. These plans are cost-effective and designed to provide value, especially when dealing with important documents like the 2022 form 4684. You can choose a plan that offers the services you need.

-

What features does airSlate SignNow offer for handling the 2022 form 4684?

airSlate SignNow includes features like customizable templates, status tracking, and automated reminders, which are all beneficial for managing the 2022 form 4684. These tools save time and ensure that the document is completed and signed promptly. The platform is also secure, protecting sensitive information.

-

Can I integrate airSlate SignNow with other applications for the 2022 form 4684?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your workflow for the 2022 form 4684. Whether you use cloud storage, CRM systems, or other business tools, integration helps streamline document management and signing processes.

-

What are the benefits of using airSlate SignNow for the 2022 form 4684?

Using airSlate SignNow for the 2022 form 4684 simplifies the signing and submission process. You can save time, reduce errors, and ensure compliance with IRS requirements. Additionally, digital signatures are legally binding, providing peace of mind for businesses.

-

Is airSlate SignNow mobile-friendly for the 2022 form 4684?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage the 2022 form 4684 on the go. This mobile-friendly design ensures that you can access, edit, and sign your documents from anywhere. It offers convenience for busy professionals.

Get more for Irs Form 4684

Find out other Irs Form 4684

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU