4684 Form 2016

What is the 4684 Form

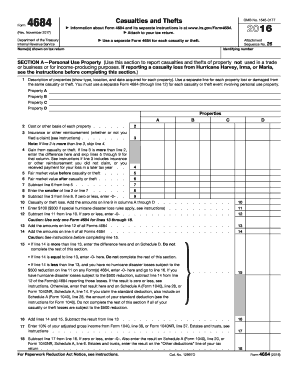

The 4684 Form is a tax form used by individuals and businesses in the United States to report gains and losses from the sale or exchange of property. This form is particularly important for taxpayers who have experienced casualty or theft losses, as it allows them to claim deductions related to these events. The form provides a structured way to calculate the amount of loss and report it accurately to the IRS, ensuring compliance with federal tax regulations.

How to use the 4684 Form

Using the 4684 Form involves several steps to ensure accurate reporting of gains and losses. Taxpayers must first gather all relevant information regarding the property in question, including purchase price, sale price, and any associated costs. Next, they should fill out the form by providing details about the property, the nature of the loss, and the calculations used to determine the deductible amount. It is essential to follow IRS guidelines closely to avoid errors that could lead to penalties or delays in processing.

Steps to complete the 4684 Form

Completing the 4684 Form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documentation related to the property, including purchase and sale records.

- Determine the type of loss you are reporting, whether it is due to casualty, theft, or other reasons.

- Fill out the form by entering relevant information, including the description of the property and the calculations for gains or losses.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Submit the form along with your tax return by the appropriate deadline.

Legal use of the 4684 Form

The 4684 Form must be used in accordance with IRS regulations to ensure its legal validity. Taxpayers are required to provide accurate information and maintain records that support their claims. Falsifying information on the form can lead to severe penalties, including fines and potential legal action. Understanding the legal implications of the form is crucial for compliance and protecting oneself from audits or disputes with the IRS.

Filing Deadlines / Important Dates

Filing the 4684 Form is subject to specific deadlines that align with the annual tax filing schedule. Typically, taxpayers must submit the form by April fifteenth of the following year after the tax year in which the loss occurred. If additional time is needed, taxpayers can file for an extension, but it is essential to ensure that the form is submitted within the extended timeframe to avoid penalties.

Required Documents

To complete the 4684 Form accurately, several documents are required. Taxpayers should have:

- Proof of ownership of the property, such as purchase receipts or titles.

- Documentation of the loss, including police reports for theft or insurance claims for casualty losses.

- Records of any repairs or improvements made to the property that may affect its value.

Having these documents readily available will facilitate the completion of the form and support the reported claims.

Quick guide on how to complete 2015 4684 2016 form

Complete 4684 Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without any delays. Manage 4684 Form on any device using airSlate SignNow's apps for Android or iOS and streamline your document-based tasks today.

How to edit and eSign 4684 Form with ease

- Locate 4684 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information carefully and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign 4684 Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 4684 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 4684 2016 form

How to create an electronic signature for the 2015 4684 2016 Form online

How to generate an eSignature for your 2015 4684 2016 Form in Google Chrome

How to make an eSignature for signing the 2015 4684 2016 Form in Gmail

How to make an eSignature for the 2015 4684 2016 Form straight from your smart phone

How to make an eSignature for the 2015 4684 2016 Form on iOS devices

How to make an eSignature for the 2015 4684 2016 Form on Android OS

People also ask

-

What is the 4684 Form and how can airSlate SignNow help with it?

The 4684 Form is a tax form used for reporting casualty and theft losses. airSlate SignNow simplifies the process of filling out and signing the 4684 Form by providing an intuitive electronic signature solution, ensuring your documents are completed accurately and securely.

-

Are there any costs associated with using airSlate SignNow for the 4684 Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. You can choose a plan that fits your budget while ensuring that you can efficiently manage the signing and submission of your 4684 Form.

-

What features does airSlate SignNow offer for the 4684 Form?

airSlate SignNow provides features such as eSigning, document templates, and automated workflows specifically designed to streamline the process of handling the 4684 Form. These features help you to save time and reduce errors when preparing your tax documents.

-

Can I integrate airSlate SignNow with other software for the 4684 Form?

Absolutely! airSlate SignNow supports integrations with various applications, making it easy to connect with your preferred tools for managing the 4684 Form. This ensures seamless data transfer and enhances your overall document management process.

-

Is it secure to use airSlate SignNow for the 4684 Form?

Yes, airSlate SignNow prioritizes security and compliance, providing a safe environment for handling sensitive documents like the 4684 Form. With features such as encryption and secure cloud storage, you can confidently manage your form submissions.

-

How can I track the status of my 4684 Form using airSlate SignNow?

airSlate SignNow offers real-time tracking features, allowing you to monitor the status of your 4684 Form throughout the signing process. You will receive notifications when your document is viewed, signed, or completed, ensuring you stay informed.

-

What are the benefits of using airSlate SignNow for the 4684 Form compared to traditional methods?

Using airSlate SignNow for the 4684 Form offers numerous benefits over traditional methods, including faster processing times, reduced paperwork, and enhanced accessibility. You can complete and sign your forms electronically from anywhere, making tax season less stressful.

Get more for 4684 Form

- Msa 5701111 form

- New york gift deed for individual to individual form

- Georgia bill of sale for automobile or vehicle including odometer statement and promissory note form

- Purchase contract for land and homeaboutblank form

- Sell deed form

- Nevada grant bargain sale deed from individual to husband and wife form

- Indiana lead based paint disclosure form

- Mississippi residential lease or rental agreement for month to month form

Find out other 4684 Form

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word