4684 Form 2015

What is the 4684 Form

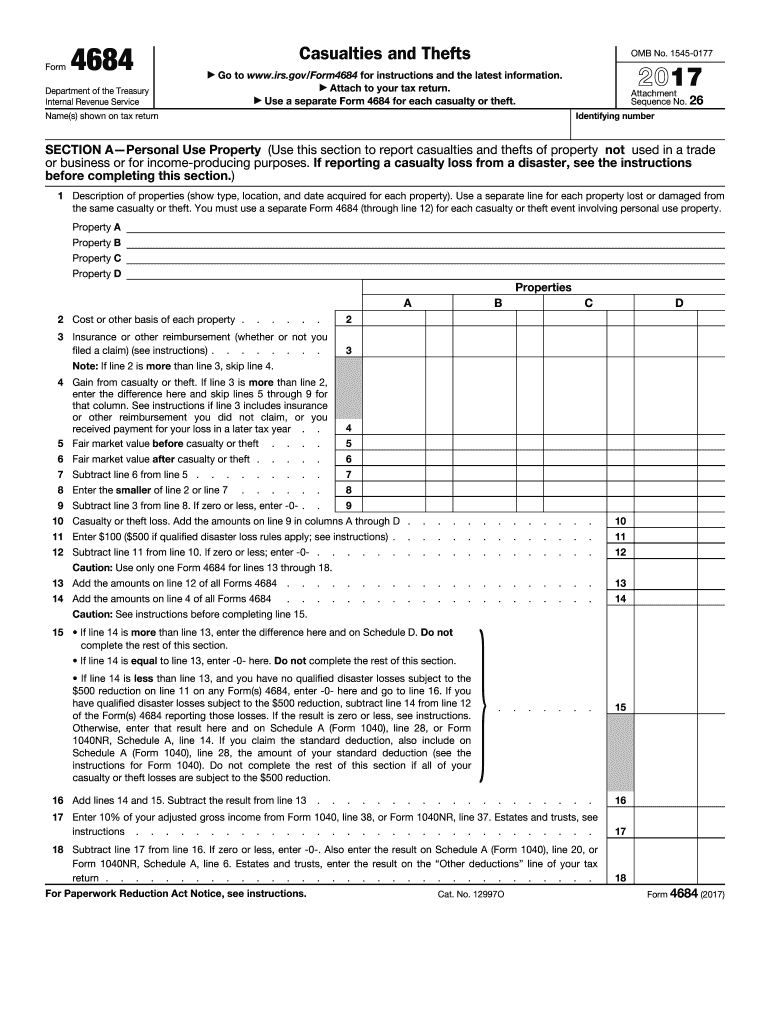

The 4684 Form is a tax form used by individuals and businesses in the United States to report casualties and theft losses. This form is essential for taxpayers seeking to claim deductions related to property damage or loss due to unexpected events. It provides a structured way to document the details of the loss, including the type of property affected, the date of the event, and the amount of the loss incurred. Understanding the purpose of this form is crucial for anyone looking to navigate tax deductions effectively.

How to use the 4684 Form

Using the 4684 Form involves several steps to ensure accurate reporting of losses. First, gather all necessary documentation, including receipts, appraisals, and insurance claims related to the loss. Next, complete the form by providing detailed information about the property, the circumstances of the loss, and the financial impact. It is important to follow the IRS guidelines closely to ensure that all required information is included. Once completed, the form should be submitted with your tax return to the IRS.

Steps to complete the 4684 Form

Completing the 4684 Form requires careful attention to detail. Follow these steps:

- Begin by entering your personal information at the top of the form.

- Identify the type of loss you are reporting, whether it's a casualty or theft.

- Provide a description of the property, including its location and fair market value before the loss.

- Document the date of the loss and the amount of the loss.

- Include any insurance reimbursements received or expected.

- Sign and date the form before submission.

Legal use of the 4684 Form

The 4684 Form is legally recognized by the IRS as a valid document for reporting losses. To ensure its legal standing, it is essential to comply with all IRS regulations regarding the form's completion and submission. This includes providing accurate information and maintaining supporting documents that validate the claims made on the form. Failure to adhere to these guidelines may result in penalties or denial of the claimed deductions.

Filing Deadlines / Important Dates

Filing deadlines for the 4684 Form align with the overall tax return deadlines. Typically, individual tax returns are due on April 15 each year. If you require an extension, you may file for an extension, but the 4684 Form must still be submitted by the extended deadline. It is advisable to keep track of any changes in tax regulations that may affect filing dates to ensure compliance.

Examples of using the 4684 Form

There are various scenarios where the 4684 Form may be utilized. For instance, if a homeowner experiences damage to their property due to a natural disaster, they can use this form to report the loss and claim deductions. Similarly, if a business suffers theft of inventory, the business owner can file the 4684 Form to account for the financial loss. Each scenario requires careful documentation to substantiate the claims made on the form.

Quick guide on how to complete 2015 4684 form

Complete 4684 Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly option to conventional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly and without hold-ups. Manage 4684 Form on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign 4684 Form without stress

- Find 4684 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to finalize your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, exhaustive form searches, and errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign 4684 Form and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 4684 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 4684 form

How to create an eSignature for a PDF document online

How to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the 4684 Form and how can airSlate SignNow help with it?

The 4684 Form is a tax document used to report casualty and theft losses. With airSlate SignNow, you can easily fill out, sign, and send the 4684 Form electronically, streamlining the process and ensuring that your documents are securely stored and easily accessible.

-

Is there a cost associated with using airSlate SignNow for the 4684 Form?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those who need to manage the 4684 Form. You can choose from various subscription options, ensuring that you only pay for the features you require to handle your documents effectively.

-

What features does airSlate SignNow offer for managing the 4684 Form?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and document tracking specifically for forms like the 4684 Form. These tools help simplify the document workflow, making it faster and more efficient to complete your tax filings.

-

Can I integrate airSlate SignNow with other applications for the 4684 Form?

Yes, airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Dropbox, and Microsoft Office. This allows you to manage your 4684 Form documents alongside other essential business tools, enhancing your productivity.

-

What are the benefits of using airSlate SignNow for the 4684 Form?

Using airSlate SignNow for the 4684 Form offers several benefits, including ease of use, cost-effectiveness, and enhanced security. The platform ensures that your sensitive tax information is protected while allowing you to complete and submit forms quickly.

-

How does airSlate SignNow ensure the security of my 4684 Form?

airSlate SignNow prioritizes security by using advanced encryption protocols to protect your documents, including the 4684 Form. Additionally, the platform complies with industry standards, ensuring that your data remains confidential and secure during the signing process.

-

Can I track the status of my 4684 Form with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for your documents, including the 4684 Form. You can easily check the status of your submissions, see when they are opened, and confirm when they are signed, giving you peace of mind throughout the process.

Get more for 4684 Form

- History formpreparticipation physical evaluation infohub

- Ut forms dearborn life benefits

- New patient questionnaire hssedu form

- Tb patient intake sheet form

- The nkf is proud to offer the 2020 culpepper exum scholarship an opportunity designed to help a form

- New york ffa association waiver release of ny ffa form

- 4031 fax form

- Dbl state disability claim packet ny sny9457pdf 647380 form

Find out other 4684 Form

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template