Form 1040 Form 8814 PDF Form 8814 Department of the 2021

Understanding Form 8814

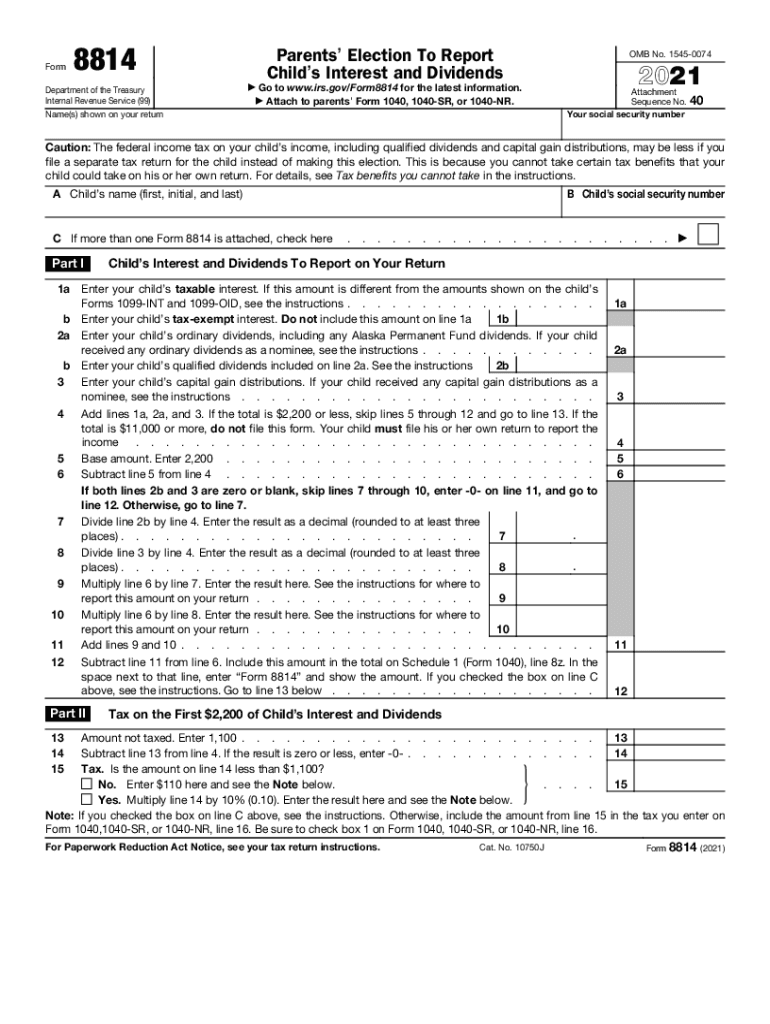

Form 8814, also known as the Parent's Election to Report Child's Interest and Dividends, is a tax form used by parents to report their child's unearned income on their own tax return. This form is typically utilized when a child has interest or dividend income exceeding a certain threshold, allowing parents to include this income on their Form 1040. By doing so, parents can simplify the tax filing process and potentially benefit from lower tax rates applicable to their income bracket.

Steps to Complete Form 8814

Completing Form 8814 involves several key steps:

- Gather necessary information about your child’s income, including any interest and dividends earned during the tax year.

- Determine if the total unearned income exceeds the threshold set by the IRS, which is typically $2,200 for the tax year.

- Fill out the relevant sections of Form 8814, including your child's name, Social Security number, and the amounts of interest and dividends.

- Transfer the total amount from Form 8814 to your Form 1040, ensuring that all calculations are accurate.

- Review the completed form for any errors before submission.

IRS Guidelines for Form 8814

The IRS provides specific guidelines for using Form 8814. It is essential to follow these instructions to ensure compliance and avoid penalties. Key points include:

- Form 8814 can only be used if the child is under age 19 at the end of the tax year or under age 24 if a full-time student.

- The child must not have any earned income, such as wages or salaries.

- Parents must report all of the child's interest and dividend income, even if it is below the reporting threshold.

Filing Deadlines for Form 8814

Form 8814 must be filed along with your Form 1040 by the standard tax filing deadline, which is typically April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to file on time to avoid penalties and interest on any taxes owed.

Digital vs. Paper Version of Form 8814

Form 8814 can be completed in both digital and paper formats. The digital version allows for easier calculations and quicker submission through e-filing. Using electronic filing also helps in ensuring accuracy and receiving confirmation of submission. However, some individuals may prefer the traditional paper method, which involves printing the form, completing it by hand, and mailing it to the IRS.

Penalties for Non-Compliance with Form 8814

Failure to accurately report a child's income using Form 8814 can result in penalties. The IRS may impose fines for underreporting income, and interest may accrue on any unpaid taxes. It is crucial to ensure that all information is reported correctly to avoid these potential consequences. Keeping thorough records and consulting with a tax professional can help mitigate risks associated with non-compliance.

Eligibility Criteria for Using Form 8814

To use Form 8814, certain eligibility criteria must be met. These include:

- The child must be under age 19 or under age 24 if a full-time student.

- The child should have unearned income only, with no earned income from jobs.

- The total unearned income must not exceed the specified threshold set by the IRS.

Quick guide on how to complete form 1040 form 8814pdf form 8814 department of the

Prepare Form 1040 Form 8814 pdf Form 8814 Department Of The easily on any device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can locate the necessary form and safely store it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents swiftly without delays. Manage Form 1040 Form 8814 pdf Form 8814 Department Of The on any platform with airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The simplest way to alter and eSign Form 1040 Form 8814 pdf Form 8814 Department Of The effortlessly

- Obtain Form 1040 Form 8814 pdf Form 8814 Department Of The and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign Form 1040 Form 8814 pdf Form 8814 Department Of The and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 form 8814pdf form 8814 department of the

Create this form in 5 minutes!

How to create an eSignature for the form 1040 form 8814pdf form 8814 department of the

The best way to make an electronic signature for your PDF file in the online mode

The best way to make an electronic signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

How to generate an e-signature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

How to generate an e-signature for a PDF file on Android

People also ask

-

What is form 8814 and how is it used?

Form 8814 is a tax form used by parents to report a child's unearned income. It allows you to include your child's income on your tax return if they meet certain criteria. Understanding how to fill out form 8814 can simplify your tax filing and ensure compliance with IRS regulations.

-

How can airSlate SignNow help with signing form 8814?

airSlate SignNow provides an intuitive platform to eSign documents like form 8814 securely and efficiently. You can quickly send the form for signatures, track its progress, and store it safely in the cloud. This streamlines the process and reduces the need for physical paperwork.

-

Is there a cost associated with using airSlate SignNow for form 8814?

While airSlate SignNow offers various pricing plans, most include features that make eSigning forms like 8814 cost-effective. You can choose a plan that suits your business needs, with options ranging from basic to advanced functionalities, ensuring budget-friendly solutions.

-

What features does airSlate SignNow offer for form 8814 management?

airSlate SignNow includes features such as automated workflows, customizable templates, and secure storage for managing form 8814. These tools enhance efficiency, allowing you to focus on your business while ensuring that your tax forms are correctly handled and signed.

-

Can I integrate airSlate SignNow with other software to manage form 8814?

Yes, airSlate SignNow offers seamless integrations with various software platforms, enhancing the management of form 8814. Whether you're using CRM systems or accounting software, these integrations allow for efficient data transfer and organization, making your processes smoother.

-

What are the benefits of using airSlate SignNow for form 8814?

Using airSlate SignNow for form 8814 offers numerous benefits, including increased efficiency, reduced paperwork, and secure document handling. It ensures that your forms are easily accessible, trackable, and compliant with legal standards, ultimately saving you time and effort.

-

Is airSlate SignNow secure for submitting form 8814?

Absolutely, airSlate SignNow employs industry-leading security measures to protect your data, making it a secure choice for submitting form 8814. Your information is encrypted and stored safely, ensuring that sensitive data remains confidential throughout the signing process.

Get more for Form 1040 Form 8814 pdf Form 8814 Department Of The

- Small business accounting package district of columbia form

- Company employment policies and procedures package district of columbia form

- Dc child form

- Newly divorced individuals package district of columbia form

- Dc statutory form

- Contractors forms package district of columbia

- Power of attorney for sale of motor vehicle district of columbia form

- Dc power attorney 497301767 form

Find out other Form 1040 Form 8814 pdf Form 8814 Department Of The

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement