Form 8814 Parents' Election to Report Child's Interest and Dividends 2020

What is the Form 8814 Parents' Election To Report Child's Interest And Dividends

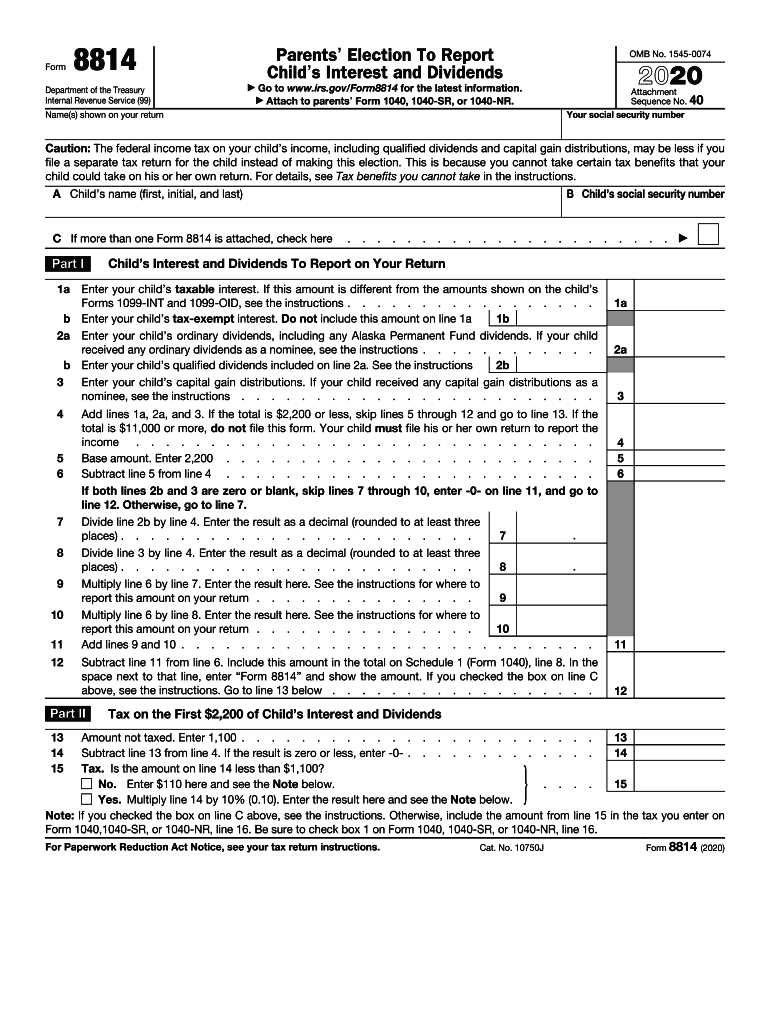

The Form 8814, officially known as the Parents' Election To Report Child's Interest And Dividends, allows parents to report their child's interest and dividend income on their own tax return. This form is particularly beneficial for parents of children under the age of 19 (or under 24 if a full-time student) who have unearned income exceeding a specific threshold. By using this form, parents can potentially simplify their tax filing process and take advantage of lower tax rates on the child's income.

How to use the Form 8814 Parents' Election To Report Child's Interest And Dividends

To use Form 8814 effectively, parents must first ensure that they meet the eligibility criteria. This includes confirming that the child's interest and dividend income falls within the specified limits. Once eligibility is established, parents can fill out the form by providing the required information about the child’s income and their own tax details. The completed form is then included with the parent's tax return, allowing the child’s income to be taxed at the parent's tax rate.

Steps to complete the Form 8814 Parents' Election To Report Child's Interest And Dividends

Completing Form 8814 involves several key steps:

- Gather necessary information about the child's income, including interest and dividends.

- Check the eligibility requirements to ensure the child qualifies for the election.

- Fill out the form accurately, providing all required details about the child and the income.

- Attach the completed Form 8814 to your tax return when filing.

It is crucial to double-check all entries for accuracy to avoid potential issues with the IRS.

Legal use of the Form 8814 Parents' Election To Report Child's Interest And Dividends

The legal use of Form 8814 is governed by IRS regulations. Parents must adhere to the guidelines set forth by the IRS to ensure that the election is valid. This includes reporting the correct amounts and ensuring that the child meets the necessary age and income criteria. Failure to comply with these regulations can result in penalties or the disallowance of the election.

Filing Deadlines / Important Dates

When filing Form 8814, it is essential to be aware of the relevant deadlines. Typically, the deadline for submitting individual tax returns, including Form 8814, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Parents should plan accordingly to ensure timely submission and avoid penalties.

Eligibility Criteria

To qualify for using Form 8814, certain eligibility criteria must be met:

- The child must be under the age of 19, or under 24 if a full-time student.

- The child's unearned income must not exceed the specified threshold set by the IRS.

- The parents must be able to claim the child as a dependent on their tax return.

Meeting these criteria ensures that parents can take advantage of the benefits offered by Form 8814.

Quick guide on how to complete 2020 form 8814 parents election to report childs interest and dividends

Effortlessly Prepare Form 8814 Parents' Election To Report Child's Interest And Dividends on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can access the right template and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents promptly without any hold-ups. Manage Form 8814 Parents' Election To Report Child's Interest And Dividends on any system using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to Modify and eSign Form 8814 Parents' Election To Report Child's Interest And Dividends with Ease

- Find Form 8814 Parents' Election To Report Child's Interest And Dividends and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize signNow sections of the documents or redact sensitive details with tools specifically provided by airSlate SignNow for that task.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

No more concerns about lost or misfiled documents, tiresome form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8814 Parents' Election To Report Child's Interest And Dividends to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 8814 parents election to report childs interest and dividends

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 8814 parents election to report childs interest and dividends

How to generate an eSignature for a PDF in the online mode

How to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What is the 2020 8814 form and how is it used?

The 2020 8814 form is utilized for reporting additional child tax credit for qualifying children. Businesses and individuals can use airSlate SignNow to easily prepare and eSign this form, streamlining the document workflow. By incorporating features designed for efficiency, airSlate SignNow ensures that your 2020 8814 form is processed seamlessly, saving you time and effort.

-

How can airSlate SignNow assist with eSigning the 2020 8814?

With airSlate SignNow, eSigning the 2020 8814 form becomes hassle-free. Our platform allows users to electronically sign and send this key tax document securely, ensuring compliance and saving on paper costs. By utilizing airSlate SignNow, you can complete your 2020 8814 quickly and efficiently.

-

What are the pricing options for using airSlate SignNow for 2020 8814 processing?

airSlate SignNow offers flexible pricing plans tailored to your business needs, making it affordable for all users. Whether you need basic features or advanced integrations for your 2020 8814 processing, we have a plan to suit you. You can choose from monthly or annual subscriptions based on your frequency of use.

-

Are there any integrations available with airSlate SignNow for handling the 2020 8814?

Yes, airSlate SignNow provides integrations with various applications and platforms to enhance your workflow when handling the 2020 8814. You can connect it to cloud storage solutions, CRM systems, and more. These integrations simplify document management, allowing for more efficient processing of the 2020 8814 and other important forms.

-

What features does airSlate SignNow offer for managing the 2020 8814?

airSlate SignNow offers robust features such as templates, secure storage, and real-time tracking for managing the 2020 8814. Users can create reusable templates for their forms, ensuring consistency and compliance. Additionally, our platform provides notifications and reminders, so you never miss a deadline when dealing with your 2020 8814.

-

What benefits does airSlate SignNow provide for businesses processing the 2020 8814?

Using airSlate SignNow for processing the 2020 8814 brings numerous benefits, including increased efficiency and reduced turnaround time. Our user-friendly interface helps minimize errors, and the secure eSigning process ensures confidentiality and compliance. By choosing airSlate SignNow, businesses can confidently manage their 2020 8814 with ease.

-

Can airSlate SignNow help with compliance related to the 2020 8814 form?

Absolutely! airSlate SignNow is designed with compliance in mind, ensuring that your processes adhere to legal standards when handling the 2020 8814. Our platform provides audit trails, secure eSignature options, and data protection measures that help you stay compliant as you complete your 2020 8814 forms.

Get more for Form 8814 Parents' Election To Report Child's Interest And Dividends

- Kumon level k solution book pdf form

- Application for moratorium on housing loan pag ibig form

- Ncl certificate form

- Sbi new passbook application form pdf

- First premier credit card upload documents form

- Glide reflection worksheet kuta form

- Auxiliaryscholarship application packet lnrmc com form

- Sisc benefit request payment form

Find out other Form 8814 Parents' Election To Report Child's Interest And Dividends

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online