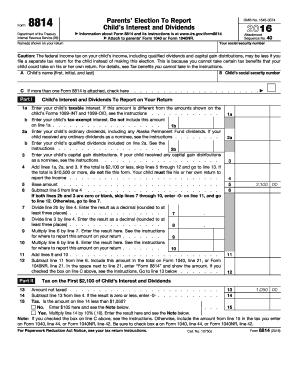

Form 8814 Parents' Election to Report Child's Interest and Dividends Irs 2016

What is the Form 8814 Parents' Election To Report Child's Interest And Dividends Irs

The Form 8814, known as the Parents' Election To Report Child's Interest And Dividends, is a tax form used by parents to report their child's unearned income on their own tax return. This form is particularly relevant for children under the age of 19 (or under 24 if a full-time student) who have unearned income exceeding a specific threshold. By electing to report the child's income, parents can simplify the tax filing process, allowing the income to be taxed at the parents' tax rate rather than the child's, which may be beneficial in reducing the overall tax liability.

How to use the Form 8814 Parents' Election To Report Child's Interest And Dividends Irs

To utilize Form 8814, parents must first determine if their child qualifies based on age and income levels. If eligible, they can include the child's interest and dividends on their own tax return using this form. It's important to ensure that the child’s total unearned income does not exceed the IRS limits, as this can affect the ability to file using this election. The form must be filled out accurately, reflecting the child’s income, and then submitted along with the parent’s tax return. This process can help streamline tax obligations and potentially minimize tax rates applied to the child's income.

Steps to complete the Form 8814 Parents' Election To Report Child's Interest And Dividends Irs

Completing Form 8814 involves several key steps:

- Gather necessary information, including the child's name, Social Security number, and total unearned income.

- Fill out the form by entering the child’s income details, ensuring accuracy to avoid any issues with the IRS.

- Include the completed Form 8814 with your tax return when filing, either electronically or by mail.

- Retain a copy of the form and all related documents for your records, as they may be needed for future reference or audits.

Legal use of the Form 8814 Parents' Election To Report Child's Interest And Dividends Irs

Form 8814 is legally binding when completed correctly and submitted as part of the tax filing process. It allows parents to report their child's income in compliance with IRS regulations. To ensure legal validity, all information must be accurate, and the form must be submitted by the tax filing deadline. Failure to comply with IRS rules regarding this form can result in penalties or additional taxes owed. Therefore, understanding the legal implications and requirements of Form 8814 is essential for parents looking to report their child's income effectively.

Eligibility Criteria

To qualify for using Form 8814, certain eligibility criteria must be met:

- The child must be under the age of 19, or under 24 if a full-time student.

- The child’s unearned income must not exceed the annual limit set by the IRS.

- The child must not file a tax return themselves, except to claim a refund of withheld taxes.

- The parents must be eligible to claim the child as a dependent on their tax return.

Filing Deadlines / Important Dates

Form 8814 must be filed by the same deadline as the parent’s tax return, typically April 15 of each year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is crucial for parents to be aware of these deadlines to avoid late filing penalties. Additionally, if an extension is filed for the parent’s tax return, it applies to Form 8814 as well, allowing additional time to submit the form without incurring penalties.

Quick guide on how to complete 2016 form 8814 parents election to report childs interest and dividends irs

Effortlessly Handle Form 8814 Parents' Election To Report Child's Interest And Dividends Irs on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the correct documentation and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents promptly and without interruptions. Manage Form 8814 Parents' Election To Report Child's Interest And Dividends Irs on any device through airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and electronically sign Form 8814 Parents' Election To Report Child's Interest And Dividends Irs effortlessly

- Find Form 8814 Parents' Election To Report Child's Interest And Dividends Irs and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your updates.

- Choose how you would like to share your form, whether via email, SMS, an invite link, or by downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements with just a few clicks from any device you prefer. Modify and electronically sign Form 8814 Parents' Election To Report Child's Interest And Dividends Irs and maintain excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 8814 parents election to report childs interest and dividends irs

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 8814 parents election to report childs interest and dividends irs

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is Form 8814 Parents' Election To Report Child's Interest And Dividends IRS?

Form 8814 allows parents to report their child's interest and dividends on their tax return, effectively treating these amounts as part of the parent's income. This can simplify the tax process for families with minor children who earn income from investments, making it important to understand when to use this form.

-

How can I complete Form 8814 Parents' Election To Report Child's Interest And Dividends IRS using airSlate SignNow?

With airSlate SignNow, you can easily complete Form 8814 by uploading the document and filling it out electronically. Our user-friendly interface streamlines the process, allowing you to eSign and share the form quickly and securely.

-

What are the benefits of using airSlate SignNow for Form 8814?

AirSlate SignNow provides a cost-effective solution to manage and eSign Form 8814 Parents' Election To Report Child's Interest And Dividends IRS. The platform enhances efficiency by minimizing paperwork, ensuring compliance, and allowing users to track the status of the document all in one place.

-

Is airSlate SignNow suitable for businesses to manage Form 8814?

Yes, airSlate SignNow is ideal for businesses wanting to manage Form 8814 efficiently. Whether you're a financial advisor or a small business, our platform helps you streamline the documentation process while ensuring that important tax forms like Form 8814 are handled properly.

-

What features does airSlate SignNow offer for managing forms like Form 8814?

AirSlate SignNow offers a range of features, including document templates, eSignature capabilities, real-time tracking, and powerful integrations with various tools. These features help simplify the process of managing Form 8814 Parents' Election To Report Child's Interest And Dividends IRS, making it easier for users to stay organized.

-

How does pricing work for airSlate SignNow when handling Form 8814?

AirSlate SignNow offers flexible pricing plans based on your needs, making it economically feasible to manage Form 8814. Whether you require basic features or advanced functionalities, our subscription plans cater to different organizational sizes and requirements, ensuring you get the best value.

-

Can I integrate airSlate SignNow with other software for Form 8814 management?

Absolutely! AirSlate SignNow seamlessly integrates with numerous applications, enhancing your ability to manage Form 8814 Parents' Election To Report Child's Interest And Dividends IRS along with other tasks. This ensures a smooth workflow and enhances productivity by connecting your favorite tools.

Get more for Form 8814 Parents' Election To Report Child's Interest And Dividends Irs

Find out other Form 8814 Parents' Election To Report Child's Interest And Dividends Irs

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer