Instructions for Form 8814 Internal Revenue Service 2022

What is Form 8814?

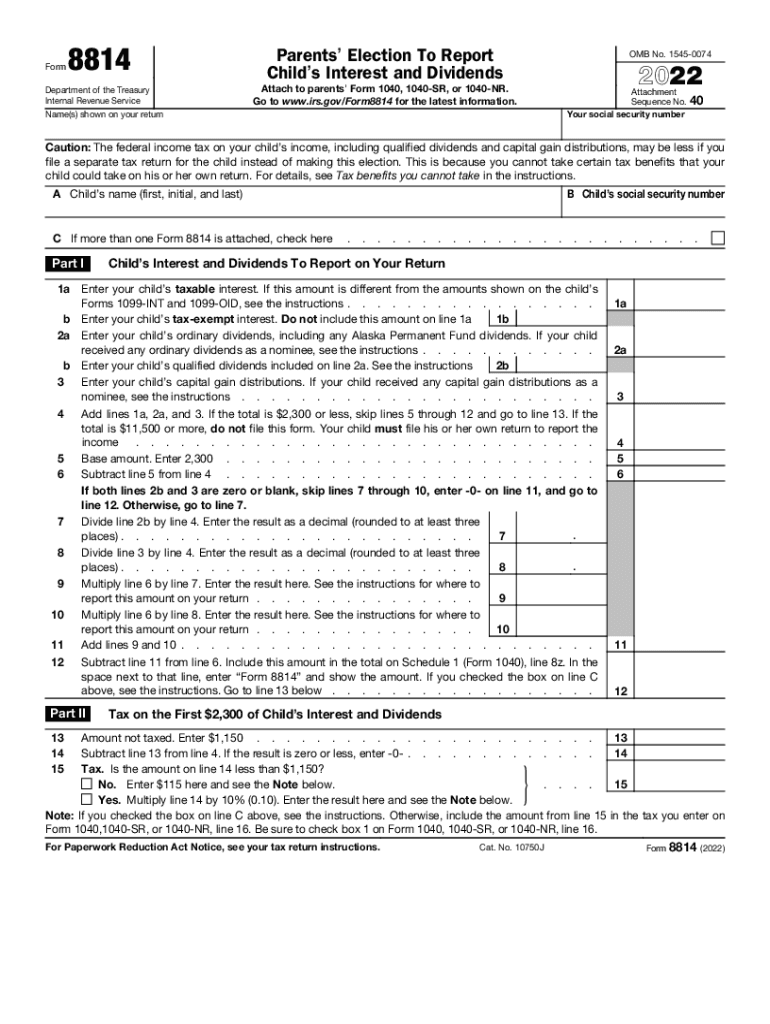

Form 8814, also known as the "Parents' Election to Report Child's Interest and Dividends," is a federal tax form used by parents to report their child's unearned income on their tax return. This form is particularly relevant for children under the age of 19, or under 24 if they are full-time students, who have unearned income exceeding a certain threshold. By using Form 8814, parents can elect to include their child's income on their own tax return, which may simplify the filing process and potentially reduce the overall tax liability.

Steps to Complete Form 8814

Completing Form 8814 involves several key steps to ensure accurate reporting of your child's income. Begin by gathering all necessary financial documents related to your child's income, such as bank statements or dividend statements. Next, fill out your personal information at the top of the form, including your name, address, and Social Security number. In the subsequent sections, report your child's interest and dividends, ensuring that you adhere to the income thresholds set by the IRS. After completing the form, review it for accuracy before submitting it with your tax return.

Legal Use of Form 8814

Form 8814 is legally binding when completed accurately and submitted in accordance with IRS guidelines. To ensure compliance, it is essential to follow the instructions provided by the IRS and to report only the income that qualifies under the rules governing the form. Utilizing a reliable eSignature solution, such as signNow, can facilitate the signing and submission process, ensuring that the form is executed legally and securely. This compliance is crucial to avoid potential penalties or issues with the IRS.

Filing Deadlines for Form 8814

Filing deadlines for Form 8814 align with the standard federal tax return deadlines. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to file Form 8814 by this deadline to avoid late fees and penalties. If additional time is needed, taxpayers can file for an extension, but they must still pay any taxes owed by the original deadline to avoid interest and penalties.

Required Documents for Form 8814

To accurately complete Form 8814, several documents are necessary. These include your child's income statements, such as Form 1099-INT for interest income or Form 1099-DIV for dividends. Additionally, you will need your own tax return information, including your Social Security number and filing status. Having these documents on hand will facilitate a smoother completion process and help ensure that all income is reported correctly.

IRS Guidelines for Form 8814

The IRS provides specific guidelines for the use of Form 8814, detailing eligibility criteria and reporting requirements. According to these guidelines, only certain types of unearned income qualify for inclusion on the form. Parents must also ensure that their child's total income does not exceed the set limits. It is advisable to review the latest IRS publications or consult a tax professional to stay informed about any changes to the guidelines that may affect the completion of Form 8814.

Quick guide on how to complete instructions for form 8814 2022internal revenue service

Complete Instructions For Form 8814 Internal Revenue Service effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed paperwork, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Instructions For Form 8814 Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign Instructions For Form 8814 Internal Revenue Service with minimal effort

- Locate Instructions For Form 8814 Internal Revenue Service and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, laborious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Instructions For Form 8814 Internal Revenue Service and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 8814 2022internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 8814 2022internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8814 and how can it be used?

Form 8814 is used by parents to report their child's unearned income on their tax return. By effectively utilizing Form 8814, families can simplify their tax filing process and ensure compliance with IRS requirements. airSlate SignNow offers a streamlined way to fill out and eSign Form 8814, making tax reporting hassle-free.

-

Are there fees associated with using airSlate SignNow for Form 8814?

Yes, while airSlate SignNow offers a cost-effective solution, subscriptions may vary based on the features you choose. For eSigning and managing documents like Form 8814, pricing plans provide flexibility, ensuring you only pay for the services you need. Check our website for current pricing details and promotions.

-

What features does airSlate SignNow provide for Form 8814?

airSlate SignNow includes features such as digital signatures, customizable templates, and secure storage options specifically for documents like Form 8814. These tools ensure that your form is completed accurately and securely. Users can easily track the status of their forms, enhancing overall efficiency.

-

How does airSlate SignNow enhance the eSigning experience for Form 8814?

With airSlate SignNow, eSigning Form 8814 is simplified through an intuitive interface that guides users step-by-step. The platform guarantees the authenticity and security of your signatures, which is crucial for documents like Form 8814. This enhancement ensures that your tax processes are professional and reliable.

-

Can I integrate airSlate SignNow with other tools while using Form 8814?

Absolutely! airSlate SignNow offers seamless integrations with various platforms such as Google Drive and Salesforce, allowing you to manage Form 8814 alongside your existing tools. This integration capability simplifies your workflow by connecting your document management processes in one ecosystem.

-

What benefits does airSlate SignNow offer specifically for tax professionals handling Form 8814?

For tax professionals, airSlate SignNow provides efficient document management and eSigning, streamlining the preparation of Form 8814 for clients. The platform's collaboration features allow for easy communication and sharing of forms, enhancing productivity. Additionally, the secure environment ensures that sensitive tax information remains protected.

-

Is there a mobile app for airSlate SignNow that supports Form 8814?

Yes, airSlate SignNow offers a mobile app that allows users to access and manage Form 8814 on the go. The app provides the same powerful features as the desktop version, including eSigning and document tracking, ensuring that you can work efficiently from anywhere. This flexibility is ideal for busy taxpayers and professionals.

Get more for Instructions For Form 8814 Internal Revenue Service

- Separate answer and defenses of school district mississippi form

- Interrogatories admissions form

- Response to plaintiffs motion to quash mississippi form

- Functional assessment checklist pdf form

- Rtb1 pdf residential tenancy agreement important notes form

- Us coast guard declaration of health defense gov form

- Immigration court practice manual form

- Bmi direct deposit authorization form

Find out other Instructions For Form 8814 Internal Revenue Service

- How Can I Electronic signature North Carolina Landlord tenant lease agreement

- Can I Electronic signature Vermont lease agreement

- Can I Electronic signature Michigan Lease agreement for house

- How To Electronic signature Wisconsin Landlord tenant lease agreement

- Can I Electronic signature Nebraska Lease agreement for house

- eSignature Nebraska Limited Power of Attorney Free

- eSignature Indiana Unlimited Power of Attorney Safe

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample