8814 Form 2018

What is the 8814 Form

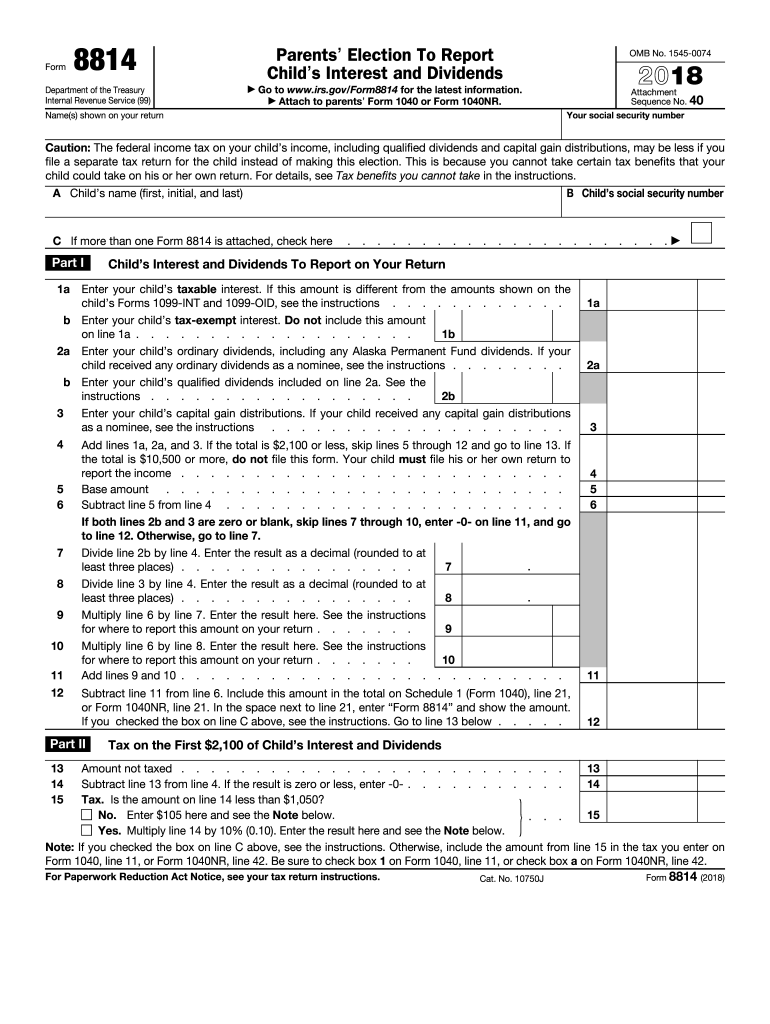

The 8814 Form, officially known as the IRS Form 8814, is used by parents to report their child's unearned income on their federal tax return. This form allows parents to include their child's income on their tax return instead of requiring the child to file a separate return. It is particularly useful for children under the age of 19 who have unearned income, such as dividends or interest, that exceeds a specific threshold. By using Form 8814, parents can simplify the tax filing process and potentially save on taxes.

How to use the 8814 Form

To effectively use the 8814 Form, parents must gather the necessary information about their child's income. This includes details about any unearned income received during the tax year. The form requires specific calculations to determine the tax liability based on the child's income. Parents should fill out the form accurately and ensure that it is attached to their own tax return when filing. It is essential to follow the IRS guidelines carefully to avoid errors and potential penalties.

Steps to complete the 8814 Form

Completing the 8814 Form involves several steps:

- Collect information about your child's unearned income, including amounts and sources.

- Obtain the 8814 Form from the IRS website or a tax preparation software.

- Fill out the form, ensuring all information is accurate and complete.

- Calculate the tax owed based on your child's income, following the IRS instructions.

- Attach the completed form to your federal tax return.

Review the form for accuracy before submission to avoid delays or issues with the IRS.

IRS Guidelines

The IRS provides specific guidelines for using Form 8814. These guidelines include eligibility criteria, income thresholds, and instructions for completing the form. Parents must ensure that they meet the requirements for reporting their child's income on their tax return. The IRS also outlines the consequences of failing to comply with these guidelines, which may include penalties or additional taxes owed. Familiarizing oneself with these guidelines is crucial for a smooth filing process.

Filing Deadlines / Important Dates

Filing deadlines for the 8814 Form align with the standard tax return deadlines. Generally, taxpayers must file their federal tax returns by April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is important for parents to be aware of these dates to ensure timely submission of their tax returns and avoid penalties. Additionally, if an extension is filed, the deadline may change, so staying informed is essential.

Eligibility Criteria

To use the 8814 Form, certain eligibility criteria must be met. Primarily, the child must be under the age of 19 at the end of the tax year and have unearned income that exceeds a specific threshold set by the IRS. The income should primarily come from sources such as interest, dividends, or capital gains. Parents should also ensure that they are the child's legal guardians and that the child does not file a separate tax return for the same year. Meeting these criteria is essential for proper use of the form.

Quick guide on how to complete form 8814 irsgov

Manage 8814 Form effortlessly across any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without any holdups. Handle 8814 Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and electronically sign 8814 Form with ease

- Locate 8814 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you want to share your form, either by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or mistakes that require printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign 8814 Form and ensure seamless communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8814 irsgov

Create this form in 5 minutes!

How to create an eSignature for the form 8814 irsgov

How to create an eSignature for your Form 8814 Irsgov online

How to create an electronic signature for the Form 8814 Irsgov in Google Chrome

How to generate an eSignature for putting it on the Form 8814 Irsgov in Gmail

How to generate an eSignature for the Form 8814 Irsgov straight from your smart phone

How to make an electronic signature for the Form 8814 Irsgov on iOS

How to make an eSignature for the Form 8814 Irsgov on Android

People also ask

-

What is the 2016 tax from form 8814 and who needs it?

The 2016 tax from form 8814 is a tax return specifically for parents who wish to report their child's unearned income. If your child had more than $2,100 in unearned income in 2016, you may need to complete this form as part of your tax filing process.

-

How can airSlate SignNow assist with filing the 2016 tax from form 8814?

airSlate SignNow offers a comprehensive document management solution that allows users to easily send, eSign, and store tax forms like the 2016 tax from form 8814. With our platform, you can ensure that all necessary signatures are obtained promptly, streamlining your tax filing process.

-

Is there a cost associated with using airSlate SignNow for my 2016 tax from form 8814?

Yes, airSlate SignNow is a cost-effective eSigning solution with flexible pricing plans that cater to different business needs. You can choose a plan that best fits your requirements for managing and signing important documents, including the 2016 tax from form 8814.

-

What features does airSlate SignNow offer for managing the 2016 tax from form 8814?

airSlate SignNow provides features such as customizable templates, secure eSignature options, and document tracking. These features enable you to efficiently handle the 2016 tax from form 8814 while maintaining compliance and security.

-

Can I integrate airSlate SignNow with other applications for processing my 2016 tax from form 8814?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications to streamline your workflow. This means you can easily access and manage your 2016 tax from form 8814 alongside other critical business tools.

-

What are the benefits of using airSlate SignNow for my 2016 tax from form 8814?

The benefits of using airSlate SignNow include enhanced efficiency, improved document security, and the ability to manage all your signing needs in one place. By choosing our platform for the 2016 tax from form 8814, you can simplify your tax processes and reduce turnaround times.

-

How secure is airSlate SignNow when handling sensitive documents like the 2016 tax from form 8814?

airSlate SignNow prioritizes security and uses advanced encryption methods to protect your documents, including the 2016 tax from form 8814. Our platform complies with industry standards, ensuring that your sensitive data is safe throughout the signing process.

Get more for 8814 Form

- Hrd 315 form

- Form bc 100 indiana

- Rct 101 2012 form

- Educational improvementopportunity scholarship tax credit election form rev 1123 educational improvementopportunity scholarship

- Rct 121c 2012 form

- Uniform request form for continuing education credit irwaonline

- Pvcc eligibility packet paradise valley community college pvc maricopa form

- Da3434 form

Find out other 8814 Form

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF