TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM 2020

What is the TY 515 Tax Year 515 Individual Taxpayer Form

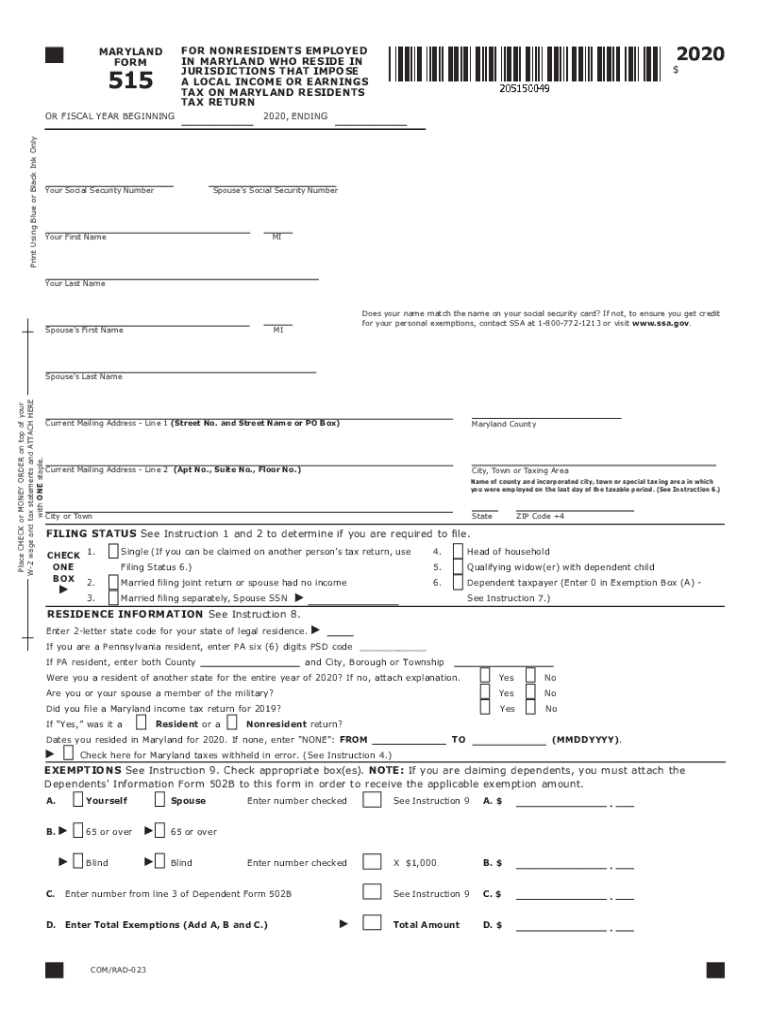

The TY 515 is a crucial document for individual taxpayers in Maryland. This form is specifically designed for reporting income, calculating taxes owed, and claiming any applicable deductions or credits for the tax year. Understanding the TY 515 is essential for ensuring compliance with state tax regulations and for accurately fulfilling tax obligations. It serves as a comprehensive tool for taxpayers to detail their financial information and determine their tax liabilities.

Steps to Complete the TY 515 Tax Year 515 Individual Taxpayer Form

Completing the TY 515 involves several important steps to ensure accuracy and compliance. Here’s a streamlined process to follow:

- Gather Required Documents: Collect all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: Accurately report all sources of income in the designated sections.

- Claim Deductions and Credits: Identify and apply any eligible deductions or credits to reduce your taxable income.

- Calculate Tax Owed: Use the provided tables or formulas to determine the total tax liability.

- Sign and Date the Form: Ensure that you sign and date the form before submission to validate it.

How to Obtain the TY 515 Tax Year 515 Individual Taxpayer Form

Obtaining the TY 515 form is a straightforward process. Taxpayers can access the form through various channels:

- Online: The Maryland State Comptroller’s website provides downloadable versions of the TY 515.

- Local Tax Offices: Visit local tax offices or public libraries where printed forms may be available.

- Tax Preparation Services: Many tax professionals and services can provide the form as part of their offerings.

Legal Use of the TY 515 Tax Year 515 Individual Taxpayer Form

The TY 515 is legally recognized as a valid document for tax reporting in Maryland. To ensure its legal use, taxpayers must adhere to specific guidelines:

- Compliance with State Laws: The form must be filled out in accordance with Maryland tax laws and regulations.

- Accurate Reporting: All information provided should be truthful and accurate to avoid penalties.

- Timely Submission: The completed form must be submitted by the designated filing deadline to maintain its legal standing.

Filing Deadlines / Important Dates

Being aware of the filing deadlines for the TY 515 is crucial for taxpayers. Key dates include:

- Filing Deadline: The TY 515 must typically be filed by April 15 of the following year.

- Extensions: Taxpayers may apply for an extension, but they must still pay any owed taxes by the original deadline to avoid penalties.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the TY 515 can result in significant penalties. These may include:

- Late Filing Penalties: Taxpayers may incur fines for submitting the form after the deadline.

- Accuracy-Related Penalties: Incorrect information may lead to additional charges or audits.

- Interest on Unpaid Taxes: Any unpaid taxes will accrue interest until fully paid, increasing the overall liability.

Quick guide on how to complete ty 2020 515 tax year 2020 515 individual taxpayer form

Manage TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Process TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM with ease

- Find TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or a shareable link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and eSign TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ty 2020 515 tax year 2020 515 individual taxpayer form

Create this form in 5 minutes!

How to create an eSignature for the ty 2020 515 tax year 2020 515 individual taxpayer form

The way to generate an e-signature for your PDF file in the online mode

The way to generate an e-signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the number 515?

airSlate SignNow is an electronic signature solution that simplifies the process of sending and signing documents. The number 515 refers to our exclusive pricing plan, which offers businesses a cost-effective way to access all features of our platform.

-

What features does the 515 plan include?

The 515 plan includes a comprehensive suite of features such as document templates, multi-party signing, and real-time tracking. It also provides robust security measures to ensure that your documents are protected throughout the signing process.

-

How does the pricing compare for the 515 plan?

Our 515 plan is designed to be budget-friendly, offering competitive pricing compared to other eSignature services. With the 515 plan, businesses can enjoy all the essential features without exceeding their budget.

-

What are the main benefits of using airSlate SignNow with a focus on the 515 plan?

Using airSlate SignNow with the 515 plan allows businesses to streamline their document workflows, saving both time and costs. The user-friendly interface also promotes efficiency, allowing teams to manage and send documents easily.

-

Can I integrate airSlate SignNow with other tools while using the 515 plan?

Absolutely! The 515 plan supports various integrations with popular applications such as Google Drive, Salesforce, and Microsoft Office. This flexibility allows businesses to enhance their productivity by connecting their existing tools.

-

Is customer support available for users of the 515 plan?

Yes, our 515 plan users have access to dedicated customer support to assist with any queries or issues. We strive to ensure that all customers have a smooth experience while using airSlate SignNow.

-

How secure is the signing process in the 515 plan?

The signing process in the 515 plan is highly secure, utilizing encryption and compliance with industry standards like GDPR and eIDAS. This ensures that your documents are safe and legally binding.

Get more for TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM

- Notice of default on residential lease delaware form

- Landlord tenant lease co signer agreement delaware form

- Application for sublease delaware form

- Inventory and condition of leased premises for pre lease and post lease delaware form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out delaware form

- Property manager agreement delaware form

- Agreement for delayed or partial rent payments delaware form

- Tenants maintenance repair request form delaware

Find out other TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF