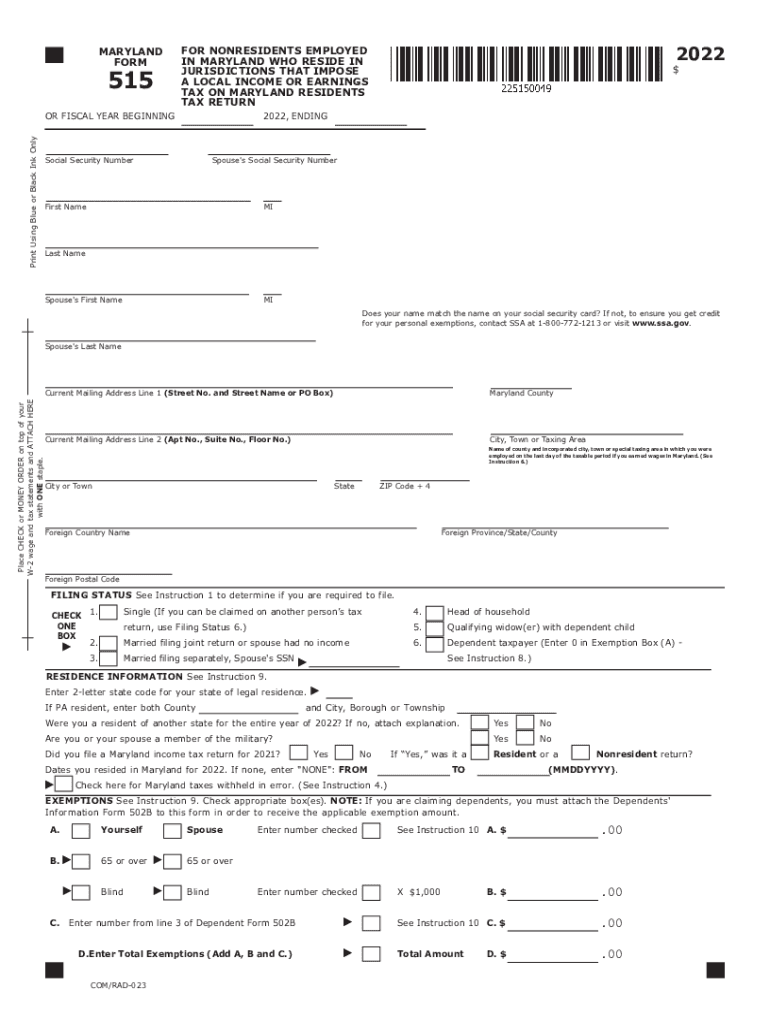

MARYLAND FORM for NONRESIDENTS EMPLOYED in 2022

What is the Maryland form for nonresidents employed in Maryland?

The Maryland form for nonresidents employed in Maryland is designed for individuals who live outside of Maryland but earn income within the state. This form, often referred to as the Maryland 515, allows nonresidents to report their Maryland-source income and calculate their tax liability. It is essential for ensuring compliance with state tax laws for those working in Maryland while residing elsewhere.

Steps to complete the Maryland form for nonresidents employed in Maryland

Completing the Maryland 515 form involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2 forms, 1099s, and any other income statements.

- Fill out personal information: Provide your name, address, and Social Security number at the top of the form.

- Report income: Enter your total Maryland-source income on the appropriate lines of the form.

- Calculate tax owed: Use the tax tables provided by the Maryland Comptroller to determine your tax liability based on your reported income.

- Sign and date the form: Ensure that you sign and date the form to validate your submission.

How to obtain the Maryland form for nonresidents employed in Maryland

The Maryland 515 form can be obtained through several methods. It is available online on the Maryland Comptroller's website, where you can download and print it. Additionally, you may request a physical copy by contacting the Maryland Comptroller's office directly. Many tax preparation software programs also include the Maryland 515 form, allowing for easier electronic filing.

Filing deadlines for the Maryland form for nonresidents employed in Maryland

It is crucial to be aware of the filing deadlines for the Maryland 515 form to avoid penalties. Typically, the deadline for filing is April 15 of the year following the tax year for which you are reporting income. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Always check for any updates or changes to the deadlines on the Maryland Comptroller's website.

Legal use of the Maryland form for nonresidents employed in Maryland

The Maryland 515 form is legally recognized for reporting income earned in Maryland by nonresidents. To ensure its legal validity, it must be completed accurately and filed by the appropriate deadline. Compliance with state tax laws is essential, as failure to file or inaccuracies can lead to penalties or legal repercussions.

Key elements of the Maryland form for nonresidents employed in Maryland

Key elements of the Maryland 515 form include:

- Personal information: Name, address, and Social Security number.

- Income reporting: Total Maryland-source income from all applicable sources.

- Tax calculation: Use of tax tables to determine the amount owed.

- Signature: A valid signature and date to authenticate the form.

Quick guide on how to complete maryland form for nonresidents employed in

Effortlessly Prepare MARYLAND FORM FOR NONRESIDENTS EMPLOYED IN on Any Device

Digital document management has become increasingly popular with companies and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without any delays. Manage MARYLAND FORM FOR NONRESIDENTS EMPLOYED IN on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign MARYLAND FORM FOR NONRESIDENTS EMPLOYED IN effortlessly

- Obtain MARYLAND FORM FOR NONRESIDENTS EMPLOYED IN and then click Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all details and then click on the Done button to store your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Alter and eSign MARYLAND FORM FOR NONRESIDENTS EMPLOYED IN to ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maryland form for nonresidents employed in

Create this form in 5 minutes!

How to create an eSignature for the maryland form for nonresidents employed in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland 515 505 form?

The Maryland 515 505 form is a vital document utilized for specific transactions and filings within the state of Maryland. It is essential for compliance with state regulations and ensures that your documentation is properly processed. Understanding how to fill out this form correctly can save time and avoid potential legal issues.

-

How can airSlate SignNow help with the Maryland 515 505 form?

airSlate SignNow offers a streamlined platform for electronically signing and sending documents, including the Maryland 515 505 form. Our solution simplifies the process, allowing you to complete and send the form quickly and securely. This feature ensures faster processing and improved efficiency in your transactions.

-

Is there a cost associated with using airSlate SignNow for the Maryland 515 505 form?

Yes, using airSlate SignNow does involve a subscription fee, but it is competitively priced, making it a cost-effective solution for businesses. We offer various pricing plans that cater to different needs, ensuring that you only pay for features that matter to you. This investment can lead to substantial savings in time and resources when managing documents like the Maryland 515 505 form.

-

Can I integrate airSlate SignNow with other software for handling the Maryland 515 505 form?

Absolutely! airSlate SignNow offers seamless integrations with a variety of applications, improving your workflow when dealing with the Maryland 515 505 form. Whether you use CRM systems or productivity tools, our platform connects effortlessly to enhance your document management capabilities.

-

What are the benefits of using airSlate SignNow for the Maryland 515 505 form?

Using airSlate SignNow for the Maryland 515 505 form brings numerous benefits, including faster document turnaround times and enhanced security. Our electronic signature technology ensures that your documents are signed and secured, preventing unauthorized access. Additionally, you can track the status of your documents in real-time, providing peace of mind during critical transactions.

-

Is it legal to eSign the Maryland 515 505 form with airSlate SignNow?

Yes, eSigning the Maryland 515 505 form with airSlate SignNow is fully compliant with Maryland's electronic signature laws. Our platform adheres to industry standards to ensure that your eSignatures are legally binding and valid. This means you can confidently use airSlate SignNow to manage your important documents.

-

How can I get started with airSlate SignNow for the Maryland 515 505 form?

Getting started with airSlate SignNow is easy! Simply visit our website, sign up for an account, and you can begin using our features to manage the Maryland 515 505 form right away. Our user-friendly interface is designed to help anyone, regardless of technical skill, navigate document signing and management effortlessly.

Get more for MARYLAND FORM FOR NONRESIDENTS EMPLOYED IN

- Quitclaim deed by two individuals to husband and wife south carolina form

- Warranty deed from two individuals to husband and wife south carolina form

- South carolina warranty form

- Quitclaim deed from two individualshusband and wife to individual south carolina form

- South carolina form sc

- South carolina owner form

- Quitclaim deed by two individuals to llc south carolina form

- Warranty deed from two individuals to llc south carolina form

Find out other MARYLAND FORM FOR NONRESIDENTS EMPLOYED IN

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document