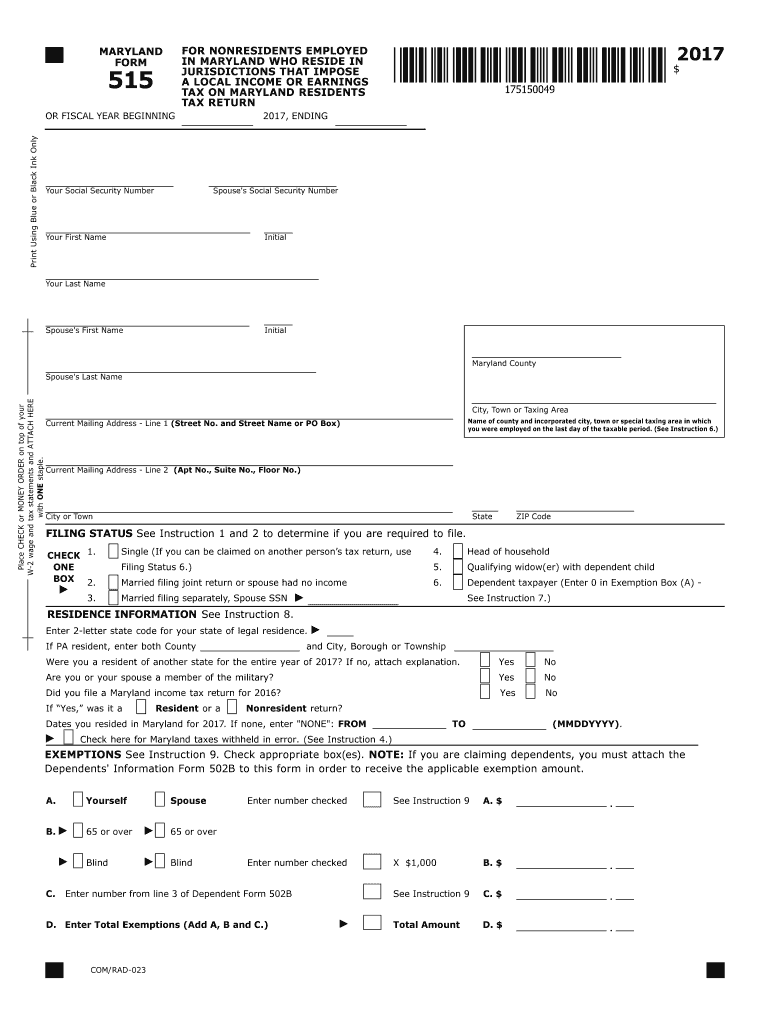

Form 515 2017

What is the Form 515

The Form 515 is an official document used for specific tax reporting purposes in the United States. It is primarily utilized by businesses and individuals to report certain types of income or deductions. Understanding the purpose of this form is essential for accurate tax compliance. The Form 515 allows taxpayers to provide necessary information to the Internal Revenue Service (IRS) while ensuring that all submissions meet federal requirements.

How to use the Form 515

Using the Form 515 involves several steps to ensure proper completion and submission. First, gather all relevant information, including income details and any applicable deductions. Next, access the form through a reliable source, ensuring you have the latest version. Fill out the required fields accurately, paying close attention to instructions provided on the form. Once completed, you can submit the Form 515 electronically or by mail, depending on your preference and the guidelines set by the IRS.

Steps to complete the Form 515

Completing the Form 515 can be straightforward if you follow these steps:

- Obtain the latest version of the Form 515 from a trusted source.

- Review the instructions carefully to understand the information required.

- Gather all necessary documentation, such as income statements and deduction records.

- Fill out the form, ensuring all entries are accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form electronically via a secure platform or mail it to the appropriate IRS address.

Legal use of the Form 515

The Form 515 must be used in accordance with IRS regulations to ensure its legal validity. This includes adhering to deadlines for submission and providing accurate information. The IRS allows for electronic signatures on this form, which enhances the convenience of filing while maintaining compliance with legal standards. It is crucial to ensure that all information is truthful and complete to avoid penalties or legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form 515 are critical for compliance. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for most taxpayers. However, specific circumstances, such as extensions or particular tax situations, may affect this date. It is advisable to keep track of any changes announced by the IRS regarding deadlines to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Form 515 can be submitted through various methods, providing flexibility for taxpayers. You may choose to file electronically using a secure eSignature platform, which offers a fast and efficient way to submit your form. Alternatively, you can print the completed form and mail it to the IRS at the designated address. In-person submission is also an option, although it is less common. Each method has its own advantages, and selecting the right one depends on your preferences and circumstances.

Quick guide on how to complete form 515 2017 2018

Your assistance manual on how to prepare your Form 515

If you’re looking to understand how to create and transmit your Form 515, here are a few brief guidelines to simplify your tax declaration process.

To start, you just need to set up your airSlate SignNow account to transform the way you manage documents online. airSlate SignNow is an extremely user-friendly and efficient document solution that enables you to modify, draft, and complete your income tax documents with ease. With its editor, you can toggle between text, check boxes, and eSignatures, returning to amend any information as necessary. Streamline your tax management with advanced PDF editing, eSigning, and seamless sharing.

Follow the directions below to complete your Form 515 in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our catalog to locate any IRS tax form; browse through versions and schedules.

- Click Obtain form to access your Form 515 in our editor.

- Populate the necessary fillable fields with your information (text content, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please be aware that paper filing may lead to increased errors and delays in refunds. Before e-filing your taxes, make sure to check the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct form 515 2017 2018

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

-

If I was unable to fill SSC Cgl 2017, can I fill SSC Cgl 2018 form?

Don’t wait till the last date, apply your form well in advance. If still you are unable to fill your form, you may fill in 2018.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the form 515 2017 2018

How to make an electronic signature for your Form 515 2017 2018 in the online mode

How to create an eSignature for your Form 515 2017 2018 in Chrome

How to make an eSignature for signing the Form 515 2017 2018 in Gmail

How to generate an electronic signature for the Form 515 2017 2018 right from your mobile device

How to generate an electronic signature for the Form 515 2017 2018 on iOS

How to create an electronic signature for the Form 515 2017 2018 on Android

People also ask

-

What is Form 515 and how does it work with airSlate SignNow?

Form 515 is a specific document used in various business processes, and airSlate SignNow simplifies its management by allowing users to create, send, and eSign this form effortlessly. With our easy-to-use interface, you can ensure that your Form 515 is completed accurately and efficiently, streamlining your workflow.

-

How much does it cost to use airSlate SignNow for Form 515 processing?

airSlate SignNow offers competitive pricing plans tailored to your business needs, making it cost-effective for processing Form 515. Our plans include various features that enhance document management, ensuring you get the best value for your investment.

-

What are the key features of airSlate SignNow for managing Form 515?

airSlate SignNow provides several powerful features for managing Form 515, including customizable templates, real-time tracking, and secure electronic signatures. These features help you save time, enhance collaboration, and ensure compliance with industry standards.

-

Can I integrate airSlate SignNow with other applications for Form 515?

Yes, airSlate SignNow seamlessly integrates with a variety of applications, allowing you to enhance your workflow when handling Form 515. Whether you need to connect with CRM systems or cloud storage, our integrations ensure a smooth experience.

-

What benefits does airSlate SignNow offer for businesses using Form 515?

Using airSlate SignNow for Form 515 provides numerous benefits, including improved efficiency, reduced paper usage, and enhanced document security. By digitizing your processes, you can focus on growing your business while ensuring that your Form 515 is handled professionally.

-

Is airSlate SignNow secure for signing Form 515?

Absolutely! airSlate SignNow uses advanced encryption and compliance measures to ensure that your Form 515 is signed securely. We prioritize your data protection, giving you peace of mind as you manage your documents electronically.

-

How quickly can I send and receive Form 515 with airSlate SignNow?

With airSlate SignNow, you can send and receive Form 515 almost instantly. Our platform is designed for speed, allowing you to expedite your document processes and reduce turnaround times signNowly.

Get more for Form 515

- Apa fillable template form

- California all purpose certificate of acknowledgment 2013 form

- Payment bond form

- Standard form 25a

- Lloyds lsw 983 form

- List of outside directorship form

- Cigna golden vitality form

- Form it 196 new york resident nonresident and part year resident itemized deductions tax year

Find out other Form 515

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template