Maryland Form 515 Nonresidents Employed in Maryland Who Reside in Jurisdictions that Impose Local Income or Earnings Tax on Mary 2023

Understanding Maryland Form 515

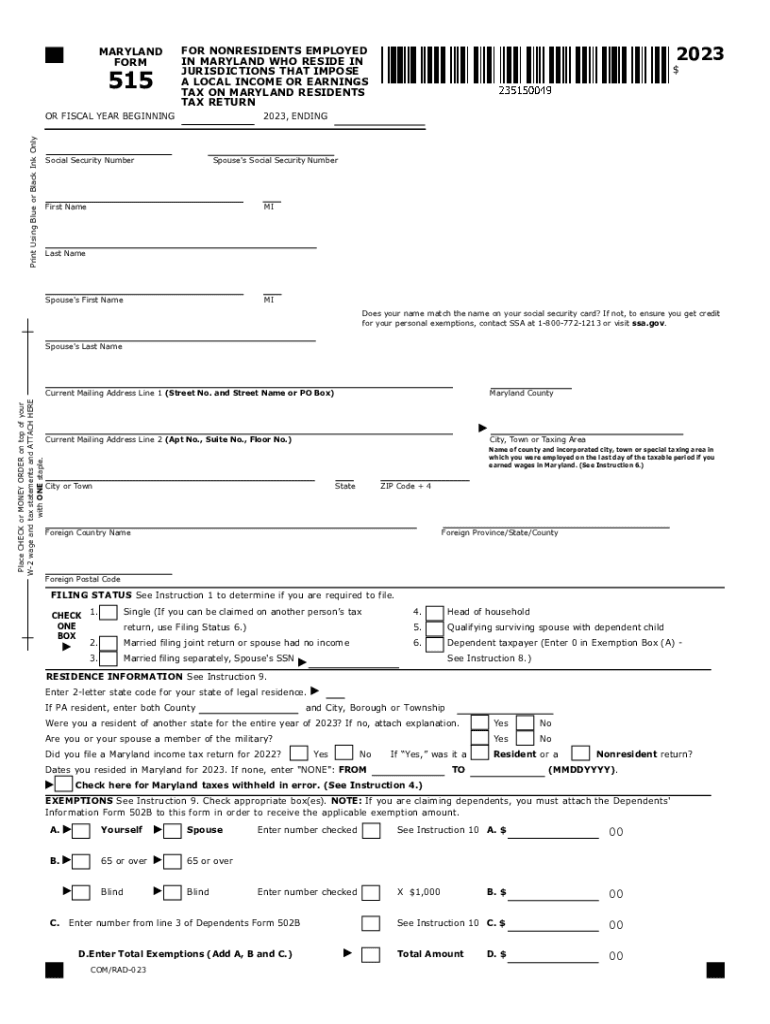

The Maryland Form 515 is designed for nonresidents employed in Maryland who reside in jurisdictions that impose local income or earnings tax on Maryland residents. This form allows individuals to report their income earned in Maryland while ensuring compliance with local tax regulations. It is essential for nonresidents to accurately complete this form to avoid potential penalties and ensure proper tax treatment.

Steps to Complete Maryland Form 515

Completing the Maryland Form 515 involves several key steps:

- Gather all necessary documents, including W-2 forms and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report income earned in Maryland, ensuring to include all applicable earnings.

- Calculate local tax credits based on your residency jurisdiction.

- Review the form for accuracy before submission.

Obtaining the Maryland Form 515

The Maryland Form 515 can be obtained from the official Maryland state tax website or through local tax offices. It is available in both digital and paper formats, allowing taxpayers to choose their preferred method for completion. Ensure to download the most recent version to comply with current tax regulations.

Key Elements of Maryland Form 515

Several critical components must be included when filling out the Maryland Form 515:

- Personal Information: Accurate identification details are necessary.

- Income Reporting: Include all income earned in Maryland.

- Local Tax Credits: Calculate any applicable credits based on your home jurisdiction.

- Signature: Ensure to sign and date the form before submission.

Filing Deadlines for Maryland Form 515

It is important to be aware of the filing deadlines associated with the Maryland Form 515. Typically, the form must be submitted by the same deadline as federal income tax returns. This ensures compliance and avoids any potential late fees or penalties. Always check for any updates regarding specific dates each tax year.

Penalties for Non-Compliance

Failure to file the Maryland Form 515 on time can result in various penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for nonresidents to meet their filing obligations to avoid these consequences and maintain good standing with tax authorities.

Quick guide on how to complete maryland form 515 nonresidents employed in maryland who reside in jurisdictions that impose local income or earnings tax on

Complete Maryland Form 515 Nonresidents Employed In Maryland Who Reside In Jurisdictions That Impose Local Income Or Earnings Tax On Mary effortlessly on any device

Digital document management has become widespread among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, amend, and eSign your documents swiftly without hold-ups. Manage Maryland Form 515 Nonresidents Employed In Maryland Who Reside In Jurisdictions That Impose Local Income Or Earnings Tax On Mary on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to amend and eSign Maryland Form 515 Nonresidents Employed In Maryland Who Reside In Jurisdictions That Impose Local Income Or Earnings Tax On Mary without hassle

- Obtain Maryland Form 515 Nonresidents Employed In Maryland Who Reside In Jurisdictions That Impose Local Income Or Earnings Tax On Mary and click Get Form to begin.

- Utilize our tools to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and then hit the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Amend and eSign Maryland Form 515 Nonresidents Employed In Maryland Who Reside In Jurisdictions That Impose Local Income Or Earnings Tax On Mary and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maryland form 515 nonresidents employed in maryland who reside in jurisdictions that impose local income or earnings tax on

Create this form in 5 minutes!

How to create an eSignature for the maryland form 515 nonresidents employed in maryland who reside in jurisdictions that impose local income or earnings tax on

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow 515?

airSlate SignNow 515 is a comprehensive eSignature and document management solution that enables businesses to send and sign documents securely. With user-friendly interfaces, it streamlines the signing process and enhances efficiency. Whether it's for contracts or forms, SignNow simplifies every step.

-

How much does airSlate SignNow 515 cost?

The pricing for airSlate SignNow 515 varies based on the chosen plan. Typically, there are tiered pricing options that cater to different business needs, ensuring flexibility and affordability. Review the pricing page to find a plan that fits your budget and requirements.

-

What features are included in airSlate SignNow 515?

airSlate SignNow 515 includes features like customizable templates, real-time tracking, and secure storage. The platform also supports mobile access and advanced authentication to ensure document security. With its robust features, SignNow serves a wide range of industries effectively.

-

What are the benefits of using airSlate SignNow 515?

Using airSlate SignNow 515 can signNowly reduce the time spent on document management and signing. The platform enhances collaboration by allowing multiple parties to sign documents effortlessly. Additionally, it offers a cost-effective solution that boosts productivity and promotes efficiency in workflows.

-

Is airSlate SignNow 515 easy to integrate with other software?

Yes, airSlate SignNow 515 easily integrates with popular software applications such as Google Workspace and Microsoft Office. These integrations facilitate seamless workflows and allow users to access documents from their preferred platforms. This versatility makes SignNow a great choice for various businesses.

-

How does airSlate SignNow 515 ensure document security?

AirSlate SignNow 515 places a high priority on security, employing advanced encryption technologies to protect your documents. Features such as multi-factor authentication further enhance the security of sensitive information. Thus, users can trust that their documents are safe and compliant.

-

Can I access airSlate SignNow 515 on mobile devices?

Absolutely! airSlate SignNow 515 is designed for mobile access, enabling users to sign and send documents anytime, anywhere. The mobile app offers all the essential functions, making it convenient for users on the go. This mobility enhances productivity and responsiveness.

Get more for Maryland Form 515 Nonresidents Employed In Maryland Who Reside In Jurisdictions That Impose Local Income Or Earnings Tax On Mary

- Kentucky warranty deed for husband and wife converting form

- Accordance with the applicable laws of the state of kentucky form

- Section 394610 right to disclaim succession ky rev stat form

- The basics of filing a private mechanics lien in kentucky form

- 1 this deed of dedication and easement made this form

- Free kentucky quit claim deed form wordpdfeforms

- Control number ky 023 77 form

- City kentucky or a form

Find out other Maryland Form 515 Nonresidents Employed In Maryland Who Reside In Jurisdictions That Impose Local Income Or Earnings Tax On Mary

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement