TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM 2021

What is the TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM

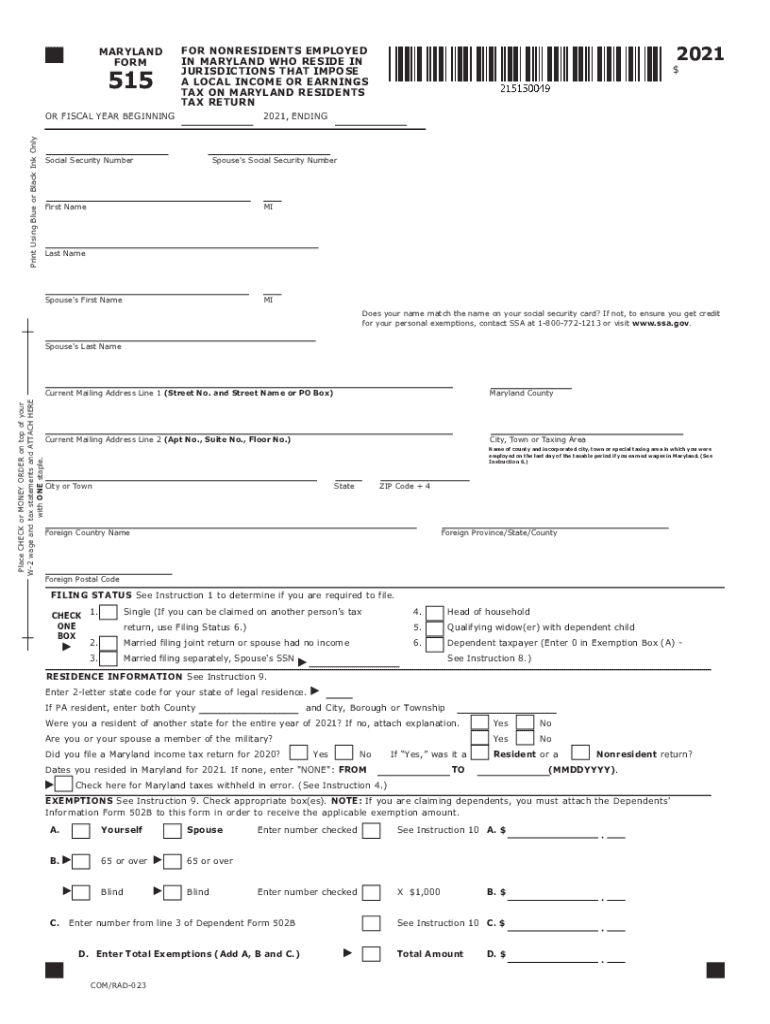

The TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM is a specific tax form used by individuals in the United States to report their income and calculate their tax obligations for the tax year 515. This form is essential for taxpayers to ensure compliance with federal tax laws and to accurately assess their tax liabilities. It includes sections for reporting various types of income, deductions, and credits that may be applicable to the taxpayer's financial situation.

How to use the TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM

Using the TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM involves several steps. First, gather all necessary financial documents, such as W-2s, 1099s, and records of any deductions or credits you plan to claim. Next, carefully fill out the form, ensuring that all information is accurate and complete. Once the form is filled out, review it for any errors before submitting it to the appropriate tax authority. It is advisable to keep a copy of the completed form for your records.

Steps to complete the TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM

Completing the TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including income statements and receipts for deductions.

- Begin filling out the form by entering personal information, such as your name, address, and Social Security number.

- Report your income in the designated sections, ensuring that all figures are accurate.

- Include any applicable deductions and credits, following the instructions provided on the form.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM

The TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM is legally binding once it is signed and submitted. It is important to ensure that all information provided is truthful and accurate, as filing false information can lead to penalties, including fines or legal action. The form must also comply with federal regulations regarding tax reporting and submission deadlines to be considered valid.

Filing Deadlines / Important Dates

Filing deadlines for the TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM are crucial for compliance. Typically, the deadline for submitting this form is April 15 of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines or extensions that may be announced by the IRS.

Form Submission Methods

The TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM can be submitted through various methods, depending on the taxpayer's preference. Options include:

- Online submission through authorized e-filing services.

- Mailing a paper copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete ty 2021 515 tax year 2021 515 individual taxpayer form

Complete TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM smoothly on any gadget

Online document administration has become favored among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can acquire the correct format and securely store it online. airSlate SignNow provides you with all the tools you require to generate, modify, and electronically sign your documents swiftly without delays. Manage TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and electronically sign TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM effortlessly

- Obtain TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ty 2021 515 tax year 2021 515 individual taxpayer form

Create this form in 5 minutes!

People also ask

-

What is the TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM?

The TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM is a specific tax document required by certain jurisdictions for individual taxpayers. This form enables individuals to report their income and deductions accurately for tax purposes. Understanding and completing this form correctly can facilitate a smoother tax filing process.

-

How can airSlate SignNow assist with the TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM?

airSlate SignNow offers an efficient platform to eSign and send documents, including the TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM. With user-friendly features, users can easily get their forms signed by relevant parties, ensuring compliance and timely submission. Our solution simplifies the document workflow, making tax season less stressful.

-

What are the pricing plans for using airSlate SignNow for the TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM?

airSlate SignNow provides competitive pricing plans tailored to different user needs, including those managing the TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM. Our plans are designed to be budget-friendly while maximizing features such as unlimited signing and document storage. You can find a plan that fits your budget perfectly.

-

Can I integrate airSlate SignNow with other applications when handling the TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM?

Yes, airSlate SignNow offers seamless integration with a variety of applications to streamline your workflow while dealing with the TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM. You can connect it with popular tools such as Google Drive, Salesforce, and more. This integration enhances productivity and helps keep your document management organized.

-

What benefits does airSlate SignNow provide for managing tax forms like the TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM?

Using airSlate SignNow for the TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM enhances efficiency and accuracy in document handling. The platform allows users to track the signing process in real-time, reduce paperwork, and store documents securely. These benefits ensure that you'll have quick access to your tax forms whenever needed.

-

Is airSlate SignNow user-friendly for completing the TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and complete the TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM. The intuitive interface allows users to upload, fill out, and send documents without any technical expertise. You can easily eSign your forms, making it accessible for all users.

-

What security features does airSlate SignNow offer for the TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM?

Security is a top priority at airSlate SignNow. When working with the TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM, your documents are protected with industry-standard encryption and secure data storage. This ensures that sensitive information remains confidential and safe from unauthorized access.

Get more for TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM

Find out other TY 515 TAX YEAR 515 INDIVIDUAL TAXPAYER FORM

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast