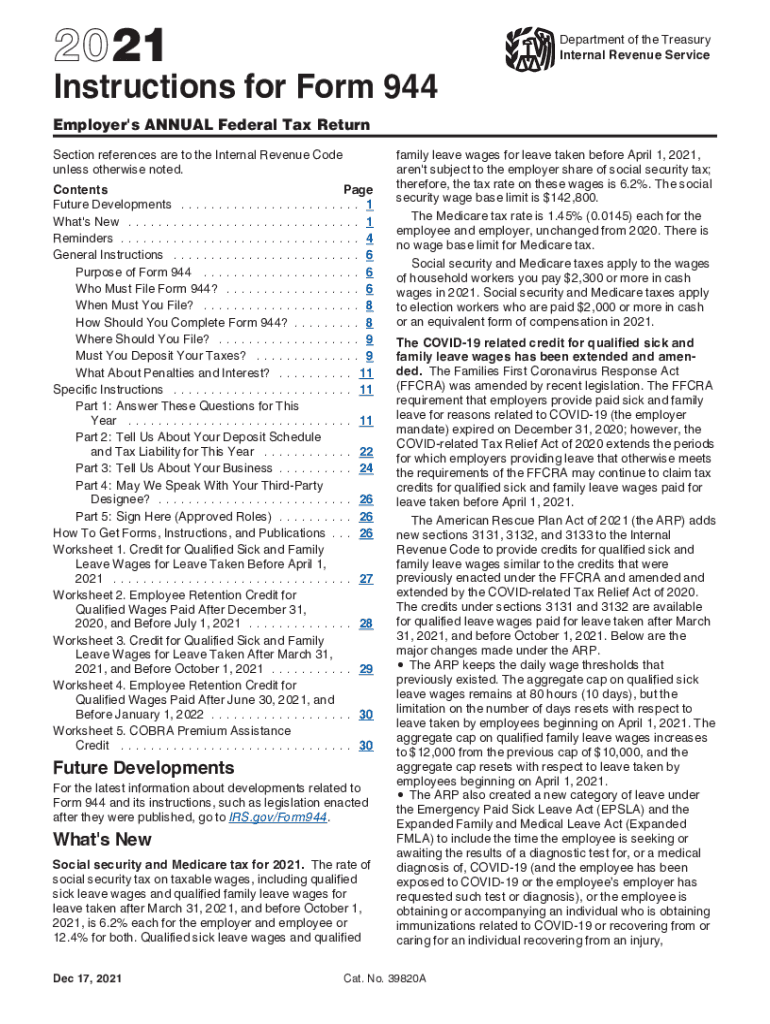

Instructions for Form 944 Internal Revenue Service 2021

What is Form 944?

Form 944 is an annual tax form used by small employers in the United States to report and pay their federal payroll taxes. This form is specifically designed for businesses that owe less than $1,000 in payroll taxes for the year. By using Form 944, employers can simplify their tax reporting process, as it allows them to file once a year rather than quarterly. Understanding the purpose and requirements of Form 944 is essential for compliance with IRS regulations.

Steps to Complete Form 944

Completing Form 944 involves several key steps to ensure accuracy and compliance. First, gather all relevant payroll records, including employee wages and tax withholdings. Next, fill out the form by providing your business information, such as the employer identification number (EIN) and the number of employees. Calculate the total wages paid and the taxes withheld, then report these amounts in the appropriate sections of the form. Finally, sign and date the form before submission to the IRS.

Filing Deadlines for Form 944

The filing deadline for Form 944 is typically January 31 of the year following the tax year being reported. Employers must ensure that their completed form is postmarked by this date to avoid penalties. If January 31 falls on a weekend or holiday, the deadline is extended to the next business day. It is crucial for businesses to keep track of these deadlines to maintain compliance with IRS requirements.

Legal Use of Form 944

Form 944 is legally binding when completed and submitted according to IRS guidelines. To ensure its legal standing, employers must provide accurate information and adhere to filing deadlines. The form must be signed by an authorized individual, confirming that the information reported is true and correct. Utilizing a reliable electronic signature platform can further enhance the legitimacy of the submitted form.

Form Submission Methods

Employers have several options for submitting Form 944 to the IRS. The form can be filed electronically using IRS-approved e-filing software, which is often the most efficient method. Alternatively, employers can print the form and mail it to the designated IRS address. It is important to choose a submission method that aligns with your business's capabilities and preferences while ensuring timely filing.

Penalties for Non-Compliance

Failure to file Form 944 on time or inaccuracies in reporting can result in significant penalties. The IRS may impose fines for late submissions, which can accumulate over time. Additionally, incorrect information may lead to further complications, such as audits or additional tax liabilities. Understanding these potential penalties emphasizes the importance of accurate and timely filing of Form 944.

Quick guide on how to complete 2021 instructions for form 944 internal revenue service

Complete Instructions For Form 944 Internal Revenue Service effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents promptly without interruptions. Manage Instructions For Form 944 Internal Revenue Service on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

How to edit and eSign Instructions For Form 944 Internal Revenue Service with ease

- Obtain Instructions For Form 944 Internal Revenue Service and then click Get Form to begin.

- Utilize our tools to finish your document.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Instructions For Form 944 Internal Revenue Service and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 instructions for form 944 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2021 instructions for form 944 internal revenue service

How to create an e-signature for a PDF in the online mode

How to create an e-signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

How to generate an e-signature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 944 and why do I need it?

Form 944 is an annual tax form used by small businesses to report payroll taxes to the IRS. If your business has a low payroll tax liability, using Form 944 can simplify your filing process. With airSlate SignNow, you can easily prepare and eSign your Form 944, ensuring compliance and accuracy without the hassle of paper forms.

-

How can airSlate SignNow help me with Form 944?

airSlate SignNow offers a seamless way to prepare, send, and eSign Form 944 electronically. Our user-friendly platform streamlines the process, reducing the time and effort needed to manage payroll tax documentation. You can ensure that your Form 944 is signed and submitted on time, every time.

-

Is there a cost associated with using airSlate SignNow for Form 944?

Yes, airSlate SignNow operates on a subscription model with competitive pricing. We provide different plans to suit various business needs, allowing you to choose the best option for managing your Form 944 and other documents. The cost-effectiveness of our platform makes it a great choice for small businesses looking to simplify their tax filing processes.

-

What features does airSlate SignNow offer for preparing Form 944?

With airSlate SignNow, you can access features such as customizable templates, secure eSignatures, and cloud storage for your Form 944. Our platform allows for easy collaboration, enabling multiple parties to review and sign the document quickly. These features enhance efficiency and ensure that your Form 944 is handled securely.

-

Can I integrate airSlate SignNow with my existing software for handling Form 944?

Yes, airSlate SignNow offers integrations with various popular business applications, allowing for seamless workflows when managing Form 944. Whether you use accounting software or HR tools, our platform can connect with your existing systems to streamline the process. This enhances your overall efficiency in preparing and filing your Form 944.

-

What are the benefits of using airSlate SignNow for Form 944 versus traditional paper methods?

Using airSlate SignNow for Form 944 saves time and reduces errors compared to traditional paper filing. Electronic signatures speed up the approval process, while cloud storage eliminates the risk of losing important documents. Additionally, you can access your Form 944 anytime, anywhere, enhancing your flexibility and overall productivity.

-

How secure is the data I submit for Form 944 on airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure data storage practices to protect the information you submit for your Form 944. Rest assured, your sensitive data is safeguarded against unauthorized access, giving you peace of mind while using our platform.

Get more for Instructions For Form 944 Internal Revenue Service

- Legal last will and testament form for a widow or widower with adult children delaware

- Legal last will and testament form for widow or widower with minor children delaware

- Legal last will form for a widow or widower with no children delaware

- Legal last will and testament form for a widow or widower with adult and minor children delaware

- Legal last will and testament form for divorced and remarried person with mine yours and ours children delaware

- Legal last will and testament form with all property to trust called a pour over will delaware

- Written revocation of will delaware form

- Last will and testament for other persons delaware form

Find out other Instructions For Form 944 Internal Revenue Service

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed