Instructions for Form 944 Instructions for Form 944, Employer's ANNUAL Federal Tax Return 2011

Understanding Form 944: Employer's Annual Federal Tax Return

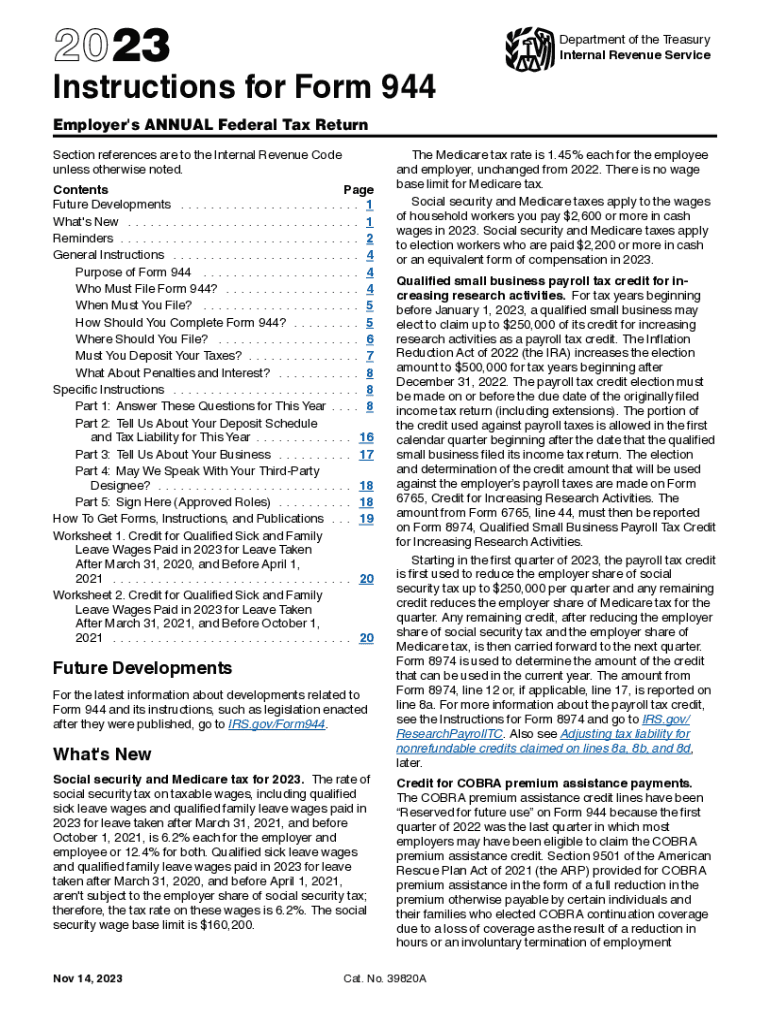

The Instructions for Form 944 provide essential guidance for employers in the United States who are required to report their annual federal tax obligations. This form is specifically designed for small businesses that owe less than a certain amount in payroll taxes. By using Form 944, employers can simplify their tax filing process by submitting a single annual return instead of quarterly filings. This can significantly reduce the administrative burden for eligible employers.

Steps to Complete Form 944

Completing Form 944 involves several key steps to ensure accuracy and compliance with IRS regulations. First, employers need to gather necessary information, including total wages paid, tips received, and federal income tax withheld. Next, they should accurately fill out each section of the form, ensuring that all calculations are correct. After completing the form, employers must review it for any errors before submitting it to the IRS. It is also important to retain copies of the form and any supporting documentation for future reference.

Filing Deadlines for Form 944

Employers must be aware of the filing deadlines associated with Form 944 to avoid penalties. Typically, Form 944 is due annually on January 31 of the following year. If January 31 falls on a weekend or holiday, the deadline is extended to the next business day. Employers should also be mindful of any changes to deadlines announced by the IRS, especially in response to extraordinary circumstances.

Required Documents for Form 944

To accurately complete Form 944, employers should have several documents on hand. These include payroll records, employee tax withholding information, and any previous tax returns that may be relevant. Additionally, employers may need to reference IRS publications that provide further details on tax obligations and reporting requirements. Having these documents readily available can streamline the process and help ensure compliance.

IRS Guidelines for Form 944

The IRS provides specific guidelines that must be followed when completing Form 944. These guidelines outline eligibility criteria, reporting requirements, and instructions for calculating taxes owed. Employers should familiarize themselves with these guidelines to ensure they are meeting all necessary obligations. The IRS also updates these guidelines periodically, so staying informed about any changes is crucial for compliance.

Penalties for Non-Compliance with Form 944

Failure to file Form 944 on time or inaccuracies in reporting can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the duration of the delay. Employers should strive to file accurately and on time to avoid these penalties. Understanding the consequences of non-compliance can motivate employers to adhere to filing requirements diligently.

Quick guide on how to complete instructions for form 944 instructions for form 944 employers annual federal tax return

Prepare Instructions For Form 944 Instructions For Form 944, Employer's ANNUAL Federal Tax Return effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a sustainable alternative to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents swiftly without any hold-ups. Handle Instructions For Form 944 Instructions For Form 944, Employer's ANNUAL Federal Tax Return on any platform using airSlate SignNow apps available on Android or iOS, and simplify any document-related procedure today.

The easiest way to modify and electronically sign Instructions For Form 944 Instructions For Form 944, Employer's ANNUAL Federal Tax Return with ease

- Obtain Instructions For Form 944 Instructions For Form 944, Employer's ANNUAL Federal Tax Return and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specially offers for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on Done to finalize your changes.

- Choose your delivery method for your form—via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Instructions For Form 944 Instructions For Form 944, Employer's ANNUAL Federal Tax Return to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 944 instructions for form 944 employers annual federal tax return

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 944 instructions for form 944 employers annual federal tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for completing the Instructions For Form 944?

airSlate SignNow offers a user-friendly platform for managing eSignatures and document workflows. You can easily complete and submit the Instructions For Form 944, Employer's ANNUAL Federal Tax Return digitally, ensuring your forms are accurate and filed on time.

-

How does airSlate SignNow help with the Instructions For Form 944 during tax season?

With airSlate SignNow, you can streamline the process of managing your Instructions For Form 944, Employer's ANNUAL Federal Tax Return. Our platform enables you to gather necessary signatures quickly, reducing the stress and time associated with tax filing.

-

What is the pricing structure for airSlate SignNow when using it for tax forms?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our competitive pricing ensures you have access to robust features for completing the Instructions For Form 944, Employer's ANNUAL Federal Tax Return without breaking the bank.

-

Can I integrate airSlate SignNow with other software to manage my taxes?

Yes, airSlate SignNow seamlessly integrates with various applications, including accounting software. This allows you to manage all aspects of your tax filing, including the Instructions For Form 944, Employer's ANNUAL Federal Tax Return, within your existing workflows.

-

Is airSlate SignNow secure for handling sensitive tax documents like Form 944?

Absolutely. airSlate SignNow prioritizes security, ensuring that your Instructions For Form 944, Employer's ANNUAL Federal Tax Return and all other documents are protected. Our platform uses encryption and complies with industry standards to safeguard your information.

-

How can I access support for using airSlate SignNow with the Instructions For Form 944?

Our dedicated support team is available to assist you with any questions regarding the Instructions For Form 944, Employer's ANNUAL Federal Tax Return. You can signNow out through our online chat, email, or extensive help center for comprehensive guidance.

-

Does airSlate SignNow offer templates for the Instructions For Form 944?

Yes, airSlate SignNow provides customizable templates tailored for the Instructions For Form 944, Employer's ANNUAL Federal Tax Return. This feature saves time and ensures your documents are formatted correctly for submission.

Get more for Instructions For Form 944 Instructions For Form 944, Employer's ANNUAL Federal Tax Return

- Inter territorial movement permit for dogs and cats form

- Student information change form waubonsee community college waubonsee

- Va form 21 0960l 1 respiratory conditions disability benefits questionnaire reginfo

- Request for preliminary conference form

- Form ct 590 ct gov trincoll

- Opinion of value letter template form

- Water damage work authorization empire construction empirecompany form

- Translation contract template form

Find out other Instructions For Form 944 Instructions For Form 944, Employer's ANNUAL Federal Tax Return

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure