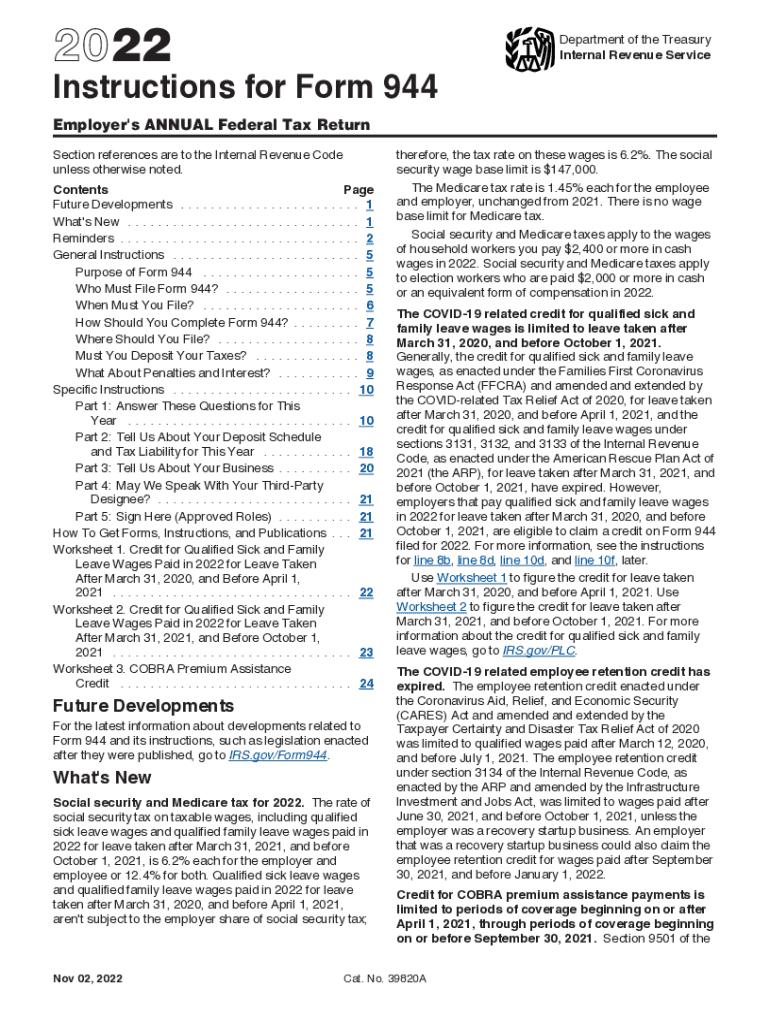

Instructions for Form 944 Instructions for Form 944, Employer's ANNUAL Federal Tax Return 2022

What is Form 944?

Form 944 is the Employer's Annual Federal Tax Return, designed for small businesses to report their annual payroll taxes to the Internal Revenue Service (IRS). This form allows eligible employers to report their total annual payroll tax liability, including federal income tax withheld and Social Security and Medicare taxes. The primary purpose of Form 944 is to simplify the filing process for employers with a lower payroll tax obligation, enabling them to file once a year instead of quarterly.

Steps to Complete Form 944

Completing Form 944 requires careful attention to detail to ensure accuracy. Here are the key steps involved:

- Gather necessary information, including your Employer Identification Number (EIN), total wages paid, and taxes withheld.

- Fill out the form by entering the total wages, tips, and other compensation in the appropriate sections.

- Calculate the total tax liability by applying the correct tax rates to the amounts reported.

- Sign and date the form, certifying that the information provided is accurate and complete.

- Submit the completed form to the IRS by the specified deadline.

Filing Deadlines for Form 944

Employers must be aware of the filing deadlines for Form 944 to avoid penalties. The form is typically due by January thirty-first of the year following the tax year being reported. If January thirty-first falls on a weekend or holiday, the due date is extended to the next business day. Employers should ensure timely submission to maintain compliance with IRS regulations.

IRS Guidelines for Form 944

The IRS provides specific guidelines for completing and submitting Form 944. Employers should refer to the official IRS instructions for detailed information on eligibility criteria, required documentation, and any changes in tax laws that may affect their filing. Adhering to these guidelines is essential for accurate reporting and avoiding potential penalties.

Penalties for Non-Compliance

Failure to file Form 944 on time or inaccurately reporting payroll taxes can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the duration of the delay. Employers should be diligent in ensuring that their filings are accurate and submitted on time to avoid these financial repercussions.

Legal Use of Form 944

Form 944 is legally recognized as a valid method for reporting payroll taxes for eligible employers. To ensure the legal validity of the form, it must be completed in accordance with IRS regulations and submitted by the designated deadline. Employers should maintain copies of their submitted forms and any supporting documentation for their records.

Quick guide on how to complete 2022 instructions for form 944 instructions for form 944 employers annual federal tax return

Prepare Instructions For Form 944 Instructions For Form 944, Employer's ANNUAL Federal Tax Return effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, as you can locate the right template and securely store it online. airSlate SignNow provides all necessary tools for swiftly creating, editing, and electronically signing your papers without delays. Manage Instructions For Form 944 Instructions For Form 944, Employer's ANNUAL Federal Tax Return on any device through the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Instructions For Form 944 Instructions For Form 944, Employer's ANNUAL Federal Tax Return without hassle

- Locate Instructions For Form 944 Instructions For Form 944, Employer's ANNUAL Federal Tax Return and click Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow has specifically created for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Instructions For Form 944 Instructions For Form 944, Employer's ANNUAL Federal Tax Return to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 instructions for form 944 instructions for form 944 employers annual federal tax return

Create this form in 5 minutes!

People also ask

-

What is Form 944 and why is it important?

Form 944 is an annual tax form used by small employers to report their payroll taxes to the IRS. It's crucial for compliance, as it helps businesses accurately report and pay federal employment taxes, ensuring smooth operations without penalties.

-

How can airSlate SignNow help with Form 944 submissions?

airSlate SignNow offers a streamlined platform to electronically sign and send Form 944 documents quickly and securely. By using SignNow, you can improve efficiency and reduce the time spent on paperwork, making tax season much more manageable.

-

Is there a cost associated with using airSlate SignNow for Form 944?

Yes, airSlate SignNow provides flexible pricing plans tailored to your business needs. You can choose a plan that fits your budget, ensuring that you have access to the necessary tools for handling Form 944 without overspending.

-

What features does airSlate SignNow offer for managing Form 944?

airSlate SignNow offers robust features like document templates, electronic signatures, and status tracking specifically designed for Form 944 and other tax documents. These features help you manage your submissions efficiently and keep your records organized.

-

Can I integrate airSlate SignNow with other software for Form 944?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and business software, allowing for streamlined workflows when dealing with Form 944. This integration helps reduce manual entry and increases productivity.

-

What benefits does electronic signing provide for Form 944?

Using electronic signing for Form 944 offers numerous benefits, including faster processing, improved security, and reduced paper waste. It also simplifies the signing process, making it more convenient for all parties involved.

-

Is airSlate SignNow compliant with IRS regulations for Form 944?

Yes, airSlate SignNow is fully compliant with IRS regulations regarding electronic signatures on Form 944 and other tax documents. This compliance ensures that your signed forms are valid and recognized by the IRS.

Get more for Instructions For Form 944 Instructions For Form 944, Employer's ANNUAL Federal Tax Return

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497320664 form

- Nevada landlord in form

- Nevada landlord tenant 497320666 form

- Landlord tenant use 497320667 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497320668 form

- Letter tenant notice template 497320669 form

- Letter from landlord to tenant about tenant engaging in illegal activity in premises as documented by law enforcement and if 497320670 form

- Nv violation form

Find out other Instructions For Form 944 Instructions For Form 944, Employer's ANNUAL Federal Tax Return

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast

- Sign New Mexico Banking Contract Easy

- Sign New York Banking Moving Checklist Free

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast