Www pdfFiller Com101249236 Cd 57 S Print2017 Form NH CD 57 S Fill Online, Printable, Fillable 2021

Understanding the NH CD 57 S Form

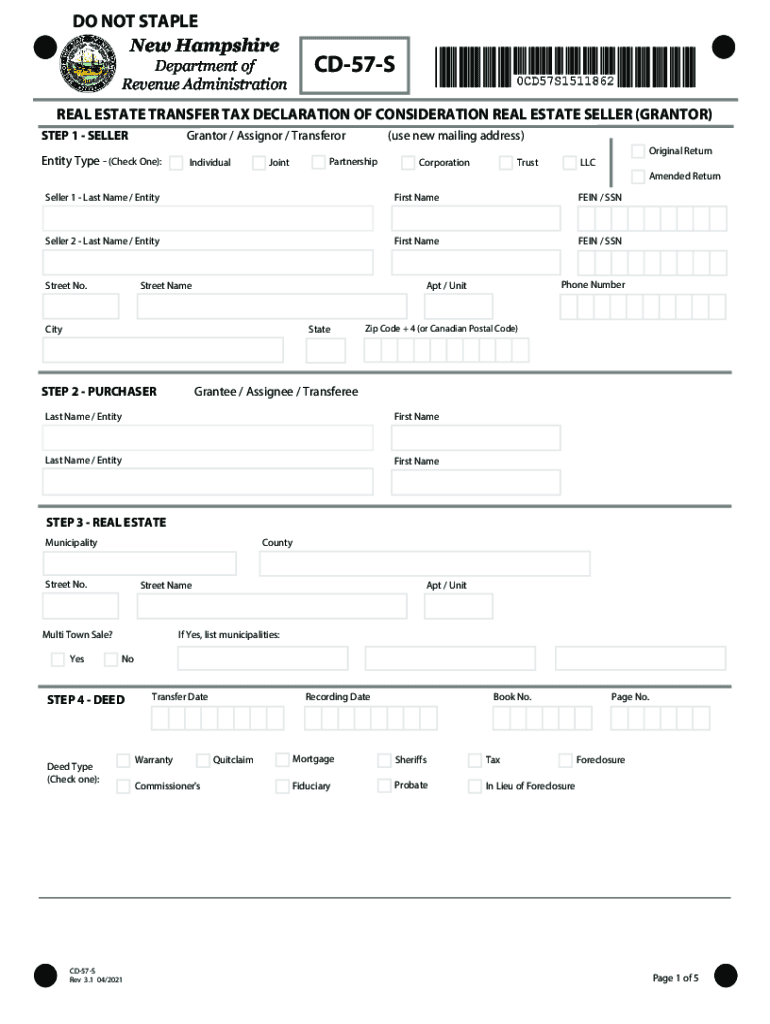

The NH CD 57 S form, also known as the New Hampshire Transfer Tax Declaration, is a crucial document for individuals and businesses involved in real estate transactions within the state. This form is used to report the transfer of real property and assess the applicable transfer tax. It is essential for ensuring compliance with state tax regulations and accurately documenting the transfer of ownership.

Steps to Complete the NH CD 57 S Form

Completing the NH CD 57 S form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including the details of the property being transferred, the names of the parties involved, and the purchase price. Next, accurately fill out the form, ensuring that all fields are completed as required. After completing the form, review it for any errors or omissions before submitting it to the appropriate state authority.

Legal Use of the NH CD 57 S Form

The NH CD 57 S form serves a legal purpose in documenting real estate transactions. It is essential for establishing the transfer of property ownership and ensuring that the correct transfer tax is assessed. Proper completion and submission of this form help protect the interests of both the buyer and seller, providing a clear record of the transaction that can be referenced in the future.

Required Documents for the NH CD 57 S Form

When preparing to submit the NH CD 57 S form, it is important to have the following documents ready:

- Proof of identity for all parties involved in the transaction.

- Purchase and sale agreement detailing the terms of the transaction.

- Any previous deeds or documents related to the property.

- Documentation of any exemptions or deductions that may apply.

Form Submission Methods

The NH CD 57 S form can be submitted through various methods to accommodate different preferences. Individuals can choose to file the form online through designated state portals, submit it via mail to the appropriate state office, or deliver it in person. Each method has its own processing times and requirements, so it is advisable to check the latest guidelines from the state.

Filing Deadlines and Important Dates

Timeliness is crucial when submitting the NH CD 57 S form. The form must be filed within a specific timeframe following the property transfer to avoid penalties. It is important to be aware of any relevant deadlines, which may vary based on the nature of the transaction and local regulations. Keeping track of these dates helps ensure compliance and prevents unnecessary complications.

Quick guide on how to complete wwwpdffillercom101249236 cd 57 s 2016 print2017 2021 form nh cd 57 s fill online printable fillable

Easily Prepare Www pdffiller com101249236 cd 57 s print2017 Form NH CD 57 S Fill Online, Printable, Fillable on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents promptly without unnecessary delays. Handle Www pdffiller com101249236 cd 57 s print2017 Form NH CD 57 S Fill Online, Printable, Fillable across any platform with the airSlate SignNow applications for Android or iOS, and simplify any document-related tasks today.

Edit and eSign Www pdffiller com101249236 cd 57 s print2017 Form NH CD 57 S Fill Online, Printable, Fillable Effortlessly

- Find Www pdffiller com101249236 cd 57 s print2017 Form NH CD 57 S Fill Online, Printable, Fillable and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important parts of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the concern of lost or misplaced documents, frustrating form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Www pdffiller com101249236 cd 57 s print2017 Form NH CD 57 S Fill Online, Printable, Fillable and ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwpdffillercom101249236 cd 57 s 2016 print2017 2021 form nh cd 57 s fill online printable fillable

Create this form in 5 minutes!

How to create an eSignature for the wwwpdffillercom101249236 cd 57 s 2016 print2017 2021 form nh cd 57 s fill online printable fillable

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The best way to make an e-signature right from your smart phone

The best way to create an e-signature for a PDF on iOS devices

The best way to make an e-signature for a PDF on Android OS

People also ask

-

What is nh cd 57 s and how can it benefit my business?

The nh cd 57 s is a specific type of digital document used in signing contracts and agreements. Utilizing this format can streamline your workflow by ensuring that all necessary information is captured accurately and securely. By integrating nh cd 57 s into your document signing process with airSlate SignNow, you can enhance efficiency and reduce turnaround times.

-

How much does it cost to use airSlate SignNow for nh cd 57 s documents?

airSlate SignNow offers competitive pricing plans that cater to various business needs for handling nh cd 57 s documents. There are monthly and annual subscriptions available, which provide differing levels of features and support. By selecting the right plan, you can optimize your document workflows without overspending.

-

What features does airSlate SignNow offer for managing nh cd 57 s documents?

airSlate SignNow includes a range of features that facilitate the creation, distribution, and signing of nh cd 57 s documents. Key features include customizable templates, real-time tracking, and secure cloud storage. These tools enhance collaboration and ensure seamless document management for your team.

-

Can I integrate airSlate SignNow with other software for nh cd 57 s document management?

Yes, airSlate SignNow supports integration with numerous third-party applications which can enhance your management of nh cd 57 s documents. This includes CRM systems, cloud storage services, and other productivity software. Integrating these tools helps centralize your processes and increases overall efficiency.

-

Is airSlate SignNow compliant with legal standards for nh cd 57 s documents?

Absolutely! airSlate SignNow ensures that all nh cd 57 s documents comply with legal standards for e-signatures. Our platform adheres to regulations such as ESIGN and UETA, providing peace of mind that your electronic signatures are valid and legally binding.

-

What are the advantages of using nh cd 57 s over traditional document signing methods?

Using nh cd 57 s through airSlate SignNow offers signNow advantages over traditional signing methods, including quicker turnaround times and reduced paper usage. The electronic format allows for easy tracking and storage, which decreases the likelihood of lost or misplaced documents. Additionally, it enhances security and simplifies the signing process for all parties involved.

-

How can I get started with airSlate SignNow for nh cd 57 s document signing?

Getting started with airSlate SignNow for your nh cd 57 s documents is simple. You can sign up for a free trial on our website to experience the platform's features. Once registered, you can begin uploading your documents and inviting others to sign easily.

Get more for Www pdffiller com101249236 cd 57 s print2017 Form NH CD 57 S Fill Online, Printable, Fillable

- Ga discovery 497303645 form

- Discovery interrogatories for divorce proceeding for either plaintiff or defendant another form georgia

- Quitclaim deed two individuals to three individuals georgia form

- Warranty deed three individuals to husband and wife georgia form

- Georgia quitclaim deed 497303649 form

- Warranty deed individual to two individuals georgia form

- Notice commencement file form

- Deed two one 497303652 form

Find out other Www pdffiller com101249236 cd 57 s print2017 Form NH CD 57 S Fill Online, Printable, Fillable

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free