NJ Division of Taxation Realty Transfer Information 2024-2026

Understanding the NJ Division Of Taxation Realty Transfer Information

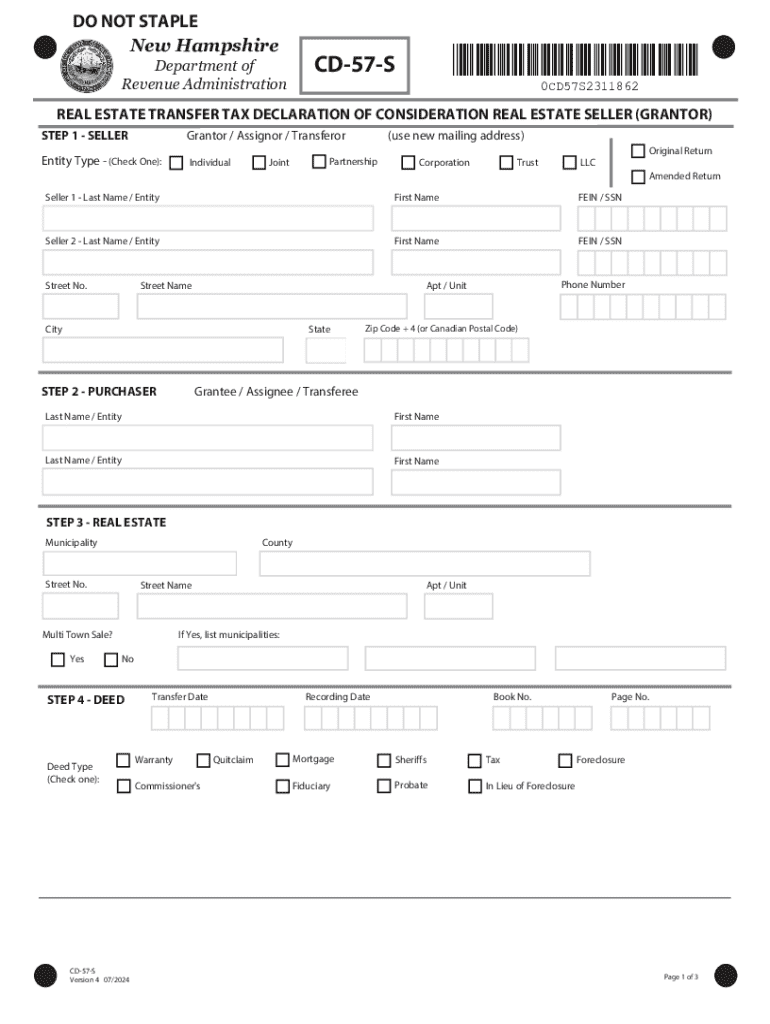

The NJ Division Of Taxation Realty Transfer Information provides essential details regarding the transfer of real estate in New Jersey. This information is crucial for buyers, sellers, and real estate professionals to ensure compliance with state regulations. It outlines the requirements for reporting real estate transactions, including the necessary forms and documentation needed for the transfer process. Understanding this information helps parties involved in real estate transactions navigate the legal landscape effectively.

Steps to Complete the NJ Division Of Taxation Realty Transfer Information

Completing the NJ Division Of Taxation Realty Transfer Information involves several key steps:

- Gather necessary documentation, including the property deed and any prior transfer documents.

- Fill out the required forms accurately, ensuring all information is complete and correct.

- Calculate the transfer tax based on the sale price of the property.

- Submit the completed forms along with any required fees to the NJ Division of Taxation.

Each step is vital to ensure a smooth transfer process and avoid potential penalties for non-compliance.

Required Documents for Realty Transfer in NJ

To successfully complete the NJ Division Of Taxation Realty Transfer Information, specific documents are required. These typically include:

- The property deed, which outlines the legal ownership of the property.

- A completed Realty Transfer Fee Declaration form, which details the sale price and calculates the transfer tax.

- Any additional documentation that may support the transaction, such as prior sale agreements or tax records.

Having these documents ready will facilitate a more efficient transfer process.

Legal Use of the NJ Division Of Taxation Realty Transfer Information

The NJ Division Of Taxation Realty Transfer Information is legally binding and must be adhered to during real estate transactions. It ensures that all parties involved are aware of their tax obligations and the legal requirements for transferring property. Failure to comply with these regulations may result in penalties, including fines or delays in the transfer process. Therefore, understanding and using this information correctly is essential for legal protection and compliance.

Form Submission Methods for Realty Transfer Information

There are several methods for submitting the NJ Division Of Taxation Realty Transfer Information. These methods include:

- Online submission through the NJ Division of Taxation's official website, which offers a streamlined process.

- Mailing the completed forms to the appropriate tax office, ensuring they are sent to the correct address.

- In-person submission at designated tax offices, which allows for immediate assistance and clarification of any questions.

Choosing the right submission method can help ensure timely processing of the transfer information.

Penalties for Non-Compliance with Realty Transfer Regulations

Non-compliance with the NJ Division Of Taxation Realty Transfer Information can lead to significant penalties. These may include:

- Fines imposed for late submission of required forms or failure to pay transfer taxes.

- Delays in the processing of the property transfer, which can affect ownership rights.

- Potential legal action if the transfer is deemed invalid due to non-compliance.

Understanding these penalties highlights the importance of adhering to the regulations set forth by the NJ Division of Taxation.

Quick guide on how to complete nj division of taxation realty transfer information

Finish NJ Division Of Taxation Realty Transfer Information seamlessly on any gadget

Web-based document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct version and securely store it online. airSlate SignNow equips you with all the tools required to create, amend, and eSign your documents quickly without delays. Manage NJ Division Of Taxation Realty Transfer Information on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign NJ Division Of Taxation Realty Transfer Information effortlessly

- Find NJ Division Of Taxation Realty Transfer Information and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the files or mask sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to submit your document, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Alter and eSign NJ Division Of Taxation Realty Transfer Information to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nj division of taxation realty transfer information

Create this form in 5 minutes!

How to create an eSignature for the nj division of taxation realty transfer information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NJ Division Of Taxation Realty Transfer Information?

The NJ Division Of Taxation Realty Transfer Information provides essential details regarding the transfer of real estate in New Jersey. This information includes tax obligations, filing requirements, and necessary documentation for property transactions. Understanding this information is crucial for both buyers and sellers to ensure compliance with state regulations.

-

How can airSlate SignNow assist with NJ Division Of Taxation Realty Transfer Information?

airSlate SignNow streamlines the process of managing NJ Division Of Taxation Realty Transfer Information by allowing users to easily eSign and send necessary documents. Our platform ensures that all required forms are completed accurately and submitted on time, reducing the risk of delays in property transactions. This efficiency helps users stay compliant with New Jersey's real estate regulations.

-

What are the pricing options for using airSlate SignNow for NJ Division Of Taxation Realty Transfer Information?

airSlate SignNow offers flexible pricing plans designed to accommodate various business needs, including those dealing with NJ Division Of Taxation Realty Transfer Information. Our plans are cost-effective, ensuring that you only pay for the features you need. You can choose from monthly or annual subscriptions, making it easy to find a plan that fits your budget.

-

What features does airSlate SignNow provide for handling NJ Division Of Taxation Realty Transfer Information?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing NJ Division Of Taxation Realty Transfer Information. These tools simplify the document preparation process and enhance collaboration among parties involved in real estate transactions. Additionally, our platform ensures that all documents are stored securely and can be accessed anytime.

-

Are there any benefits to using airSlate SignNow for NJ Division Of Taxation Realty Transfer Information?

Using airSlate SignNow for NJ Division Of Taxation Realty Transfer Information offers numerous benefits, including increased efficiency and reduced paperwork. Our platform allows for quick turnaround times on document signing, which can expedite real estate transactions. Furthermore, the ease of use and accessibility of our solution means that users can manage their documents from anywhere, at any time.

-

Can airSlate SignNow integrate with other tools for NJ Division Of Taxation Realty Transfer Information?

Yes, airSlate SignNow can integrate with various tools and applications to enhance your workflow related to NJ Division Of Taxation Realty Transfer Information. Our platform supports integrations with popular CRM systems, cloud storage services, and other business applications. This connectivity allows for seamless data transfer and improved efficiency in managing real estate documents.

-

How secure is airSlate SignNow when handling NJ Division Of Taxation Realty Transfer Information?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive NJ Division Of Taxation Realty Transfer Information. Our platform employs advanced encryption and security protocols to protect your documents and personal information. Additionally, we comply with industry standards to ensure that your data remains safe and confidential throughout the signing process.

Get more for NJ Division Of Taxation Realty Transfer Information

- Flooring contractor package south dakota form

- Trim carpenter contractor package south dakota form

- Fencing contractor package south dakota form

- Hvac contractor package south dakota form

- Landscaping contractor package south dakota form

- Commercial contractor package south dakota form

- Excavation contractor package south dakota form

- Renovation contractor package south dakota form

Find out other NJ Division Of Taxation Realty Transfer Information

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF