FORM NEW HAMPSHIRE DEPARTMENT of REVENUE ADMINISTRATION CD 57 S REAL 2022

Understanding the New Hampshire Department of Revenue Administration CD 57 S Real Estate Transfer Tax Form

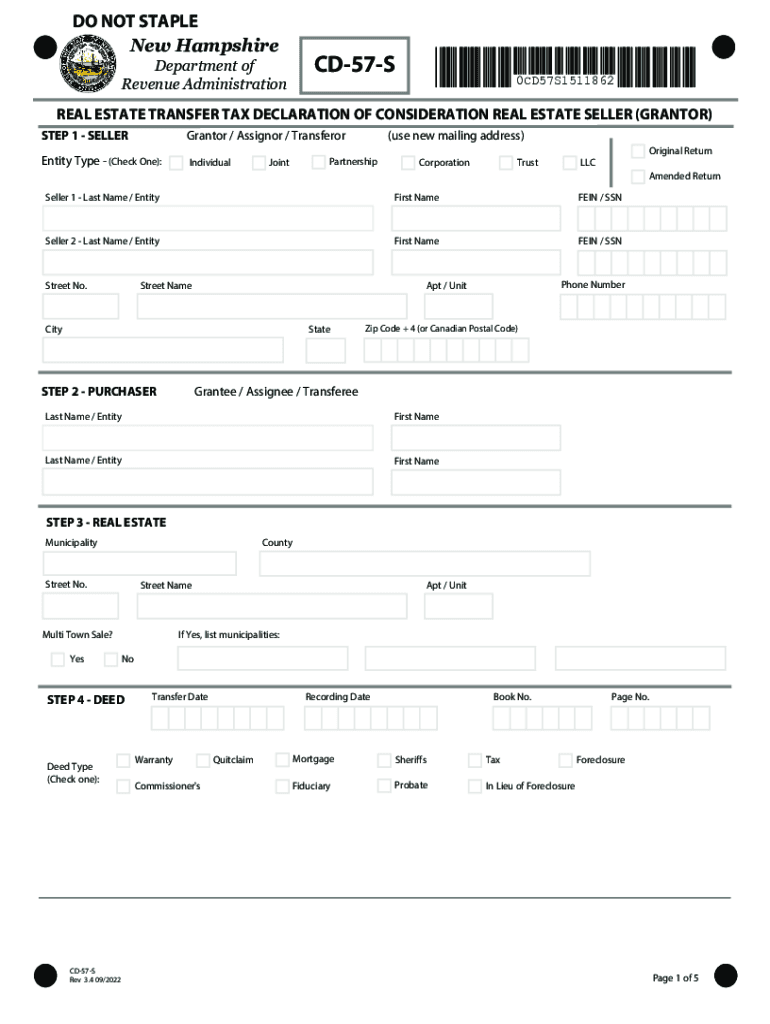

The New Hampshire CD 57 S form is essential for reporting real estate transfers in the state. This form is used to document the transfer of property ownership and is required by the New Hampshire Department of Revenue Administration. It ensures that the appropriate real estate transfer tax is calculated and collected. The form captures vital information about the transaction, including the parties involved, the property details, and the consideration paid. Understanding this form is crucial for both buyers and sellers to ensure compliance with state tax laws.

Steps to Complete the New Hampshire CD 57 S Form

Completing the CD 57 S form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information about the property and the transaction. This includes the names and addresses of the buyer and seller, the property description, and the sale price. Next, accurately fill out each section of the form, ensuring that all details are correct. After completing the form, review it for any errors or omissions. Finally, submit the form to the appropriate state agency, along with any required payment for the transfer tax.

Legal Use of the New Hampshire CD 57 S Form

The CD 57 S form serves a legal purpose in documenting real estate transactions in New Hampshire. It is a legally binding document that must be completed and submitted to ensure that the transfer of property is recognized by the state. The form must be signed by both the buyer and seller, affirming the accuracy of the information provided. Failure to submit this form can result in penalties and complications in the property transfer process. Thus, understanding the legal implications of this form is crucial for all parties involved in real estate transactions.

Required Documents for the New Hampshire CD 57 S Form

When preparing to complete the CD 57 S form, certain documents are necessary to facilitate the process. These documents typically include the purchase and sale agreement, proof of identity for both the buyer and seller, and any existing property deeds. Additionally, if the property is part of a trust or estate, relevant documentation regarding the trust or estate may also be required. Having these documents on hand will streamline the completion of the form and help ensure that all information is accurate and complete.

Filing Deadlines for the New Hampshire CD 57 S Form

Timely filing of the CD 57 S form is crucial to avoid penalties. In New Hampshire, the form must be submitted within a specific timeframe following the completion of the real estate transaction. Generally, this form should be filed within five days of the transfer date. Adhering to this deadline ensures compliance with state regulations and helps avoid any late fees or additional penalties associated with late submissions. It is advisable to check for any updates regarding deadlines or changes in filing requirements.

Submission Methods for the New Hampshire CD 57 S Form

The CD 57 S form can be submitted through various methods, providing flexibility for users. Individuals can file the form online through the New Hampshire Department of Revenue Administration's website, which offers a streamlined process for electronic submissions. Alternatively, the form can be mailed directly to the department or submitted in person at designated offices. Each submission method has its own requirements and processing times, so it is important to choose the one that best fits your needs.

Quick guide on how to complete form new hampshire department of revenue administration cd 57 s real

Complete FORM NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION CD 57 S REAL effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage FORM NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION CD 57 S REAL on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign FORM NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION CD 57 S REAL effortlessly

- Obtain FORM NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION CD 57 S REAL and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to finalize your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from your selected device. Modify and electronically sign FORM NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION CD 57 S REAL to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form new hampshire department of revenue administration cd 57 s real

Create this form in 5 minutes!

People also ask

-

What is the new hampshire real estate transfer tax?

The new hampshire real estate transfer tax is a tax levied on the transfer of real property in New Hampshire. This tax is typically calculated based on the sale price of the property and can vary depending on the municipality. It’s important for buyers and sellers to understand this tax as it can impact their overall transaction costs.

-

How is the new hampshire real estate transfer tax calculated?

The new hampshire real estate transfer tax is calculated as a percentage of the property's sale price. As of now, the tax rate is typically 1.5% for most transactions. Both the buyer and seller are generally responsible for paying this tax, so it’s crucial to factor it into your budget when buying or selling property.

-

Who is responsible for paying the new hampshire real estate transfer tax?

In New Hampshire, both the buyer and seller share the responsibility of paying the new hampshire real estate transfer tax. Typically, the seller pays a portion of the tax at closing, but this can sometimes be negotiated. Clear communication can help ensure that both parties understand their obligations.

-

Are there any exemptions to the new hampshire real estate transfer tax?

Yes, there are certain exemptions to the new hampshire real estate transfer tax. For instance, transfers between immediate family members or transfers in a divorce settlement may be exempt from this tax. It's advisable to consult with a real estate attorney to understand if your transaction qualifies for any exemptions.

-

How can I prepare for the new hampshire real estate transfer tax when buying property?

To prepare for the new hampshire real estate transfer tax, ensure you budget for this cost early in the buying process. Review the details of the tax with your real estate agent or attorney, who can provide guidance on how it may affect your financing. Understanding this tax can help avoid surprises at closing.

-

Can airSlate SignNow help with managing new hampshire real estate transfer tax documents?

Absolutely! airSlate SignNow provides an easy-to-use platform for eSigning and managing documents related to real estate transactions, including those involving the new hampshire real estate transfer tax. Our solution helps streamline the document process, ensuring that all necessary forms are accurately completed and timely submitted.

-

What are the benefits of using airSlate SignNow for real estate transactions in New Hampshire?

Using airSlate SignNow for real estate transactions in New Hampshire offers several benefits, such as reducing time spent on paperwork and enhancing the overall efficiency of your transaction. With secure eSigning capabilities, you can manage documents related to the new hampshire real estate transfer tax conveniently from anywhere. This flexibility can lead to smoother transactions and improved client satisfaction.

Get more for FORM NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION CD 57 S REAL

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair montana form

- Letter from tenant to landlord containing notice that doors are broken and demand repair montana form

- Montana letter landlord form

- Letter from tenant to landlord with demand that landlord repair plumbing problem montana form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497316175 form

- Letter from tenant to landlord with demand that landlord repair unsafe or broken lights or wiring montana form

- Montana repair form

- Letter from tenant to landlord with demand that landlord remove garbage and vermin from premises montana form

Find out other FORM NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION CD 57 S REAL

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors