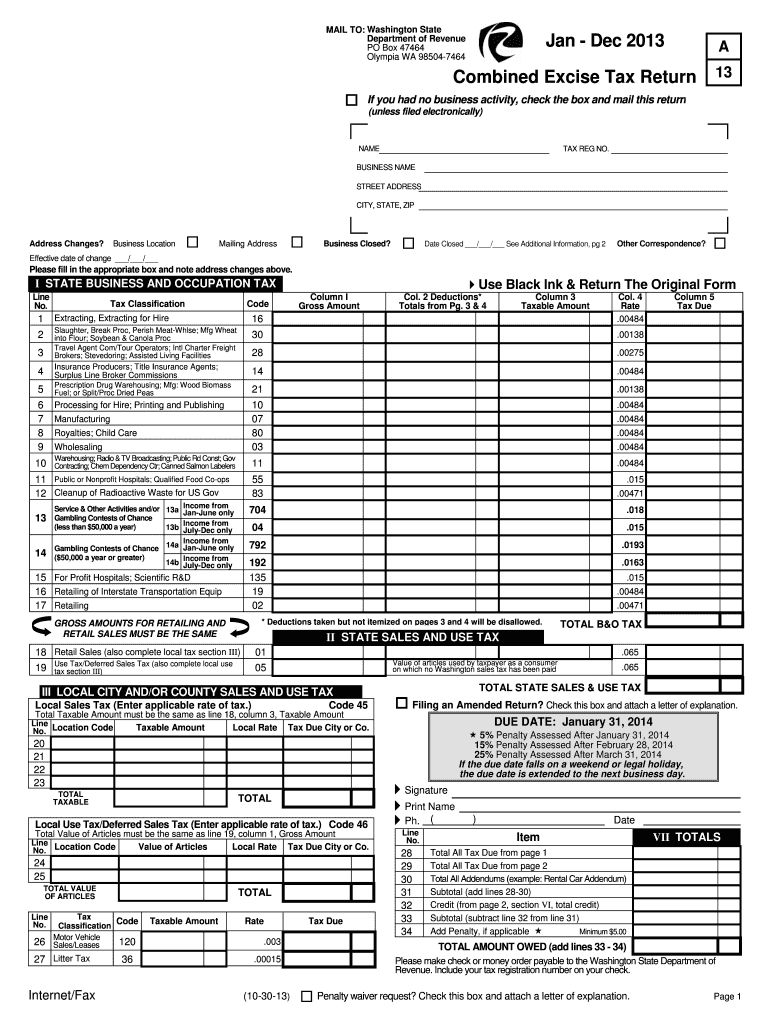

Combined Excise Tax Form 2013

What is the Combined Excise Tax Form

The Combined Excise Tax Form is a crucial document used by businesses and individuals to report and pay various excise taxes imposed by the federal government. This form consolidates multiple excise tax reporting requirements into a single submission, streamlining the process for taxpayers. Excise taxes may apply to specific goods, services, or activities, such as fuel, alcohol, and tobacco, among others. Understanding this form is essential for ensuring compliance with tax regulations and avoiding potential penalties.

Steps to complete the Combined Excise Tax Form

Completing the Combined Excise Tax Form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records related to your excise tax liabilities, including sales figures and relevant receipts. Next, carefully fill out the form, providing accurate information in each section. Pay close attention to the calculations, as errors may lead to discrepancies and potential penalties. After completing the form, review it thoroughly for any mistakes before signing and dating it. Finally, submit the form according to the specified guidelines, whether online, by mail, or in person.

How to use the Combined Excise Tax Form

The Combined Excise Tax Form is designed to be user-friendly, allowing taxpayers to report their excise tax liabilities efficiently. To use the form, start by identifying the specific excise taxes applicable to your situation. Follow the instructions provided on the form to fill in the required fields accurately. Utilize any available online resources or software to assist in the calculations and ensure compliance with IRS guidelines. Once completed, sign the form electronically if permitted, or print it for a handwritten signature before submission.

Filing Deadlines / Important Dates

Timely submission of the Combined Excise Tax Form is essential to avoid penalties and interest charges. The filing deadlines may vary depending on the specific excise taxes being reported. Generally, the form must be submitted quarterly or annually, depending on the taxpayer's reporting frequency. It is crucial to stay informed about these deadlines to ensure compliance. Mark important dates on your calendar and set reminders to prepare and submit the form on time.

Legal use of the Combined Excise Tax Form

The Combined Excise Tax Form is legally binding and must be completed in accordance with IRS regulations. To ensure its legal validity, taxpayers must provide accurate information and adhere to the specific guidelines outlined by the IRS. Electronic signatures are accepted on this form, provided they comply with the requirements of the ESIGN Act. It is important to retain copies of submitted forms and any supporting documentation for record-keeping and potential audits.

Required Documents

When preparing to complete the Combined Excise Tax Form, certain documents are necessary to support your submissions. These may include financial statements, sales records, and any relevant receipts that pertain to the excise taxes being reported. Additionally, it may be helpful to have previous tax returns available for reference. Ensuring that you have all required documents on hand can streamline the completion process and improve accuracy.

Quick guide on how to complete combined excise tax 2013 form

Your assistance manual on how to prepare your Combined Excise Tax Form

If you wish to understand how to finalize and submit your Combined Excise Tax Form, here are a few straightforward instructions on how to simplify tax filing.

To begin, you only need to create your airSlate SignNow profile to change how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, generate, and finalize your income tax documents effortlessly. With its editor, you can alternate between text, check boxes, and electronic signatures and revert to amend answers where necessary. Enhance your tax administration with advanced PDF editing, electronic signing, and intuitive sharing options.

Follow the steps below to complete your Combined Excise Tax Form quickly:

- Establish your account and start editing PDFs in just a few minutes.

- Utilize our catalog to find any IRS tax form; browse through variations and schedules.

- Press Get form to access your Combined Excise Tax Form in our editor.

- Input the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-sanctioned electronic signature (if required).

- Examine your document and rectify any inaccuracies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper can lead to return errors and delay refunds. Additionally, before electronically filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct combined excise tax 2013 form

FAQs

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

How do I e fill Income tax ITR-1 form in excel and generate xml in excel 2013?

First download the excel file.Then after all the relevant information is filled click on validate.After you click on validate XML file will be generated which is required to be uploaded.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

Shouldn't guns have at least as many requirements as getting a driver's license in the U.S.?

There are those who say that the government should regulate gun permits (and therefore ownership) in exactly the same way it regulates driver’s licenses. This position ignores the US Constitution and the Second Amendment, however, as this grants as a RIGHT the right to bear arms.Given that this is a defined RIGHT in the US Constitution, I would ask if you would similarly suggest that other rights be similarly regulated, such as the right to freedom of speech, freedom of assembly, and protections to personal property. Should these be licensed too as rights? For instance, should a person have to apply to the government for a permit to exercise their free speech rights? Should the press have to register and get a license to practice their freedom of the press rights?I think you would say NO, in capital letters.Several points of discussion follow:Those who disagree with the Second Amendment right to bear arms should fight to repeal the Second Amendment, not seek to dilute or invalidate that right by unconstitutional legislative action. To do so requires an amendment to be introduced, passed, and then ratified by 2/3s of the states in the USA. That’s simple enough — except that those who wish to eliminate or limit the right to bear arms know that it will never get ratified by 2/3s of the states and probably wouldn’t even get ratified by 1/2 of the states. That fact reflects on the democratic expression of America on this issue. Ignoring that they are essentially ignoring the democratic and popular interest, the anti-gun lobbies thus seek other means to get their way.For further discussion purposes and to head off pointless arguments that rehash age-old issues, the Supreme Court’s Heller decision makes clear that to exercise the right to bear arms, the gun-owner need NOT NOT NOT be a member of a militia. This was a point that needed clarification given that the anti-gun lobby was clamoring to make that a requirement to own a gun. On careful review, the Supreme Court ruled on the matter and put the issue to bed.The Heller ruling will likely stand for decades to come as it is unlikely that the Supreme Court will take up many gun cases in the near term (the previous gun rights case was over 70 years earlier if memory serves). I would suggest that people look up and read the Heller decision and the dissenting opinion(s) as it can form a very educational starting point for any discussions on gun rights in America.As to the RIGHT to bear arms, just because it is enshrined in the US Constitution does not mean that reasonable restrictions cannot be legally to be applied, such as denying guns to felons or the insane, etc.. However, licensing as you suggest, which implies mandatory training, initial and recurring testing to ascertain qualifications, is not likely legal, nor will it likely ever be applied on a national basis.On a state by state level, the legislatures may pass laws with varying terms that limit ownership or require certain types of licensing, but where they cross the line and violate the right enshrined in the US Constitution, those laws will likely also be overturned, one by one.The common arguments heard that the number of school shootings, mass shootings, etc., in America more than justifies a repeal of the Second Amendment or draconian restrictions on gun ownership — ala Australia — is spurious. The US Constitution stands. One can claim that the number of deaths warrant sharp restrictions and that the Founding Fathers did not foresee the future deadly nature of automatic weapons, etc., but this is all a matter of educated opinion. If the argument is compelling enough then 2/3s of the states should be persuaded to ratify a repeal of the Second Amendment — clearly, the argument falls flat.A final point, referenced just prior, is the argument that the Founding Fathers could not have foreseen the deadly nature of automatic weapons ignores that if gun ownership is to be limited to flintlock, black powder, single shot Revolutionary War era weapons. To hold that position ignores the precedent it sets that can be applied to other rights as well — should the press, for instance, be disallowed from using radio, television, email, cable, modern printing presses, magazines, modern postal systems, digital distribution through the web, etc., simply because those technologies were not around during the Revolutionary War. Clearly, the Founding Fathers didn’t see that the press might someday be 24/7/365, global, and entirely digital — they never imagined the world we live in, and so the rights should be restricted to the world’s technologies and understanding of the time…. I think any reasoned person would say no.Ultimately, I am not saying that gun violence is acceptable. I am not saying that the number of mass shootings should not bring the nation to look at alternatives. I am, however, saying that I support the US Constitution and the law of the land and I am absolutely confirming that I believe in America’s democratic system of government. I respect that the Second Amendment is a defined right, equal to all other rights granted in the Bill of Rights, and should be in full force and effect until it is amended or repealed by a democratic vote in accordance with the process laid out for amending the US Constitution. Holding this position is a confirmation that I am an American and a patriot.However, holding a position that seeks to repeal or replace the Second Amendment is also your right as an American. The path is laid out in law before you on what must be done to democratically achieve your goals. If the nation agrees and 2/3s of the states ratify, you may achieve those goals. No current amendment to change or repeal the Second Amendment is in draft or under consideration — why not? If you believe that gun ownership should not be a right, then get started on changing it — the right way and not in ways that are unconstitutional (as these are illegal on their face). Denying an American of their rights is a severe offense.Finally, I don’t suppose that you believe that licensing is required for you to exercise the right to call for changes of the US Constitution. Perhaps you might next claim that this too should require a license — you know, one similar to a drivers license, where they test you for political knowledge and organizational skill, etc., before you have a right to oppose and advocate for a repeal of the Second Amendment?

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

Why not treat guns like cars, i.e., why not license gun owners, register the guns and require gun owners to carry insurance?

Why not indeed? In that case, anyone can own a gun at any age. Anyone can legally carry a gun on private property as long as they’re physically capable. Anyone can obtain a “learner’s permit” to carry any gun in public areas, even a handgun, at 14, and get a full concealed carry permit or license to carry at age 16 by passing a course and taking an eye exam, but undergoing no background check or fingerprinting. And if the child waits until 17 to get the license, he or she doesn’t even have to take the course, just the tests. And once the license is obtained, it is recognized in every state. There also would be no waiting time to purchase a gun or obtain a license.Getting drunk and killing someone would incur maybe a five year sentence.Insurance and registration are also not required when operating a motor vehicle on private property.My son at 17 legally owns and operates his car on public roads. He can’t legally own a gun.Now if we regulated cars like guns, here’s how it would be.No one under 18 can drive any vehicle anywhere without either direct parental supervision or adult supervision and written parental permission.Nobody under 18 can purchase any car.18 is the legal age for purchasing SUV’s (the best equivalent I can think of to a long gun), but SUV’s with extra features like all terrain tires, trailer hitches, snowplows, winches, and “high capacity” fuel tanks are considered “assault SUV’s” in some states and are banned there. It is assumed by big city politicians that nobody really needs these features and that only ignorant rednecks ever want them.Of course all vehicle purchases require a background check. And some may require waiting periods.A few states offer licenses, but don’t require them of in-state residents provided they are legally qualified to possess a vehicle. One state (Vermont) doesn’t even issue licenses. Some states may allow people as young as 18 to obtain a license, but it requires a course ranging from eight hours to several days, a more thorough background check, and fingerprinting. Most, however, don’t allow anyone to get a license until age 21. Some states insist you prove to your county sheriff that you need a car, and needing to go places when public transportation is not available is not considered a good enough reason. Waiting times to obtain a license after passing the tests can last up to three months in more permissive states, longer in others.Once you get a car and a license, good luck taking a road trip. Drivers will have to plan all interstate travel around which state will recognize their licenses, because reciprocity is not guaranteed, and driving in a state that doesn’t recognize your license is a felony.Absolutely nobody from outside of California allowed to drive there. Same goes for New York, Illinois, and several other states that don’t recognize any out-of-state license. Some states require you to keep your vehicles in locked garages with the fuel tank emptied and fuel stored separately.While some states may allow 18–21 year olds to own a sedan or compact (the closest automotive equivalent to a handgun) if it’s a gift, nobody can legally purchase such a vehicle until age 21.Waiting times may be placed on all vehicle purchases, depending on the state. Some states will not allow out-of-state residents to buy cars there. Waiting times to obtain a license can take up to three months in some states, even longer than others.Committing any crime with a car could get you a minimum of five years fixed. Kill anyone with a car, and you could be facing life in prison or even the death penalty.Buying any vehicle with an automatic transmission will require a federal tax stamp, another background check, and a personal letter from your county sheriff to the ATF vouching for your character. Once you obtain said vehicle, you cannot drive it anywhere without giving the ATF prior notification. And civilian ownership of all cars with automatic transmission manufactured later than 1986 is completely illegal.Yeah. People who want guns regulated like cars really don’t know what they’re asking for.

Create this form in 5 minutes!

How to create an eSignature for the combined excise tax 2013 form

How to create an electronic signature for your Combined Excise Tax 2013 Form in the online mode

How to make an eSignature for your Combined Excise Tax 2013 Form in Google Chrome

How to make an eSignature for signing the Combined Excise Tax 2013 Form in Gmail

How to make an electronic signature for the Combined Excise Tax 2013 Form from your smart phone

How to create an eSignature for the Combined Excise Tax 2013 Form on iOS devices

How to generate an eSignature for the Combined Excise Tax 2013 Form on Android

People also ask

-

What is the Combined Excise Tax Form and why is it important?

The Combined Excise Tax Form is a comprehensive document used by businesses to report various excise taxes owed to the state. It's crucial for compliance, as it helps ensure that businesses meet their tax obligations and avoid penalties. Properly filing the Combined Excise Tax Form can streamline your tax reporting process and keep your business in good standing.

-

How can airSlate SignNow assist with the Combined Excise Tax Form?

airSlate SignNow simplifies the process of completing and eSigning your Combined Excise Tax Form. Our platform allows you to easily fill out the form, add necessary signatures, and securely send it to relevant parties, all in one place. This saves time and reduces the risk of errors when submitting important tax documents.

-

Is there a cost associated with using airSlate SignNow for the Combined Excise Tax Form?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. Our cost-effective solution allows you to manage document signing and filing processes, including the Combined Excise Tax Form, without breaking the bank. You can explore our pricing options on our website to find the best plan for your requirements.

-

What features does airSlate SignNow offer for handling the Combined Excise Tax Form?

airSlate SignNow includes features such as customizable templates, secure eSignature capabilities, and document tracking, making it an ideal choice for managing the Combined Excise Tax Form. Additionally, our user-friendly interface ensures that you can navigate the platform with ease, enhancing your overall filing experience.

-

Can I integrate airSlate SignNow with other software for filing the Combined Excise Tax Form?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, allowing you to streamline the process of filing the Combined Excise Tax Form. This integration capability helps you maintain consistency across your business operations while ensuring compliance.

-

What are the benefits of using airSlate SignNow for the Combined Excise Tax Form?

Using airSlate SignNow for the Combined Excise Tax Form provides several benefits, including increased efficiency, reduced paperwork, and enhanced security. Our electronic signature solution not only expedites the signing process but also keeps your sensitive information safe and compliant with legal standards.

-

How does airSlate SignNow ensure the security of my Combined Excise Tax Form data?

airSlate SignNow prioritizes the security of your data by employing advanced encryption methods and secure cloud storage. When you manage your Combined Excise Tax Form through our platform, you can rest assured that your information is protected against unauthorized access and data bsignNowes.

Get more for Combined Excise Tax Form

- Rev 516 percent taxable form

- Dar scholarship application form

- Application for employment feather falls casino form

- Dental health bformb san diego unified school district

- Grafik cdc girl form

- Donation form running aces casino amp racetrack

- Ftb 4107 mandatory e pay requirement waiver request form

- Service level for maintenance agreement template form

Find out other Combined Excise Tax Form

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document