Washington State Department of Revenue Real Estate Excise 2020

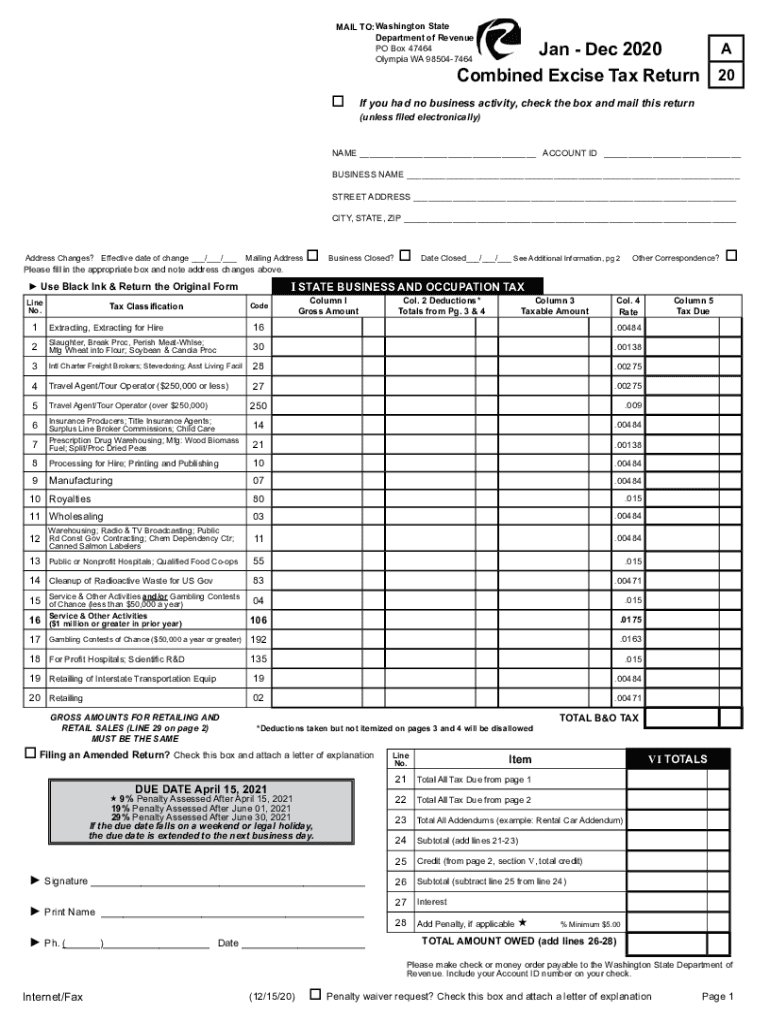

What is the Washington State Department of Revenue Combined Excise Tax?

The Washington State Department of Revenue Combined Excise Tax is a tax imposed on various business activities, including sales, use, and certain services. This tax applies to businesses operating within the state and is essential for funding public services. Understanding this tax is crucial for compliance and accurate reporting.

Steps to Complete the Washington State Combined Excise Tax Form

Filling out the Washington State Combined Excise Tax Form involves several key steps:

- Gather necessary financial records, including sales and purchase invoices.

- Determine the applicable tax rates based on your business activities and location.

- Complete the form by accurately reporting gross income, deductions, and the calculated tax due.

- Review the form for accuracy before submission to avoid penalties.

Filing Deadlines and Important Dates

It is essential to be aware of filing deadlines to ensure compliance with tax regulations. The Washington State Combined Excise Tax Form is typically due on the last day of the month following the reporting period. For example, the form for January must be filed by the end of February. Missing deadlines may result in penalties and interest on unpaid taxes.

Required Documents for Filing

When completing the Washington State Combined Excise Tax Form, certain documents are necessary:

- Sales and purchase records to verify income and expenses.

- Previous tax returns for reference and consistency.

- Any exemption certificates if applicable to your business.

Penalties for Non-Compliance

Failure to comply with the Washington State Combined Excise Tax regulations can lead to significant penalties. Common penalties include:

- Late filing penalties, which may accumulate over time.

- Interest on unpaid taxes, which compounds daily.

- Potential legal actions for severe non-compliance.

Form Submission Methods

The Washington State Combined Excise Tax Form can be submitted through various methods, ensuring flexibility for businesses:

- Online submission via the Washington State Department of Revenue website, which is often the quickest option.

- Mailing a paper form to the designated address provided by the Department of Revenue.

- In-person submission at local Department of Revenue offices for immediate assistance.

Quick guide on how to complete washington state department of revenue real estate excise

Complete Washington State Department Of Revenue Real Estate Excise effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without any hold-ups. Handle Washington State Department Of Revenue Real Estate Excise seamlessly on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Washington State Department Of Revenue Real Estate Excise effortlessly

- Obtain Washington State Department Of Revenue Real Estate Excise and click Get Form to begin.

- Utilize the features we offer to fill out your form.

- Highlight pertinent sections of your documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that reason.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all information carefully and click the Done button to confirm your changes.

- Select your preferred method to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Washington State Department Of Revenue Real Estate Excise, ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct washington state department of revenue real estate excise

Create this form in 5 minutes!

How to create an eSignature for the washington state department of revenue real estate excise

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the state of washington combined excise tax form 2018 annual?

The state of Washington combined excise tax form 2018 annual is a specific document used by businesses to report and pay their excise taxes. This form consolidates multiple tax obligations into a single submission, making tax reporting more efficient and straightforward. Using this form can help businesses ensure compliance with state tax regulations while saving time.

-

How can airSlate SignNow assist in completing the state of washington combined excise tax form 2018 annual?

airSlate SignNow provides an intuitive platform that allows businesses to create, send, and eSign the state of Washington combined excise tax form 2018 annual seamlessly. With our user-friendly interface, you can easily fill out the required information, ensuring accuracy and compliance. Plus, eSigning the document saves time and increases efficiency.

-

What features does airSlate SignNow offer for handling the state of washington combined excise tax form 2018 annual?

airSlate SignNow offers a range of features designed to facilitate the completion of the state of Washington combined excise tax form 2018 annual. These include customizable templates, automated reminders for filing deadlines, and secure cloud storage for all your tax documents. Additionally, our platform supports collaboration between team members for efficient document preparation.

-

Is there a cost associated with using airSlate SignNow for the state of washington combined excise tax form 2018 annual?

Yes, there is a subscription fee for using airSlate SignNow, but it is a cost-effective solution compared to traditional document management methods. The pricing structure is designed to be scalable, making it accessible for businesses of all sizes. Considering the time savings and efficiency gained, the investment can be well worth it.

-

Can I integrate airSlate SignNow with my existing accounting software for the state of washington combined excise tax form 2018 annual?

Absolutely! airSlate SignNow can be integrated with various accounting software, allowing for seamless transfer of data required for the state of Washington combined excise tax form 2018 annual. This integration helps eliminate manual data entry and reduces the chances of errors, ensuring that your tax submissions are accurate and timely.

-

What are the benefits of using airSlate SignNow for my tax documentation needs?

Using airSlate SignNow for your tax documentation, including the state of Washington combined excise tax form 2018 annual, offers numerous benefits. It streamlines the document creation and signing process, enhances collaboration among team members, and provides a secure platform for managing sensitive information. Additionally, it helps ensure compliance with tax regulations, reducing the likelihood of penalties.

-

How does airSlate SignNow ensure the security of my tax forms, such as the state of washington combined excise tax form 2018 annual?

airSlate SignNow prioritizes the security of your documents, including the state of Washington combined excise tax form 2018 annual. Our platform utilizes advanced encryption methods to protect sensitive data both in transit and at rest. Furthermore, we comply with industry standards to ensure that your information remains confidential and secure.

Get more for Washington State Department Of Revenue Real Estate Excise

- Indiana temporary guardianship forms

- Tsp loan payment coupon form

- Company information sheet pdf

- Affidavit for change of signature non availability of signatureinability to sign due to form

- Chapter 10 lesson 4 nutrition labels and food safety form

- Verizon law enforcement ping request form

- Bridge card number form

- Newborn screening release request form pennsylvania

Find out other Washington State Department Of Revenue Real Estate Excise

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple