Wa Dor June Combined Excise Form 2012

What is the Wa Dor June Combined Excise Form

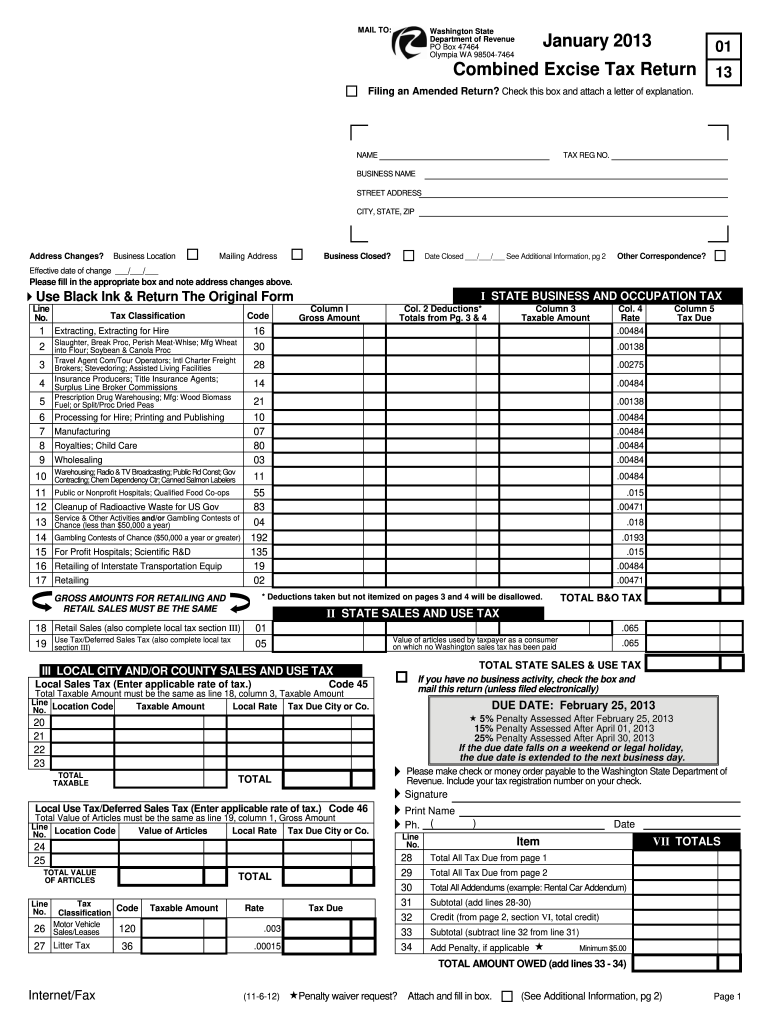

The Wa Dor June Combined Excise Form is a tax document used primarily in the state of Washington. This form consolidates various excise tax obligations, making it easier for businesses to report and remit their taxes in a single submission. It is particularly relevant for businesses involved in retail sales, services, and certain activities that incur excise tax liabilities. Understanding this form is essential for compliance with state tax regulations.

How to use the Wa Dor June Combined Excise Form

To effectively use the Wa Dor June Combined Excise Form, businesses must first gather all necessary financial data, including sales figures and any applicable deductions. The form is structured to capture various types of excise taxes, so users should ensure they are filling out the correct sections based on their business activities. After completing the form, it can be submitted electronically or via mail, depending on the preferences of the taxpayer and the requirements of the Washington Department of Revenue.

Steps to complete the Wa Dor June Combined Excise Form

Completing the Wa Dor June Combined Excise Form involves several key steps:

- Gather all relevant financial documents, including sales records and receipts.

- Fill out the form accurately, ensuring that all sections applicable to your business are completed.

- Double-check all calculations to avoid errors that could lead to penalties.

- Sign the form electronically or by hand, depending on the submission method chosen.

- Submit the completed form by the designated deadline to avoid late fees.

Legal use of the Wa Dor June Combined Excise Form

The legal use of the Wa Dor June Combined Excise Form is governed by Washington state tax laws. Businesses must ensure that they are using the most current version of the form and adhering to all related regulations. This includes understanding the types of taxes being reported and the specific rates that apply to their business activities. Proper use of the form not only ensures compliance but also helps avoid potential legal issues with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Wa Dor June Combined Excise Form are typically set by the Washington Department of Revenue. Businesses should be aware of the specific due dates to ensure timely submission. Generally, the form is due on a quarterly basis, with deadlines falling on the last day of the month following the end of each quarter. Keeping a calendar of these important dates can help businesses avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Wa Dor June Combined Excise Form can be submitted through various methods, providing flexibility for businesses. The options include:

- Online submission through the Washington Department of Revenue's website, which is often the fastest method.

- Mailing a paper copy of the completed form to the appropriate address provided by the Department of Revenue.

- In-person submission at designated tax offices, if preferred.

Each method has its own processing times and requirements, so businesses should choose the one that best suits their needs.

Quick guide on how to complete wa dor june combined excise 2012 form

Your assistance manual on how to prepare your Wa Dor June Combined Excise Form

If you’re wondering how to generate and submit your Wa Dor June Combined Excise Form, here are some quick pointers on how to simplify tax processing.

To begin, you just need to set up your airSlate SignNow account to change how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that allows you to edit, draft, and finalize your income tax documents effortlessly. With its editing tool, you can toggle between text, check boxes, and eSignatures and return to modify information as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and convenient sharing options.

Follow the steps below to complete your Wa Dor June Combined Excise Form in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your Wa Dor June Combined Excise Form in our editor.

- Fill in the required fillable fields with your details (text, numbers, check marks).

- Use the Sign Tool to add your legally binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper can lead to increased errors and postponed reimbursements. Of course, before e-filing your taxes, verify the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct wa dor june combined excise 2012 form

Create this form in 5 minutes!

How to create an eSignature for the wa dor june combined excise 2012 form

How to generate an electronic signature for your Wa Dor June Combined Excise 2012 Form online

How to generate an eSignature for the Wa Dor June Combined Excise 2012 Form in Google Chrome

How to create an eSignature for signing the Wa Dor June Combined Excise 2012 Form in Gmail

How to make an eSignature for the Wa Dor June Combined Excise 2012 Form from your smartphone

How to generate an eSignature for the Wa Dor June Combined Excise 2012 Form on iOS

How to make an electronic signature for the Wa Dor June Combined Excise 2012 Form on Android devices

People also ask

-

What is the Wa Dor June Combined Excise Form?

The Wa Dor June Combined Excise Form is a state-specific filing requirement for businesses in Washington that consolidate various excise taxes. This form simplifies the reporting process, allowing businesses to report multiple tax types in one submission. Ensuring accurate completion is crucial to comply with state regulations and avoid penalties.

-

How does airSlate SignNow support the completion of the Wa Dor June Combined Excise Form?

airSlate SignNow provides a user-friendly platform that allows you to easily fill out and eSign the Wa Dor June Combined Excise Form. Our templates and automated workflows streamline the process, making it faster and less prone to errors. This ensures you can complete your submissions accurately without unnecessary delays.

-

Is there a cost associated with using airSlate SignNow for the Wa Dor June Combined Excise Form?

Yes, while airSlate SignNow offers a range of pricing plans, the cost is typically quite competitive compared to other platforms. Investing in our solution for the Wa Dor June Combined Excise Form provides signNow time savings and enhances compliance, which can lead to long-term cost benefits for your business.

-

What are the key benefits of using airSlate SignNow for the Wa Dor June Combined Excise Form?

Using airSlate SignNow for the Wa Dor June Combined Excise Form offers several benefits, including quick access to templates, eSigning features, and secure document storage. These tools improve efficiency and compliance, allowing your team to focus on growing your business without getting bogged down by administrative tasks.

-

Are there integrations available for airSlate SignNow when using the Wa Dor June Combined Excise Form?

Absolutely! airSlate SignNow integrates seamlessly with various business tools, enhancing the efficiency of your workflow when filling out the Wa Dor June Combined Excise Form. You can connect with applications like CRM systems and project management tools to simplify document management and streamline your processes.

-

Can I track my Wa Dor June Combined Excise Form submissions with airSlate SignNow?

Yes, airSlate SignNow provides tracking capabilities that allow you to monitor the status of your Wa Dor June Combined Excise Form submissions in real time. This feature helps you stay informed and ensures that you can follow up on any necessary actions promptly, promoting better compliance and organization.

-

How secure is my data when using airSlate SignNow for the Wa Dor June Combined Excise Form?

Security is a top priority at airSlate SignNow. When using our platform for the Wa Dor June Combined Excise Form, your data is protected by industry-standard encryption and security protocols. This ensures that your sensitive information remains confidential and secure throughout the submission process.

Get more for Wa Dor June Combined Excise Form

Find out other Wa Dor June Combined Excise Form

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile