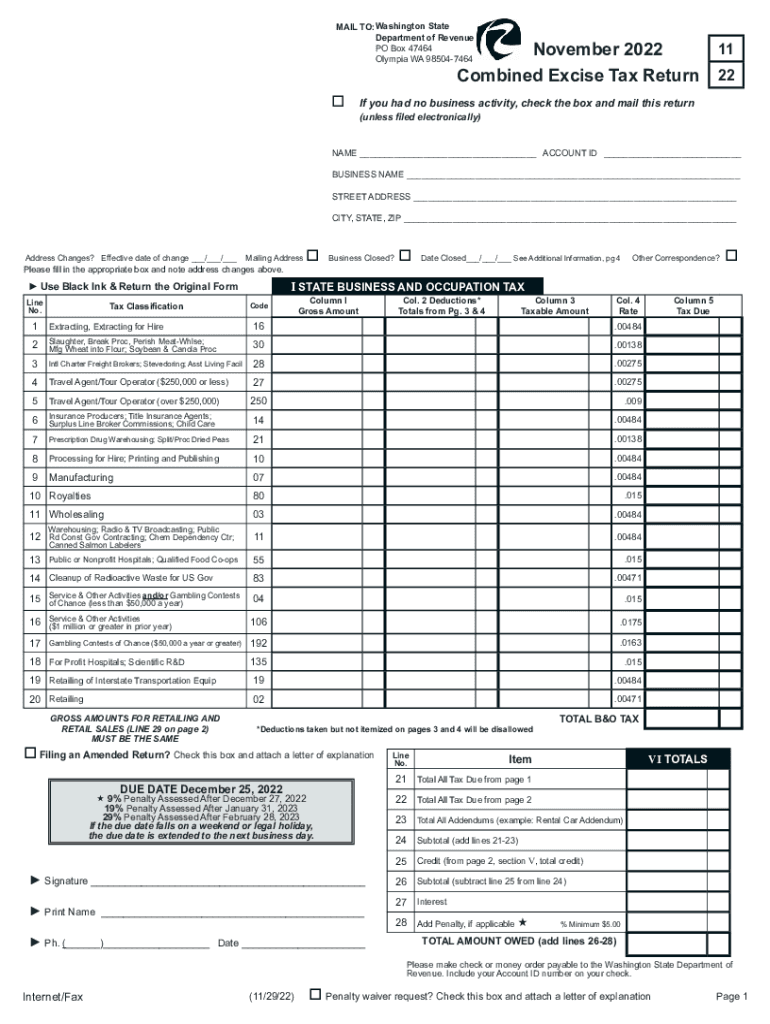

November Combined Excise Tax Return 22 2022

What is the November Combined Excise Tax Return?

The November Combined Excise Tax Return is a specific form used by businesses in Washington State to report and pay various excise taxes. This return consolidates multiple tax obligations into a single submission, simplifying the process for taxpayers. The form covers different types of excise taxes, including those related to retail sales, use, and business and occupation (B&O) taxes. Understanding this form is crucial for compliance and ensuring that all tax liabilities are accurately reported and paid on time.

Steps to Complete the November Combined Excise Tax Return

Completing the November Combined Excise Tax Return involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial records, including sales figures and any applicable deductions. Next, fill out the form with precise information regarding your business activities and tax liabilities. It's essential to calculate the taxes owed accurately based on the reported figures. After completing the form, review it thoroughly for any errors before submission. Finally, submit the return either online or by mail, depending on your preference and the requirements set by the Washington State Department of Revenue.

Legal Use of the November Combined Excise Tax Return

The November Combined Excise Tax Return holds legal significance as it serves as an official document for reporting tax obligations to the state. To be considered valid, the form must be completed accurately and submitted by the designated deadlines. Compliance with state regulations ensures that the return is recognized legally, preventing potential penalties or legal issues. Utilizing a reliable eSignature solution can enhance the legal standing of your submission by providing a secure and verifiable signature.

Filing Deadlines / Important Dates

Filing deadlines for the November Combined Excise Tax Return are critical for maintaining compliance and avoiding penalties. Typically, the return is due on the last day of the month following the reporting period. For November, this means the return must be filed by December 31. It is advisable to keep track of these dates and set reminders to ensure timely submission. Late filings may incur additional fees and interest, impacting your business's financial standing.

Required Documents

To successfully complete the November Combined Excise Tax Return, several documents are necessary. These include financial records such as sales receipts, invoices, and any relevant deduction documentation. Additionally, having your previous tax returns on hand can provide a helpful reference for completing the current form. Ensuring that all required documents are organized and accessible will streamline the filing process and reduce the likelihood of errors.

Form Submission Methods

The November Combined Excise Tax Return can be submitted through various methods, providing flexibility for taxpayers. The most common submission methods include online filing via the Washington State Department of Revenue's website, mailing a paper form, or, in some cases, in-person submission at designated offices. Online filing is often recommended for its convenience and speed, allowing for immediate confirmation of receipt.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the November Combined Excise Tax Return can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action by the state. It's essential to understand the implications of non-compliance and to take proactive measures to file on time. Businesses should consider utilizing digital tools that facilitate timely submissions and maintain compliance with state regulations.

Quick guide on how to complete november 2022 combined excise tax return 22

Complete November Combined Excise Tax Return 22 effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to generate, modify, and electronically sign your documents swiftly without any delays. Manage November Combined Excise Tax Return 22 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign November Combined Excise Tax Return 22 hassle-free

- Find November Combined Excise Tax Return 22 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign November Combined Excise Tax Return 22 and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct november 2022 combined excise tax return 22

Create this form in 5 minutes!

People also ask

-

What is Wador and how does it integrate with airSlate SignNow?

Wador is a powerful digital signing and document management tool that seamlessly integrates with airSlate SignNow. It enhances the eSigning process by providing additional features that help streamline document workflows. By using Wador within airSlate SignNow, businesses can ensure their documents are signed quickly and securely.

-

What are the key features of Wador within airSlate SignNow?

Wador offers several features that complement airSlate SignNow, including customizable templates, automated reminders, and real-time tracking of document status. These features help improve efficiency and reduce turnaround times. Having Wador integrated ensures a comprehensive approach to document management.

-

How much does Wador cost when using airSlate SignNow?

The pricing for Wador can vary depending on the plan selected within airSlate SignNow. Generally, businesses can choose from flexible pricing tiers that accommodate various needs and budgets. This allows organizations to find a cost-effective solution that incorporates Wador's capabilities.

-

What benefits does Wador provide for my business with airSlate SignNow?

Wador signNowly boosts productivity and saves time by streamlining document signing processes within airSlate SignNow. With its user-friendly interface, employees can quickly navigate the signing process. Additionally, Wador's capabilities lead to enhanced security and compliance.

-

Can I track document status using Wador in airSlate SignNow?

Yes, Wador allows users to track the status of documents in real-time when combined with airSlate SignNow. This feature helps businesses stay informed about the progress of document signing, facilitating better follow-ups. Enhanced visibility into document workflows is crucial for effective management.

-

Does Wador support multiple integrations with other software?

Absolutely! Wador is designed to work alongside various software tools when integrated with airSlate SignNow. This compatibility allows businesses to enhance their workflows by connecting Wador with the systems they already use, like CRM platforms or accounting software.

-

Is Wador suitable for all business sizes with airSlate SignNow?

Yes, Wador is a versatile solution that caters to businesses of all sizes when utilized within airSlate SignNow. Whether you're a small startup or a large enterprise, Wador's features can be tailored to meet your specific document signing needs. Its scalability ensures that it grows alongside your business.

Get more for November Combined Excise Tax Return 22

Find out other November Combined Excise Tax Return 22

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will