Combined Excise Tax Return 1223 Combined Excise Tax Return 1223 2023-2026

Understanding the Combined Excise Tax Return

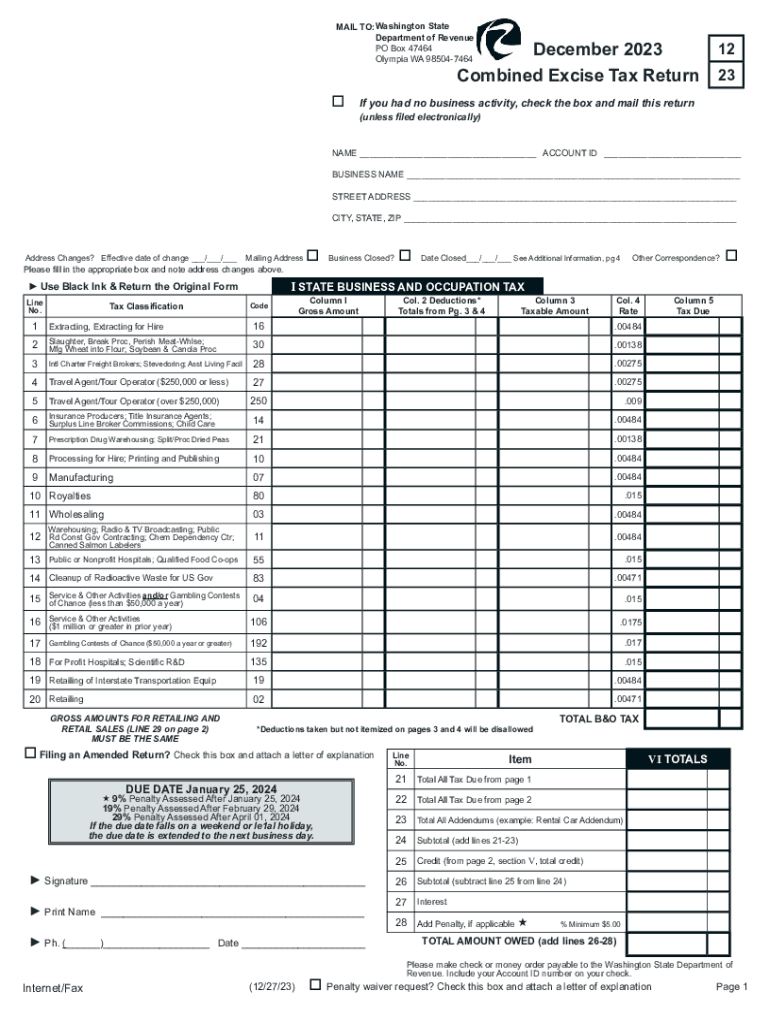

The Combined Excise Tax Return is a crucial document for businesses operating in Washington State. It consolidates various tax obligations into a single form, simplifying the reporting process for sales tax, use tax, and other excise taxes. This return is essential for ensuring compliance with state tax laws and for calculating the correct amount of taxes owed. Businesses must be familiar with this form to avoid penalties and ensure accurate reporting.

Steps to Complete the Combined Excise Tax Return

Completing the Combined Excise Tax Return involves several key steps:

- Gather necessary financial records, including sales and purchase invoices.

- Determine the total sales and taxable amounts for the reporting period.

- Calculate the excise tax due based on the applicable rates for your business type.

- Fill out the Combined Excise Tax Return form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

Taking the time to carefully complete this return can help prevent issues with tax authorities.

Filing Deadlines and Important Dates

It is vital for businesses to be aware of the filing deadlines for the Combined Excise Tax Return. Typically, the return is due on the last day of the month following the end of the reporting period. For example, if the reporting period ends in December, the return must be filed by January thirty-first. Missing these deadlines can result in penalties and interest on unpaid taxes.

Required Documents for Filing

When preparing to file the Combined Excise Tax Return, businesses should have the following documents on hand:

- Sales records detailing all transactions during the reporting period.

- Purchase invoices for any taxable goods or services acquired.

- Previous tax returns for reference, if applicable.

- Any correspondence from the Washington State Department of Revenue regarding tax obligations.

Having these documents ready can streamline the filing process and ensure accuracy.

Penalties for Non-Compliance

Failure to file the Combined Excise Tax Return on time or inaccuracies in reporting can lead to significant penalties. These may include late fees, interest on unpaid taxes, and potential audits by the Washington State Department of Revenue. It is essential for businesses to understand these risks and take proactive steps to ensure compliance.

Digital vs. Paper Version of the Form

Businesses have the option to file the Combined Excise Tax Return either digitally or via paper submission. The digital version is often more efficient, allowing for quicker processing and confirmation of receipt. Additionally, electronic filing can reduce the chances of errors, as many online systems provide prompts and checks during the submission process. However, some businesses may prefer the traditional paper method for record-keeping purposes.

Who Issues the Combined Excise Tax Return

The Washington State Department of Revenue is responsible for issuing the Combined Excise Tax Return. This agency oversees the collection of state taxes and ensures compliance with tax laws. Businesses can find resources and guidance on the Department of Revenue's website, which can help in understanding the requirements and processes related to the Combined Excise Tax Return.

Quick guide on how to complete combined excise tax return 1223 combined excise tax return 1223

Effortlessly Prepare Combined Excise Tax Return 1223 Combined Excise Tax Return 1223 on Any Gadget

The management of documents online has gained traction among both businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the correct template and safely archive it online. airSlate SignNow provides all the tools necessary to generate, adjust, and electronically sign your documents promptly. Manage Combined Excise Tax Return 1223 Combined Excise Tax Return 1223 on any gadget with airSlate SignNow's Android or iOS applications and enhance any process that involves documentation today.

How to Modify and Electronically Sign Combined Excise Tax Return 1223 Combined Excise Tax Return 1223 with Ease

- Locate Combined Excise Tax Return 1223 Combined Excise Tax Return 1223 and then select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign function, which takes seconds and has the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about missing or lost files, tedious form searching, or mistakes that require new document prints. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Combined Excise Tax Return 1223 Combined Excise Tax Return 1223 and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct combined excise tax return 1223 combined excise tax return 1223

Create this form in 5 minutes!

How to create an eSignature for the combined excise tax return 1223 combined excise tax return 1223

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the washington state sales tax 2024 rate?

The washington state sales tax 2024 rate is set at 6.5%. However, local jurisdictions may add additional sales taxes, resulting in varying total rates across different areas. Businesses should stay updated on any changes as they can impact pricing strategies.

-

How does airSlate SignNow help with managing washington state sales tax 2024?

airSlate SignNow allows businesses to efficiently send and eSign documents related to sales tax management. By streamlining your documentation process, you can ensure compliance with the washington state sales tax 2024 regulations without the hassle of paper trails. This boosts accuracy and saves valuable time.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning, making it ideal for handling tax-related documents. These features ensure that businesses can quickly adapt to changes in washington state sales tax 2024, maintaining compliance and efficiency.

-

Is airSlate SignNow cost-effective for small businesses concerned about washington state sales tax 2024?

Yes, airSlate SignNow is designed to be cost-effective for small businesses. With flexible pricing plans, you can choose a solution that fits your budget while effectively managing the complexities of washington state sales tax 2024. This helps small businesses remain competitive and compliant.

-

Can airSlate SignNow integrate with accounting software for sales tax tracking?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing for effective sales tax tracking including the washington state sales tax 2024. This integration helps maintain accuracy and simplifies the process of preparing for tax filings.

-

How does eSigning documents benefit businesses regarding washington state sales tax 2024?

ESigning documents through airSlate SignNow can signNowly enhance efficiency in handling business transactions relating to washington state sales tax 2024. It eliminates delays, reduces paper usage, and ensures that stakeholders can approve documents quickly, which is crucial for timely tax compliance.

-

What support does airSlate SignNow provide for businesses navigating washington state sales tax 2024?

airSlate SignNow offers robust customer support to assist businesses with the complexities of washington state sales tax 2024. Whether it's through FAQs, live chat, or dedicated account managers, you can get the help you need to ensure your documentation meets all legal requirements.

Get more for Combined Excise Tax Return 1223 Combined Excise Tax Return 1223

Find out other Combined Excise Tax Return 1223 Combined Excise Tax Return 1223

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement